Why work a 9 to 5 job for the rest of your life when you can make money while you sleep?

Like Warren Buffett (the fifth wealthiest man in the world) once said:

"If you don't find a way to make money while you sleep, you will work until you die."

Ready to make money overnight?

Here are 19 ways to make money while you sleep:

- Invest in Rental Real Estate

- Invest in Farmland & Timberland

- Invest in Fine Wine

- Invest in Rare Art

- Invest in Private Real Estate

- Invest in AI Startups

- Invest in the Stock Market

- Start a Twitter Account

- Promote Products Through Emails

- Build a Blog

- Share Your Internet Connection

- Rent Out Your RV

- Rent Out a Room in Your Home

- Rent Out Your Unused Space

- Develop an Online Course

- Write and Sell an eBook

- Open a High Yield Savings Account

- Invest in Peer-to-Peer Lending

- Invest in Alternative Assets

I’ll also show you the pros and cons and how to get started with each idea so you can start making money right away.

Let’s dive in.

1. Invest in Rental Real Estate

When you invest in rental real estate you make money in 2 ways:

- Rental income – Cash flow from rent

- Appreciation – Property value increases over time

Especially over the past few years, rental real estate investing has become very profitable.

The historical rental property returns are 11.7% per year – while the S&P 500 has returned 9.4% over the past several decades.

Take a look at the rate of property appreciation over the past decade:

As you can see, as long as you are invested for the long-term, your overall compound annual return can increase significantly.

Pros

Let’s take a look at the advantages of investing in rental real estate:

#1: Make Money While You Sleep

One of the best things about rental real estate investing is that you can earn passive income.

In addition to earning passive income, you can also make more money if the property sells for a profit in the future.

#2: Portfolio Diversification

It’s always a good idea to diversify your portfolio investments and investing in real estate has been a proven strategy for many years.

#3: Anyone can Invest

You don’t have to be a millionaire to start investing in rental real estate.

In fact, with Arrived Homes, you can start investing for just $100!

Cons

Here are some downsides to investing in rental real estate:

#1: Illiquid

You can’t just liquidate your investment, instead, you’ll have to stay invested for 5+ years before you see a return on your principal investment.

#2: Fees can be High

Especially when investing in real estate, you could be facing some high fees.

Fees could be used to pay for:

- Property taxes

- Maintenance fees

- Renter management fees

- Property management fees

Just make sure that the fees are not so high that they start eating into your overall net profit.

#3: Properties are Often Limited

Investing in rental real estate has become so popular, that you often have only hours left to buy investment shares before a property is 100% sold out.

How to Invest in Rental Real Estate

Here’s how to get started with investing in rental real estate:

- Sign-up to Arrived Homes

- Browse rental real estate properties

- Do your thorough research

- Link your bank account with your Arrived Homes account

- Transfer cash to your Arrived Homes account

- Buy the number of shares that you want in your Arrived Homes investment (minimum of $100)

- Stay invested for the long term

Not many people can say that they own a rental property and are making money overnight.

Now you can, with this unique alternative platform.

Recommended Reading: Arrived Homes Review

2. Invest in Farmland

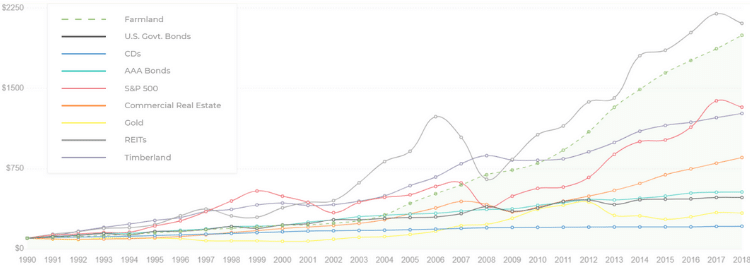

Did you know that farmland returns have been positive every year since 1990?

Check out the evidence in the chart below:

Farmland can be a lucrative investment because it is a tool used for:

- Portfolio diversification

- Hedging against inflation

- Passive income generation

Farmland also has lower volatility and a similar growth rate as most traditional investments (like the S&P 500):

With farmland assets, you’re getting the best of three worlds:

- Low volatility

- Passive income

- Long term appreciation

Here’s a quick average annual return comparison chart:

There is a catch, however: You must be an accredited investor to invest in farmland.

As long as you pass this test, then you can start investing in farmland with platforms like FarmTogether.

Pros

What are the advantages of investing in farmland?

#1: Passive Income

There are many ways to make money with farmland.

The most common way is to earn passive income through rents (aka the farmland is rented out to farmers).

This can be a very stable income source.

#2: Low Volatility

Land, in general, is not as susceptible to economic swings as the stock market.

So if you’re looking for an appreciating asset that is generally more stable over the long term, farmland is a great option.

#3: Low Fees

Surprisingly, investing in farmland can actually be pretty inexpensive.

Yes, there will always be fees to help cover costs such as property management, but otherwise, fees are pretty reasonable.

Cons

Here are some downsides to investing in farmland:

#1: Illiquid

Farmland investing is very illiquid (7+ years).

So before you start investing, make sure you know this is what you want.

#2: Accredited Investors Only

One of the largest downsides to investing in farmland is that the opportunity is only available for those who are accredited investors.

In other words, if you have a net worth of $1 million+ (excluding your primary residence) or you earn $200,000+ (if single) or $300,000+ (if married), you would qualify.

#3: Limited Investment Opportunities

Since farmland is so limited already, it’s becoming increasingly harder to invest in farmland.

How to Invest in Farmland

Here’s how to get started with farmland and timberland investing:

- Sign-up to FarmTogether

- Confirm you’re an accredited investor

- Browse and research the available investment options

- Connect your bank account

- Fund your account

- Execute your investment order

- Start earning passive income

Since investing in farmland is becoming pretty popular, make sure you sign up to receive email notifications so that you know exactly when a new farm property is available for investing.

3. Invest in Fine Wine

You know the saying, “fine wine gets better with age,” right?

Well, fine wine also gets more expensive with age.

In fact, fine wine has outperformed the S&P 500 over the past 20 years.

The other good news is that fine wine has a very low correlation with the stock market.

A low correlation means that if the stock market goes into a recession, there is a very high chance that your wine investment will continue on a steady path.

The best part?

You don’t even have to be a wine expert.

If you sign up to Vinovest, you can be guided by your own wine experts to invest in what is most profitable for your situation.

Pros

Let’s take a look at the advantages of investing in fine wine:

#1: Low Market Volatility

Fine wine has been more stable than the S&P 500, especially during market downturns such as the 2008 Great Recession.

#2: Hedge Against Inflation

Fine wine returns can average around 13%, while inflation has averaged around 3.8% over the past 60 years.

#3: Available to all Investors

Investing in fine wine is available to all investors – regardless if you are considered accredited or non-accredited.

Cons

Here are some downsides to investing in fine wine:

#1: Unregulated Industry

Unlike regular stocks and bonds, investing in fine wine is a private and unregulated industry.

Some may like that fine wine investing is unregulated, while others may consider this to be a red flag.

#2: Long Term Investment

The saying still holds true, “wine gets better with age.”

So, the longer you hold on to your wine investment, the more likely you’ll make a profit.

#3: High Fees

Investing in fine wine could cost you some money in higher than normal fees.

Fees for fine wine investing are typically used for:

- Storage

- Insurance

- Acquisitions

- Shipping fees

- Taxes and tariffs

Make sure you read the fine print so you are 100% informed.

How to Invest in Fine Wine

Here’s how to get started with investing in fine wine:

- Sign-up to Vinovest

- Transfer funds to your Vinovest account (via bank, credit card, check, etc.)

- Browse your potential wine investments or chat with a Vinovest expert on the phone

- Execute your investment order

- Stay invested for the long term

If you invest with Vinovest, you can also keep your fine wine insured and stored at a secure location.

Recommended Reading: Vinovest Review

4. Invest in Rare Art

Investing in rare art used to be a past-time of the ultra-wealthy.

Not anymore.

Now, virtually anyone can start investing in rare, blue-chip art with just $500.

One reason to invest in rare art is because it has outperformed the S&P 500 over the past 16 years:

If you take a closer peek at the screenshot above, you can also see that the value of rare art is typically not correlated with the movements in the stock market.

This means that the art market won’t be affected when the economy experiences economic volatility.

So is the rare art market a good way to make money in your sleep?

Absolutely.

The rapid appreciation of the value of artwork can make it easier to justify investing in art, especially if you’re bound to see high returns.

The best part?

You don’t even have to be an art expert.

If you sign up to Masterworks, you can be guided by art experts to invest in what is most profitable for your situation.

Pros

Let’s take a look at the advantages of investing in rare art:

#1: Protect Yourself Against Inflation

It’s always a good idea to invest in something that protects you against inflation.

That’s where rare art comes into the picture.

Over the past few decades, the value of rare art has appreciated, far exceeding inflation.

#2: Low Volatility

Another great feature is that art is not correlated with the stock market.

So, when the stock market goes down, the value of your artwork is minimally impacted.

#3: High Returns

If you invest in rare art through a platform like Masterworks, you can tap into returns that often exceed the average returns of the S&P 500.

Cons

Here are some downsides to investing in rare art:

#1: High Fees

Investing in rare art can cost you a lot in fees.

Fees can be used to cover:

- Storage costs

- Art auction costs

- Art insurance costs

- Administration costs

- Annual art appraisals

So always make sure that you read the fine print and understand how the fees are eating into your overall profit.

#2: Illiquid

Investing in rare art – and actually making a profit – really all depends on how long you are willing to hold on to your artwork.

Typically speaking, you’ll want to stay invested for 7+ years to make your investment profitable.

#3: Unregulated World

If you’re someone who prefers industry oversight and some kind of industry organization, then investing in rare art might not be your best choice.

That’s because the art world is largely unregulated.

How to Invest in Rare Art

Here’s how to get started with rare art investing:

- Sign-up to Masterworks

- Complete the interview phone call

- Connect your bank account

- Browse the available investments

- Fund your Masterworks account

- Execute your investment order

While rare art investing can be extremely profitable, keep in mind that you will have to keep the money invested over a long timeframe (7+ years).

Recommended Reading: Masterworks Review

5. Invest in Private Real Estate

Private real estate investments used to be available only to the ultra-rich.

But not anymore.

Thanks to platforms like Fundrise, anyone can invest in private real estate for just $10!

But can private real estate help you make money while you sleep?

It certainly can.

In fact, there are 2 main reasons why private real estate can be a lucrative investment:

Private real estate investments help you earn:

- Cash flow from rents

- Profits from property appreciation

And it gets better:

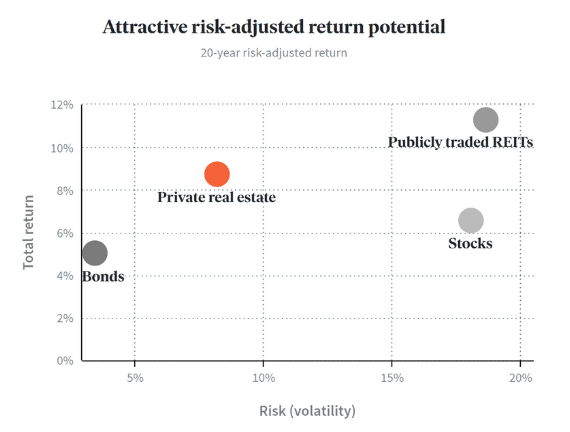

Private real estate has had solid passive income results over the past 20 years:

Not only do you get higher passive income, but you also have less volatility than other asset classes:

With private real estate, you get the best of both worlds:

- Less volatility

- High returns

Examples of private real estate investments include:

- Single-family homes

- Apartment buildings

- Industrial / commercial

- Home developer construction

Pros

Let’s take a look at the advantages of investing in private real estate:

#1: Earn Passive Income

One of the best things about real estate investing is that you make money from rental income.

Everyone needs a place to live, so investing in real estate can be a pretty stable and predictable flow of income.

#2: Low Investment Minimum

It used to take millions of dollars to start investing in private real estate. Not anymore.

Thanks to platforms like Fundrise, investing in private real estate deals is open to virtually anyone for as little as $10.

#3: Portfolio Diversification

They always say, “Never put all of your eggs into 1 basket.” The same goes for your investments.

Make sure you diversify your holdings – and investing in real estate is a great way to start diversifying.

Cons

Here are some downsides to private real estate investing:

#1: Illiquid

Investing in any sort of real estate deal means your cash will be tied up for a long period of time.

#2: Complex

Private real estate deals can be complex and confusing, especially for new investors.

#3: Fees can be High

Real estate investments tend to come with more expenses, such as:

- Property insurance

- Property maintenance

- Property management

So, as an investor, you can expect your fees to be higher than more traditional investment classes (such as stocks and bonds).

How to Invest in Private Real Estate

Here’s how to get started with private real estate investing:

- Sign-up to Fundrise

- Determine your real estate portfolio strategy

- Connect your bank account with your Fundrise account

- Fund your Fundrise account

- Execute your investment orders

- Start earning passive quarterly income

The best part about investing with Fundrise is that you can start with just $10!

Recommended Reading: Fundrise Review

6. Invest in AI Startups

Do you want to be an early investor in the AI revolution?

Investing in AI startups before they go public could give you significant returns.

AI startups can also provide:

- Diversification

- Positive societal impact

- Long-term growth potential

The best part?

You don’t need $100,000s to start investing in AI startups.

With the Fundrise Innovation Fund, you can start investing in less than 5 minutes and with as little as $10.

(Most venture capital funds have a $200,000+ minimum).

The Innovation Fund invests in some of the world’s best tech companies.

Including those leading the AI revolution, before they go public.

Pros

Let’s take a look at the advantages of investing in AI:

#1: Low Minimum Investment

Thanks to the Fundrise Innovation Fund, you can invest for as little as $10.

#2: Open to all Investors

Most alternative investment platforms are only available to accredited investors.

However, you don’t have to be an accredited investor to take advantage of this opportunity.

Cons

Here are some downsides to investing in AI startups:

#1: Higher Risk Investment

Investing in AI startups can be risky:

- There is no proven track record

- You are never guaranteed returns

- It’s a typically a start-up company

And if your AI startup goes bankrupt, then you probably won’t see a single penny as a repayment.

#2: No Secondary Market

Some alternative investment platforms offer a secondary market.

A secondary market is basically where you can sell your investment for a discount to other investors who are on the same platform.

AI startups typically don’t offer secondary markets, so don’t expect to see your cash any time soon.

How to Invest in AI Startups

The Innovation Fund invests in some of the world’s best tech companies.

Including those leading the AI revolution, before they go public.

Here’s how to get in on the action:

- Sign up for the Fundrise Innovation Fund

- Create your account

- Complete your investor profile

- Link your bank account

- Fund your account

- Place your investment

- Monitor your investment

The signup process should take less than 5 minutes.

And best part about the Innovation Fund is the investment minimum is also only $10.

(Most venture capital funds have a $200,000+ minimum).

7. Invest in the Stock Market

If you’ve ever wanted to own a slice of a major company, then investing in the stock market might be for you.

For example, you could buy a fractional share of Tesla for $5 and officially own a very small piece of that company.

The best part?

You don’t even have to be an experienced investor.

Pros

Let’s take a look at the advantages of investing in the stock market:

#1: Build Wealth

One of the best and fastest ways to build wealth is by investing in the stock market.

The stock market grows with the economy over time – and you don’t need a lot of money to start investing.

#2: Beat Inflation

From a historical perspective, investing in the stock market has helped beat inflation.

In fact, over the past roughly 50 years, the S&P 500 has averaged about 9% to 10% in returns – well above the 3% average inflation rate.

#3: Liquidity

Investing in the stock market allows you the added benefit of liquidity.

If you’re ever in a bind and need your cash fast, all you do is liquidate your stocks and voila!

You have your cash available within a few business days of liquidating.

Cons

Here are some downsides to investing in the stock market:

#1: Volatility

As the stock market increases, the value of your investment increases… and vice versa.

#2: You Could Lose Everything

Since stocks are equity investments (ie, you’re buying a piece of ownership rather than lending out your money), you may lose everything if a business goes bankrupt.

#3: You Should do Your Research

If you’re a beginner, then investing in stocks could be a little overwhelming at first.

That’s why it might be smart for you to do 1 of 2 things:

- Invest in index funds and just stay invested for the long term

- Subscribe to Seeking Alpha and learn from the investing professionals

How to Invest in the Stock Market

Here’s how to get started with investing in the stock market:

- Sign-up to M1 Finance (it’s free)

- Complete your investment profile

- Decide what stocks or funds you want to invest in

- Determine the number of shares you want to buy

- Connect your bank account and fund your M1 Finance account

- Execute your investment order

A key to becoming a successful stock investor is staying invested for the long term – even during volatile times.

If you want expert advice on picking stocks, then I highly recommend checking out Seeking Alpha.

8. Start a Twitter Account

Ever dreamed of building a successful side hustle and making money overnight?

You can make that dream a reality.

How?

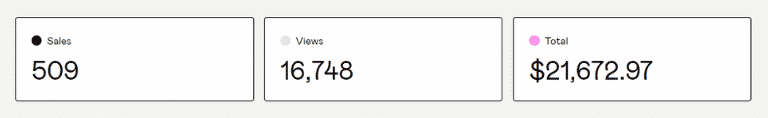

In fact, I’ve made over $20,000 from Twitter in passive income by selling my Gumroad products (like my eBook).

Here are a few other Twitter monetization methods:

- Getting clients

- Affiliate marketing

- Promoting your business

- Selling your products/services

- Starting a paid Twitter community

While it’s a lot of upfront work, it doesn’t take a genius-level IQ to make $10,000+ per month on Twitter.

Pros

What are some advantages of making money on Twitter?

#1: Make Money Overnight

Twitter can be the key to set you free.

In fact, you can start earning up to $10,000+ per month on just Twitter and you won’t ever have to worry about joining a corporate office job again.

#2: Flexibility

Another luxury about Twitter is the flexibility that comes with the platform.

As long as you keep making passive income, you can work from anywhere and at anytime.

#3: Unlimited Earning Potential

Being your own boss means you can make as much money as you want.

Of course, this sounds easier said than done – and it is.

But in reality, as with so many things in life, your financial success really depends on how much you put into the platform itself.

Cons

What are some of the disadvantages of making money on Twitter?

#1: Upfront Work

There is a lot of upfront work required, it’s hard, and it’s all about the details.

Don’t be discouraged, just keep working on your goals and you’ll start seeing a difference.

#2: You Always Have to be on Twitter

To be a successful Twitter personality, you really have to be on the platform 24/7 (or as much as possible).

Since you need to sleep, it’s helpful to have an AI algorithm help you on your Twitter journey – and that’s where Tweet Hunter comes into play.

The app helps you retweet and even auto-comment on posts while you’re not on the platform.

#3: You’re in the Hands of the Twitter Algorithm

When you’re working on Twitter, you’ll both love and hate the algorithm.

Sometimes, the algorithm makes updates in your favor and other times the updates will make you rethink your entire Twitter strategy.

While the tough times will pass, they will certainly make you scratch your head and think twice.

How to Start Making on Twitter

Here’s how to get started with making money on Twitter:

- Get X Mastery course

- Follow the instructions in the course

- Create a professional-looking Twitter profile

- Choose your niche

- Create high-value content

- Consistently tweet and engage with your audience

- Use the strategies in the course to make money on Twitter

The key to making money on Twitter is to make your content high-quality.

Never sacrifice the quality of your content to make a few extra $$$.

That is the fastest way to lose trust with your audience.

9. Promote Products Through Emails

Can you write 200-500 words per day in 5th grade English?

Do you like making money?

If you answered yes to both, then promoting products through emails could be the right option for you.

The truth is, you can make money by writing a simple email, pressing the send button, and then sitting back and watching the sales roll in.

That 1 email could generate $100’s or even $1,000’s depending on how many sales you make.

Pros

What are the advantages of email marketing?

#1: Passive Income

Writing a genuine story, and promoting a product/service through emails can be seriously profitable.

Just by using your imagination and your computer keyboard, you can make sales from your emails while you sleep.

#2: Low Upfront Expenses

Unlike many other businesses, email marketing doesn’t take a high upfront cost.

All you need is a computer, WiFi, and maybe a course like Write Once, Sell Twice that can teach you the absolute essential strategies you need to get started.

#3: Help People

One of the most rewarding things about selling a product or service is that you can truly help people!

For example, I can’t tell you how many times I’ve had someone reach out to me about my book, How to Get Rich from Nothing, and share how their lives have been positively impacted.

Cons

What are the downsides to email marketing?

#1: Upfront Work

You’ll have to dedicate quite some time upfront.

For example, you’ll have to build up your email list, learn how to write persuasively, and find great products or services to promote.

It’s not easy but it can certainly be worth it.

#2: Income Fluctuates

As with any business operation, expect your income to fluctuate.

For example, some months (like the winter holidays) may be more lucrative than other months (like summer).

#3: Updates are Necessary

Things change, and to continue with your success, you’ll have to make the appropriate updates to your writing (be it an email list, a blog, an eBook, etc.).

Keep your audience engaged by providing the latest and greatest.

How to Get Started with Email Marketing

Here’s how to get started making money with email marketing:

- Download Write Once, Sell Twice

- Subscribe to an email service provider such as MailChimp or MailerLite

- Design your own unique email landing page

- Promote your email landing page on your social media, website, communities, etc.

- Use the strategies in the Write Once, Sell Twice email course to build your email list 100+ subscribers

- Follow the step-by-step process in the email course to make money from your emails

- Keep growing your email list

You don’t need a degree from college to make money writing emails.

All you need is a simple guide that helps you sell your products, services, etc.

10. Build a Blog

If you’re wondering how to make money in your sleep and you can dedicate 100% of your time to starting an online business, then consider building a blog.

In fact, you could make $10,000’s if not $100,000’s per month by blogging.

HOWEVER, it’s not easy.

Here’s how much money bloggers earn on average:

As you can see, only 9% of bloggers earn over $1,000 per month.

But it’s possible to earn more – and you don’t have to be a genius.

All you need is consistency, hard work and patience.

Pros

Let’s take a look at the advantages of building a blog:

#1: Earn Passive Income

The best part about blogging is that you can make money while you sleep – for as long as your blog is running.

Here’s how you can earn passive income blogging:

- Ads

- Sponsored posts

- Affiliate marketing

- Sell your own product/service

#2: Flexibility

One of the BEST things about blogging is the inherent flexibility that comes with the territory.

You can:

- Blog anytime

- Blog anywhere

- Blog with anyone

- Blog from your bed

- Blog in your underwear

Aside from making money overnight, the flexibility part of blogging is the second best thing.

You are your own boss.

That means your success – or failure – is completely dependent on you.

#3: Starting is Easy – and Often Free

Starting a blog is straightforward, it’s free, and it can be done within a day (typically a few hours!).

Especially if you’re a writer by nature and have something interesting to share, blogging can be very fun and easy.

Cons

Here are some downsides to building a blog:

#1: Requires A LOT of Upfront Work

Especially in the beginning stages of building your blog, you will likely have to put in hundreds of hours of work.

As an example, when I first started my blog, I put in anywhere between 50 to 100+ hours a week.

So, you have to be patient.

It’s not easy, but it will be worth the effort.

#2: Can be Technologically Challenging

I remember that one of the most difficult roadblocks to becoming a profitable blogger is the technology side.

Now, I’m not a tech expert nor am I a natural, so it took me some time to figure out:

- How to focus on SEO

- Which blogging platform I should use

- How to develop an email landing page

- How to refine the technical code on my website

- Which plugins I should use (let alone, the definition of plugins!)

…And the list goes on and on.

Let me tell you, it’s not easy figuring this out on your own, so expect some tech hiccups along the way.

#3: Blogger Burnout

Blogging consumes so much of your time – even after the initial upfront heavy lifting.

For example, to keep your audience engaged, it’s important to regularly update your blog posts.

While blogging is very flexible, to be successful, you do need to maintain a strict schedule to keep your blog in top shape.

How to Build a Blog

Here’s how to get started with building a blog:

- Think about your niche of expertise

- Determine your blog name

- Sign up to Bluehost

- Create your website

- Select a theme that’s simple and fits

- Start writing, editing, and publishing content

- Promote your blog on social media

- Learn affiliate marketing

- Implement affiliate marketing tactics

- Create thoughtful content while implementing affiliate links

Affiliate marketing can make you a lot of passive income, but there is one catch.

To be the best affiliate marketer, you should have some experience with the products/services you are promoting.

You want to be in the know when promoting a company.

Otherwise, you’ll seem insincere and may lose credibility.

11. Share Your Internet Connection

Did you know that you could make up to $500 per month by just sharing your internet connection?

And it’s thanks to an app called Pawns app.

Sharing your internet helps individuals and companies to:

- Improve SEO

- Overcome geo-restrictions

- Improve marketing strategies

- Advertise in your specific location

It’s also worth noting that sharing your internet does not mean the app would access your computer, contacts, use spyware, etc.

Pros

Let’s take a look at the advantages of sharing your internet connection:

#1: Earn Passive Income

Of course, one of the key features to sharing your internet is making money while you sleep.

You can make up to $500 per month (that’s $6,000 per year), which essentially helps pay for your internet and other expenses.

#2: Low Payout Threshold

The payout threshold is $5, which is very low compared to other websites.

Especially if you’re earning $500 per month (that’s a little over $16 per day), you can crack the threshold payout very early.

You can get paid in cash (via PayPal) or in Bitcoin.

#3: Anyone can Join Around the World

One of the best things about the IPRoyal app is that whether you’re located in New York City or in India, you can earn passive income by sharing your internet connection.

Cons

Here are some downsides to sharing your internet connection:

#1: Limited Earning Opportunities

Don’t rely on sharing your internet connection to become a millionaire.

Yes, you can earn between $600 to $6,000 per year, but you can’t quit your full-time job for this.

#2: Could Lower Your Internet Efficiency

Sometimes, reviews have stated that sharing your internet connection could decrease your internet speed and bandwidth.

It’s not true for every instance but it can happen.

#3: Earnings are Based on Location

You can make more money from sharing your internet connection if you live in a desirable location.

How to Share Your Internet Connection

Here’s how to get started with sharing your internet connection:

- Sign up to the Pawns app

- Download the correct version (Mac, Windows, Android, etc.) of the IPRoyal app and install it

- Let the app run in the background while you keep working on your daily tasks

- Log in to your IPRoyal portal and request a payout

Sharing your internet literally allows you to make money in your sleep – without moving a finger.

You can probably earn between $10 to $500 per month just by sharing your internet – and that income will probably pay for your internet!

12. Rent Out Your RV

With the onset of the pandemic, 2021 was dubbed “The Year of the RV.”

In fact, in 2021, America had 62% more RV owners than in 2001.

While the initial RV craze may decrease over the next few years, it’s still very likely that explorers will be looking for their next adventure.

That’s where renting out your RV on platforms like RVshare comes into play.

Instead of buying an RV, a lot of travelers are looking to rent an RV unit and venture through the countryside.

Especially with the increase of emphasis on mental health and work-life balance, the popularity of RVing may likely persist.

Pros

Let’s take a look at the advantages to renting out your RV:

#1: Earn Passive Income

The recent surge in popularity of RV’ing is one of the best reasons to consider renting out your idle RV.

Knowing that you could make $40,000+ per year in passive income – literally means making money overnight.

#2: No Lot Rot

There’s a common expression in the RV community, and that’s known as “Lot Rot.”

Lot rot is when you leave your RV idle for several months.

The longer RVs sit idle, the higher your repair and maintenance costs.

#3: Avoid Paying Storage Fees

Not all people can store their RVs on their property, so storing your RV might be your next best option.

However, storage fees can be expensive, so renting out your RV may offset those storage fees.

Cons

Here are some downsides to renting out your RV:

#1: Wear & Tear

Of course, if people use your RV, you should expect for the typical wear and tear.

On top of that, you should also expect to see increased mileage on your RV, which could cause issues down the road.

#2: Potential for Liability

While RVshare does offer insurance and protection for owners (up to $1 million in liability coverage), additional coverage may depend on your RV.

#3: Damage

If you allow a novice RV renter to take your RV on a trip, there is a very high chance that they may come back with some damage.

Below are some high-risk situations for novice RVers:

- Uphill starts

- Taking corners

- Fitting under trees

- Fitting under bridges

- Backing into a campsite

Thankfully, however, RVshare does have insurance protection coverage, and you should make sure to read the fine print to see whether you’re covered.

How to Rent Out Your RV

Here’s how to get started with making money by renting out your RV:

- Sign up to RVshare

- Clean out your RV and make it look presentable (if not already)

- Take appealing pictures and post those on RVshare

- Promote your RV on the RVshare website

As long as you don’t need your RV and you’re ok putting a few miles on it, RVshare is a fantastic way to make money in your sleep.

13. Rent Out A Room in Your Home

Do you have a room in your house or apartment that you don’t use?

If that’s the case, then you may want to consider renting out your spare room.

In fact, 43% of homeowners have rented out a room in their home to earn extra cash.

On average, you can make between an extra $800 to $1,200 in monthly income from renting out an extra room.

But… is it actually worth your time?

Pros

Let’s take a look at the advantages of renting out a spare room in your home:

#1: Extra Income

One of the most obvious benefits of renting out a room is the extra income.

You could earn between $800 to $1,200 per month (that’s between $9,600 to $14,400 per year!).

That extra cash could help:

- Get rid of debt

- Invest and save

- Pay off the mortgage

#2: Test the Waters

If you’ve always been interested in making money in rental real estate, then becoming a landlord by renting out a room in your home might be a good first step.

#3: Company

If you’re single and you want to have some companionship, then finding a roommate could be a perfect solution.

Cons

Here are some downsides to renting out a spare room in your home:

#1: The Costs May Offset the Gains

On average, renting out a spare bedroom can cost up to $9,400.

The extra costs come from:

- Taxes

- Utilities

- Maintenance

- Improvements

- Rental insurance

So, if you charge less than $783.33 per month in rental income, you may actually be facing a loss.

#2: Troublesome Tenants

If you fail to screen your tenants, then you may be in for a long, painful experience.

In fact, 17.6% of landlords regretted not screening their tenants to avoid conflict.

#3: Attorney Fees

While making extra income is always a good thing, it’s also critical that you take the necessary steps to legally and financially protect yourself – and your family.

That’s why it should be a priority to work with an attorney who is knowledgeable in:

- Real estate

- Contract law

- Rental negotiations

It would probably be a good idea to use a rental agreement drafted by an attorney, specifically for your situation.

How to Rent Out Your Room

Here’s how to get started with renting out your room:

- Identify which room you wish to rent out

- Determine whether you need to make any updates to that room to be suitable for renting

- Find an attorney to draft a rental agreement specific to your situation

- Promote your rental unit to find potential tenants (use word of mouth, classified ads, or websites such as Roommates.com)

- Thoroughly vet and screen potential tenants

- Ensure your contract is signed

Just make sure you weigh the pros with the cons before you make any decisions.

14. Rent Out Your Unused Space

Do you have unused space on your driveway or in your garage?

If yes, then consider renting out your unused space for extra cash!

Here’s how:

- Find unused space in your home

- Determine your rental price

- Take pictures of the space

- Post your space on Neighbor

- Earn monthly income

Check out how much you could earn by renting out your space:

Even if you have access to an unpaved lot, you could make up to $1,200 per year for the extra storage space!

Pros

Let’s take a look at the advantages of renting out your space:

#1: Passive Income

Renting out unused storage space in your home is one of the easiest ways to make money while you sleep.

#2: Minimal Maintenance

Aside from keep the area clean (aka normal living conditions), you really don’t have to worry about additional maintenance.

#3: Flexibility

Since you’re the host, you decide how to handle the arrangements:

- The cost

- The contract time frame

- The type of items stored in your space

You are the boss, you decide, and you make the cash.

Cons

Here are some downsides to renting out your space:

#1: Liability

Of course, there are risks involved, especially when someone else is trusting you to protect their personal belongings.

However, Neighbor does provide insurance protection for hosts (and renters) in the case property is damaged or needs to be replaced.

#2: Limited Renters

Depending on your location (aka you live in a city), you may have more luck renting out your space than those who live out in the countryside.

#3: Lower Prices

Yes, you can make passive income from renting out your spare storage space.

However, you may have to provide competitive pricing (unless you are a 5-star rated host) to attract renters.

How to Rent Out Your Unused Space

Here’s how to get started renting out your unused space:

- Sign-up to Neighbor

- Complete your profile

- Take good, aesthetic pictures of your available space

- Determine how much you will charge based on the size, safety of the location, and other amenities (such as security cameras)

- Post your storage space

- Wait for a message from renters through the app’s built-in message platform

- Payments are handled through the app’s website

If you’re wondering how to make money while you sleep, then renting out your unused space is probably one of the best options.

It’s minimal maintenance, and you still make cash fast!

15. Develop an Online Course

Online course creators are expected to earn $325 Billion by 2025!

Clearly, online courses can be very lucrative – if done right.

Below are some factors:

- Consistent updates

- Industry experience

- First-level promotion

Especially when you are first developing your online course, you will need to put in a lot of upfront effort.

While successful online courses can range anywhere from gardening advice to financial advice, the niches that typically perform well include:

- Education

- Computer coding

- Financial education

- Marketing and promotion

Pros

Let’s take a look at the advantages of building an online course:

#1: Make Money in Your Sleep

If you really commit the time, energy, and effort, then you could be making money in your sleep for many years to come.

The caveat?

You will have to put in a lot of upfront work (see the cons section).

#2: Work From Home

One of the best parts about creating a profitable online course (in my opinion) is working from home.

You have the flexibility and you can essentially be your own boss!

#3: Scalability

You can sell your online course to a very large audience, day and night, 24/7.

Cons

Here are some downsides to building an online course:

#1: Upfront Work

There is a lot of sacrifice that goes into building an online course.

It can take between 3 days to 60 days – and that’s assuming you’re working on your course full-time.

The time it takes to develop an online course really depends on:

- The topic

- Your availability

- Your level of expertise

- How in-depth your course is

- Beginner vs. Advanced audience

Even if it takes you 3 months to create your course, if it’s high quality, you could be making money in your sleep for years to come.

#2: Must Provide Updates

In order for the course to stay relevant with your audience, you have to make sure to provide regular updates.

For example, if your course is an in-depth masterclass on estate planning, you should make sure to provide updates on new tax laws, state laws, etc.

No one wants to buy an outdated course.

#3: Poor Promotion

Unfortunately, one of the key factors determining whether a course will be successful or not is how you promote your online course.

Pre-sales are excellent tools to help gauge whether your audience is even interested in this course.

If you find that not many people are buying your pre-sale, simply cancel your pre-sale, provide a refund, and save the 60+ days you would have spent building a course that would have received minimal sales anyway!

How to Build an Online Course

Here’s how to get started with creating your own online course:

- Consider your area of expertise

- Test your online course idea with a test audience

- Research the topic and consider the feedback from your test audience

- Sign-up for an online course creation platform such as Teachable

- Draft the course outline

- Incorporate the course material

- Launch a pre-sale on your website, social media, e-mail, etc.

- Promote your course using podcasts, e-mails, your website, sponsored tweets, and other social media ads

- Request social media influencers to help you launch your course

Building an online course may be the right next step for you.

Just keep in mind that online courses could be a lot of upfront work.

16. Write and Sell an eBook

One of my proud moments was authoring and publishing my very first eBook, How to Get Rich from Nothing.

It took me weeks to complete this book from cover-to-cover.

But, after putting in the hard, upfront work, writing my own eBook completely paid off: Within the first week, I made over $2,000 from my eBook!

I couldn’t believe it.

While I’m not making $2,000 a week anymore from my eBook (sales do tend to dwindle after a book’s initial promotion), I’m still making money in my sleep – 2 years later!

Pros

Let’s take a look at the advantages to writing and selling your own eBook:

#1: Earn Passive Income

When done right, your eBook can earn you anywhere from $100 per month to $5,000+ per month.

How much you earn really depends on:

- Your topic

- Your writing ability

- Your level of expertise

- Your promotional tactics

#2: Help People in Need

An eBook gives you the chance to share your expertise with the rest of the world.

And believe it or not, there are people out there who actually need your help and insight.

#3: Flexibility

You have control over every aspect of writing your eBook.

For example, you control:

- The title

- The price

- The layout

- The subject

- How it is sold

- The cover design

- How it is promoted

And, if your eBook really does it make into the big leagues and earns you several $1,000+ per month, you could even quit your full time job!

Cons

Here are some downsides to writing and selling your own eBook.

#1: Upfront Work

It’s no joke that writing an eBook can be a lot of upfront work.

Typically, you’ll have to spend between 30 to 100+ hours upfront in the phases of writing, editing, and re-editing.

You really won’t see any money until your book is promoted (which you’ll probably have to do as well).

#2: It’s All on You

The task of writing an eBook doesn’t just stop when you write the last word.

As an eBook writer, chances are you will have to:

- Sell

- Edit

- Write

- Design

- Publish

- Promote

…And the list keeps going.

If you’re wearing all the hats, it might feel overwhelming to do all of these things at once.

But, keep your head in the game and stay focused on the main goal.

#3: Volatile Income

One of the hardest parts to writing and selling eBooks is that your income is never guaranteed.

Specifically, you’ll probably find that you sell a lot of copies when your eBook has just released… however those sales can and typically do slow down over time.

How to Write an eBook

Here’s how to get started with writing and selling your own eBook:

- Think about a topic

- Download How to Create & Sell eBooks

- Study the strategies in the ebook course

- Write an eBook outline

- Start writing the actual eBook

- Edit

- Re-edit

- Re-re-edit

- Re-re-re-edit (and probably do it again after that!)

- Use actual publishers or a free self-publishing platform (like Gumroad)

- Promote vigorously via your email list, social media, word of mouth, influencers, etc.

- Start selling your eBook

If you have a gift for writing and if you have specialized knowledge in a specific field, then writing an eBook might be the right next step for you.

17. Open a High Yield Savings Account

Want to earn a higher interest rate on your spare cash?

If yes, then you may want to consider opening a high yield savings account.

Here’s why:

High yield savings accounts typically have interest rates much higher than regular savings accounts.

For example, as of April 2024, you could earn 5.26% APY with a savings account at Raisin 👇

Compare that to the current national average savings interest rate which is just 0.08%!

Big difference right?

So how do high yield savings accounts help you make money while you sleep?

Here’s how:

- Deposit cash

- Earn interest on your cash

- Let the interest compound daily

As long as you don’t touch the cash in your account, over time, you’ll see your money grow.

Pros

Let’s take a look at the advantages of investing in a high yield savings account:

#1: Higher Interest Rates

Compared to the interest rate of regular savings accounts, a high yield savings account actually has a very high rate.

Sometimes, that rate can be up to 60X higher than a regular savings account (which means more money in your pocket).

#2: No Maintenance Fees

The maintenance costs on high yield savings accounts are minimal to none.

Paying $0 compared to paying $10+ per month in account maintenance fees can help you save a lot of money in the long run.

#3: FDIC Insured

Just like a regular savings account, a legit high yield savings account is also FDIC insured.

This means that up to $250,000 per account owner, per bank will be insured in the case the bank fails.

Cons

Here are some downsides to investing in a high yield savings account:

#1: Rates are Variable

While rates for high yield savings accounts are typically higher than a regular savings account, the rates still vary.

#2: Will Not Beat Inflation

Chances are, a high yield savings account will not beat inflation.

Why?

Inflation, historically, has averaged between 2% to 4% and high yield savings account rates are hovering a little over 1%.

#3: More Steps are Involved

Since a high yield savings account is almost always strictly online, to withdraw your cash you may have to jump through some additional hoops.

How to Open a High Yield Savings Account

Ready to open a high yield savings account?

Here’s the process:

- Go to Raisin

- Find the best savings account rates

- Select your desired savings account

- Complete your profile

- Link your outside bank account and/or your paycheck information to receive direct deposits

- Start earning interest on your savings

This is an easy way to make money in your sleep.

18. Invest in Peer-to-Peer Lending

Peer-to-Peer lending (aka P2P) is an online platform that connects lenders (you) with borrowers.

With P2P, you essentially are the bank.

Keep in mind, however, that you are lending money to people that normally can’t qualify for traditional financing loans (maybe they have a poor credit or bad track record).

Pros

Let’s take a look at the advantages of peer-to-peer lending:

#1: Earn Passive Income

The key benefit to P2P is that you can build multiple streams of income.

#2: Low Minimum Investment

Let’s say you want to start making money overnight, but you’re a little hesitant to start with P2P.

The good news is that you can invest in P2P for as little as $10 with platforms like Groundfloor.

#3: You Choose Your Level of Risk

If you’re lending out your money, you can choose how much risk you want to take, based on the profile of the borrower, the project type of the borrower, the number of installment payments, etc.

Cons

Here are some downsides of peer-to-peer lending:

#1: Loans are Risky

Keep in mind that the people who are borrowing your money were rejected from the bank for a reason.

So, the chances of you not receiving your full investment can be higher than usual.

#2: No Liquidity

When you hand-out your loan, then you can’t just liquidate and ask for cash back when you feel like it.

P2P is a long-term investment (or at least for the duration of your borrower’s project).

So once you invest your money, you’ll have to wait a bit until you see your cash again (if at all).

#3: Early Repayment Hurts Your Income

If borrowers decide to repay your loan earlier than expected, then you may actually make less money.

While it’s always a good thing to have your principal balance repaid, an early loan payment might cause you to miss out on some of the interest charges that you could have otherwise earned.

How to Invest in Peer-to-Peer Lending

Here’s how to get started with peer-to-peer lending:

- Sign-up to Groundfloor

- Determine your risk tolerance

- Select investments based on your risk tolerance

- Link your bank account to your Groundfloor account

- Transfer funds to your Groundfloor account

- Execute your investment order

The Groundfloor platform states that within 6 to 9 months, most loans are repaid, which is actually not bad.

19. Invest in Alternative Assets

When you hear the term “alternative assets,” you might think that these are exclusively available to only the ultra-wealthy.

That’s not the case anymore.

The playing field is now leveled where virtually anyone can invest in alternative assets.

For example, with investment platforms like Yieldstreet, you could invest in:

- Crypto

- Fine art

- Real estate

- Legal contracts

- Marine financing

- Structured notes

…And much more.

Not only do have a wide array of investment options, but you can also receive higher returns.

Take a look at the returns Yieldstreet has achieved with their private market offerings:

Question is: Why even consider alternative assets?

First, alternative assets increased by about 90% in value in 2021.

And second, alternative assets can generate passive income – sometimes far more than traditional passive income sources.

Pros

What are some advantages of alternative assets?

#1: Earn Passive Income

Alternatives not only boast high potential returns, but they also give you the opportunity to earn consistent passive income.

#2: Hedge Against Inflation

No one likes the “I” word (inflation).

That’s why it’s important to diversify your portfolio and consider investing in asset classes (like alternatives) that offer protection against rising inflation.

#3: Very High Potential Returns

If you do your proper research and stay invested for the long term, then you could achieve very high returns.

Cons

What are some disadvantages of alternative assets?

#1: Fees Can be High

Almost any time you invest in alternative assets, you should expect to pay a higher than normal fee.

That’s because fees are used to cover property managers, deal negotiators, etc.

#2: Very Illiquid

Don’t expect to cash out of your investment anytime soon.

Typically, you’ll have to keep your money invested for 5 to 10 years.

#3: High Investment Minimums for Accredited Investors

Both accredited and non-accredited investors have access to alternative assets.

But the investments designated for accredited investors generally have high minimum investment thresholds (typically $10,000 to $25,000).

How to Invest in Alternative Assets

Here’s how to get started with alternative asset investments:

- Sign-up to Yieldstreet

- Complete your profile

- Browse the open offerings

- Do your proper research

- Link your bank account

- Fund your Yieldstreet account

- Execute your investment order

While all types of investors can access Yieldstreet, you’ll have more investment options if you are an accredited investor.

Recommended Reading: Yieldstreet Review

Making Money While You Sleep: The Bottom Line

Imagine going to sleep at night and waking up to more money in your bank account.

Now that’s a great feeling.

And believe it or not, this can be you!

By saving, investing, and building income generating assets, you can become financially independent.

…And you probably won’t see immediate results, either.

But when you do start making money overnight, the rush becomes addictive and you’ll probably want to keep making more money.