If you’re looking to invest in apartment buildings then you’ve come to the right place.

In fact, investing in apartment buildings is one of the best ways to build wealth in real estate.

And in this article, you’ll learn how to grow your annual income by $1,000’s by investing in apartments.

Let’s jump right in.

Is an Apartment Building a Good Investment?

Investing in apartment buildings could be a lucrative investment.

People that invest in apartment complexes are looking to:

- Diversify their portfolio

- Hedge against inflation

- Buy an appreciating asset

If you invest in apartment buildings, then you could also generate passive income.

For example, you could:

- Enjoy deferred tax liability with a Section 1231 Exchange

- Costs and maintenance can be deducted against income

- Deduct a portion of your apartment building’s value annually

While there is a lot of work that goes into managing an apartment complex (and dealing with grumpy tenants), there is good news.

Thanks to technology, you don’t just have to invest in physical apartment buildings.

With platforms like Fundrise, you could invest as little as $10 and tap into the cash flow without managing the property or tenants.

How Much can You Make with Apartment Investing?

Investing in apartment buildings can be highly profitable.

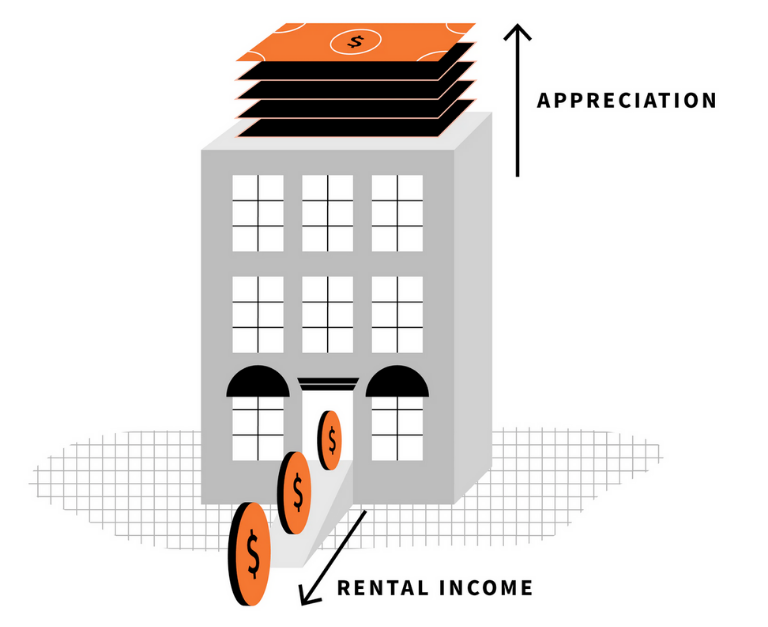

For example, when you invest in apartment building structures, you create a steady income generating asset.

Apartment investing can also offer you a high return on your investment over time, because the value of your property increases.

Here’s how this works:

So not only do you earn a consistent income stream through rental income but the property value also appreciates.

To really figure out whether your apartment building investment is profitable, you need to use what experts dub, “the 1% Rule.”

So, if you buy a property for $200,000, then you’ll want to make sure that the monthly rental income is over $2,000.

Otherwise, you might be operating at a loss.

Think about it, as a landlord, you’ll likely have the following costs:

- Maintenance

- Property taxes

- PMI (potentially)

- Mortgage (potentially)

- Homeowner’s insurance

- Landscaping (potentially)

And on top of that, you might have stubborn tenants who may not be good to work with… so there are plenty of costs to cover first.

However, if you charge the right amount of rent to your tenants, then investing in apartments buildings can be one of the best investment vehicles.

9 Ways to Start Investing in Apartment Buildings

Whether you’re a beginner or an advanced real estate investor, these 9 options will set you up for apartment building investing success.

1. Invest through Crowdsourcing

Crowdsourced real estate platforms offer their real estate investments to a number of investors for a lower price.

An investment in apartment buildings via crowdsourcing can give you the following benefits:

- Earn passive income

- Avoid market volatility

- Tap into capital appreciation

And on top of that, you also avoid managing grumpy tenants and you don’t have to physically maintain the property.

How to Invest in Crowdsourced Real Estate

If you want to start investing in apartment buildings with higher returns, you may want to consider looking into crowdsourced real estate investing platforms.

Here are the best ones:

A. Fundrise

Minimum Investment: $10

Average Returns: 5% to 22%

Average Fees: 1%

Accredited Only? No

You can invest in an apartment complex via real estate portfolios on platforms like Fundrise.

Fundrise makes apartment investing easy because all you need is $10 to start and you don’t just invest in 1 building; you get multiple real estate properties with 1 investment.

Below is a typical breakdown of a real estate portfolio through Fundrise:

The variety of property types diversifies your risk.

In fact, Fundrise recently invested in several new apartment build ideas around the Austin, Texas metro area, which has recently been booming.

While everyone’s investment experience will be different, out of the 442,544 active investment accounts, many have seen positive growth.

What’s overwhelming to me is that after 7 years, some Fundrise accounts have gained over 80% in value!

Recommended Reading: Fundrise Review

B. Groundfloor

Minimum Investment: $10

Average Returns: 10%

Average Fees: 0%

Accredited Only? No

Yes, you read that right: 0% fees.

Groundfloor is one of the few real estate investing platforms that charges $0 in fees to its investors.

With Groundfloor, you are essentially giving out a loan to people looking to flip and fix a residential home.

So in essence, you’re acting like the bank. Your “investment” is a loan to someone looking to flip a property and in exchange for the loan, you get:

- Interest (typically quarterly)

- Repaid on your full loan after the property sells

Groundfloor is a platform where you don’t just invest, but you can also apply for a loan (if you’re flipping a house) OR you can simply stash your cash in a high yield savings account (earning about 4%).

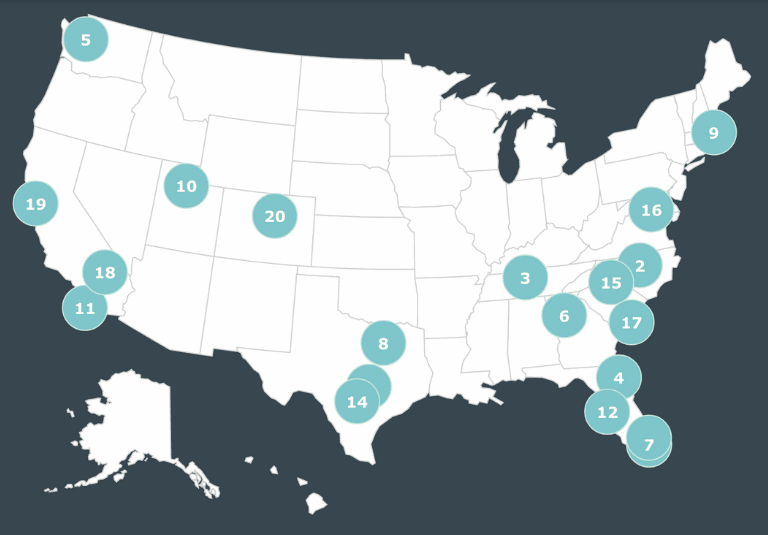

Currently, you can lend money across 34 states through Groundfloor:

With Groundfloor, you’ll have access to several different “tranches” of real estate properties.

The tranches range from Tranch A to Tranch G, with A being the safest (and lowest return) and G the riskiest (and highest return).

I would just point out that in general, platforms like Groundfloor can be pretty risky because the people you lend out your money to often didn’t qualify for loans at banks.

That might be due to a poor credit score, recent bankruptcy, etc.

However, that doesn’t mean you won’t earn money on your investment – especially if you invest just $10 to start.

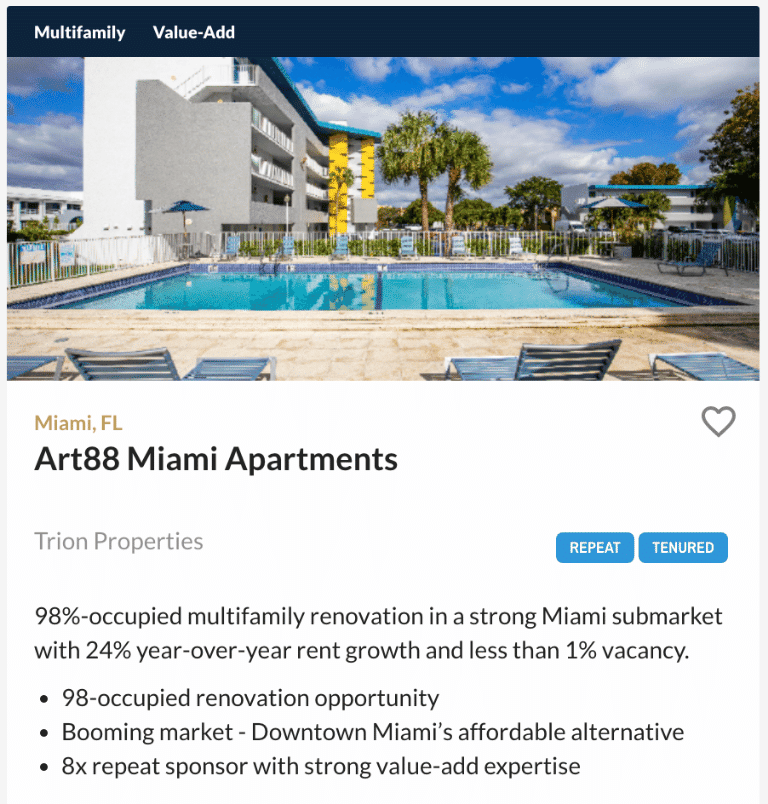

Minimum Investment: $5,000

Average Returns: 18.7%

Average Fees: 1%

Accredited Only? Yes

EquityMultiple’s main investment focus is directly investing in commercial real estate properties.

However, EquityMultiple also gives you the chance to invest in real estate funds (which are typically more diversified than a direct investment) or in a short-term note.

With EquityMultiple’s direct investing approach, you could start owning apartments in the middle of Brooklyn, New York!

If you’re really looking for long-term growth, then EquityMultiple might be a right fit for you, since the average net (after fees) returns have hovered around 18.7%.

If you’re interested in EquityMultiple and qualify as an accredited investor, then consider opening an account on their website.

2. Invest in a REIT

An investment in apartment buildings could also mean you own a REIT.

REITs (aka Real Estate Investment Trusts) are investments in income generating real estate.

The real estate and tenants are managed by the REIT company so you just collect your income stream.

Investing in an apartment complex through REITs can help you:

- Generate income

- Diversify your portfolio

- Protect against inflation

- Hedge against market volatility

And the best part is that you don’t have to manage apartment buildings on your own – the REIT company does all of it!

REITs can fall into 3 categories:

- Publicly traded REITs

- Publicly non-traded REITs

- Privately non-traded REITs

You can buy publicly traded REITs on stock exchanges, and they trade like stocks (so every day).

Privately held REITs and publicly non-traded REITs lock up your money for longer.

However, these types of REITs invest in much riskier (and possibly more lucrative) real estate properties.

How to Invest in REITs

There are many platforms for you to invest in apartment buildings by way of REITs.

Here are the best ones:

A. Streitwise

Minimum Investment: $5,000

Average Returns: 8% to 9%

Average Fees: 2%

Accredited Only? No

Streitwise is a privately traded REIT that caters to both accredited and non-accredited investors.

Founded in 2016, Streitwise specializes in cash flow producing real estate, typically office buildings.

Streitwise could be a good diversification for your investment portfolio if you don’t want to invest in high risk real estate.

In general, Streitwise invests in:

- Hotels

- Office buildings

- Apartment buildings

- Retail shopping centers

Investing in commercial real estate is a fairly safe bet – especially during recessions.

That’s because you’ll very likely get a passive income stream from rent, even when market conditions aren’t favorable.

Some other benefits from REIT investing include:

- Hedging against inflation

- Diversifying your portfolio

- Generating passive income

- Higher than average returns

And it gets better:

Over the past few years, REITs have also outperformed the S&P 500.

I like REITs because they can grow in value over time (as does most real estate) and they also throw off quarterly income in the form of dividends.

In Streitwise’s case, the average dividend yield for the past 22 quarters is 9.1%.

Other investments like publicly traded stocks or publicly traded REITs also throw off dividends.

However, Streitwise has outperformed the other assets consistently over the past few years.

Compared to other assets, Streitwise certainly has some advantages:

Even though Streitwise has many pros, it’s important to consider the cons as well. Specifically, when it comes to liquidity.

In general, the holding period (aka the amount of time that your cash is locked up) is about 5 years.

And if you try to take your cash out of your investment early – you can – but you probably won’t get 100% back of what you originally put in.

B. RealtyMogul

Minimum Investment: $5,000

Average Returns: 10%

Average Fees: 1% to 1.25%

Accredited Only? Both (accredited and non-accredited)

With RealtyMogul, you can invest primarily in what are known as REITs.

RealtyMogul offers 2 types of REITs:

- Income REIT

- Growth REIT

The Income REIT focuses on generating income, having produced about 6% to 8% of consistent income (after fees).

Regardless of the REIT that you decide to invest in, both offer diversification in:

- The type of real estate holdings

- The location of the real estate holdings

- The type of investment (debt versus equity)

If you’re aiming for capital appreciation (so growth on the value of your investment), then investing in apartment buildings through the Growth REIT would probably be a better fit.

3. Buy A Physical Property

Of course, one of the more obvious ways to invest in apartment buildings is simply to buy a physical property.

Buying a physical asset means you’re actually taking either partial or full ownership interest of a physical home.

Buying a physical apartment building yourself and managing it can be extremely rewarding because you make your own decisions.

But, it can also be a lot of hard work and will need the right people working alongside with you – like an accountant, an apartment building manager, etc.

But here’s the good news:

Thanks to fractional share investing, you can actually buy a share of a physical building.

A fractional share is a slice of ownership. Instead of owning 100%, you invest based on a dollar amount that works for your wallet, so you’ll own a fraction of a share.

While fractional ownership took the stock market by storm, the concept has also become popular with real estate investors.

With fractional ownership, you can still invest in a physical property, but just a part of it.

How to Invest in a Physical Property

Buying a physical property doesn’t mean you have to shell out $100,000’s.

In fact, you can invest $100 in apartment buildings using modern fintech platforms.

Here are the best ones:

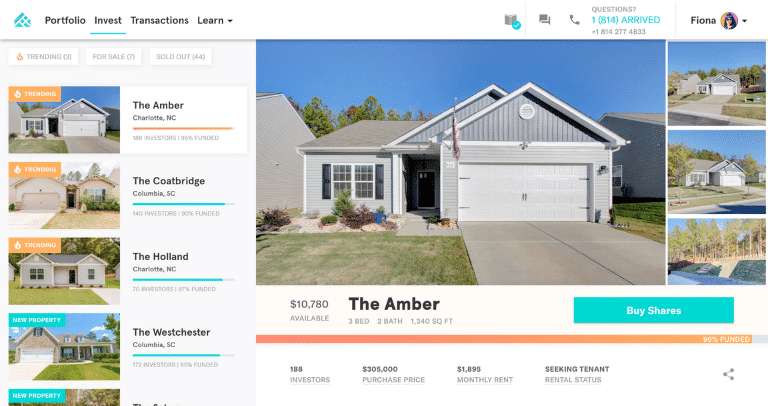

Minimum Investment: $100

Average Returns: 5.4% to 7%

Average Fees: 1% and up

Accredited Only? No

Since Arrived Homes was founded back in 2019, the platform has already skyrocketed in popularity.

As of late 2022, over 170,000 registered investors have joined the Arrived Homes platform.

And who can blame these investors?

You literally get all the benefits to real estate investing for a fraction of the price.

Plus, you get the added benefits of:

- Passive income

- Some tax benefits

- Property appreciation

- Portfolio diversification

If you want to start investing, it’s a very simple, 4-step process that really shouldn’t take you more than 4 minutes.

All you do is:

- Browse your favorite properties

- Select which property you want to invest in

- Buy shares by opening an Arrived Homes account

- Start earning passive income and property appreciation

Arrived Homes also recently built out a feature where you can invest in not just rental homes but also vacation rentals.

Vacation rentals often tend to be more cyclical, which means you can expect some high cash flow months and other months where you virtually don’t earn anything.

But, vacation rentals also add a good layer of diversification to your real estate portfolio.

The only downside is that when you do invest, your money will be tied up for several years.

Recommended Reading: Arrived Homes Review

B. Roofstock

Minimum Investment: $5,000 (for Roofstock One), 20% downpayment on all other physical properties

Average Returns: 11% to 12%

Average Fees: 0.5% or $500 (whichever is greater)

Accredited Only? Both

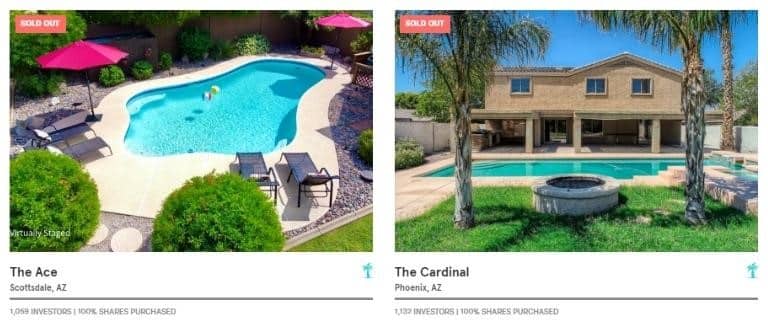

If you want to invest in apartment buildings and earn passive income the second the paperwork is signed, check out Roofstock.

With Roofstock you can invest in physical properties in 2 ways:

- Buying the physical property itself

- Buying a share of a physical property

Roofstock’s platform is available to home buyers and sellers.

If you’re in the market of buying a physical property, then check out the Roofstock Marketplace.

Using this app, you can browse through Roofstock’s many available homes for sale.

What sets Roofstock apart is that many homes available to buy on the Roofstock Marketplace already have rentals WITH tenants available.

So when you buy the property, you’ll start earning a monthly cash flow from rent the second you sign the paperwork!

As you browse Roofstock Marketplace, you’ll notice the “Occupied” tagline next to each property, which will indicate whether the property has tenants living in it or not.

Not ready to buy a house yet? No problem.

Roofstock just released a feature called Roofstock One.

Roofstock One is an app that’s available to accredited investors and is a way to invest in shares of rental properties.

The minimum investment is $5,000, which is much lower than paying a massive $20,000 to $100,000 down payment on a home.

Some of the features included with Roofstock One include:

- Actively managed

- Customized portfolios

- Transparent rental property platform

- Easy access to buy real estate shares online

To sign-up with Roofstock One, it’s literally a 3-step process:

- Confirm you are an accredited investor

- Browse the properties and fund your investment

- Review all investment offering documents and sign them

With the Roofstock One app, you can invest in several different rental opportunities.

They all vary, based on location, rental income, housing market growth opportunity, etc.

4. Invest in an Opportunity Zone

If you’re looking to invest in apartment buildings in a tax advantaged way, then you should also consider opportunity zones.

Opportunity Zones (aka OZs) give you the chance to invest in economically distressed communities in the US that may qualify for tax deferment.

OZs are a fairly new idea, first launched in April of 2018. They are used as an incentive for investors to help low-income communities.

Each state then blocks off a certain amount of land, which is then designated as part of the Opportunity Zone.

Here’s how investing in apartment buildings through OZs works: When you make a profit (from stocks or real estate, for example) you have to pay a capital gains tax.

With the OZ, you put your capital gains tax into the OZ and thus defer your capital gains tax payment.

There are, as always, moving parts that need to be considered to validate an OZ.

So if you’re focused on impact investing, OZs might be a good place to start.

5. Invest on Your Own

Owning apartment complex structures is a big financial responsibility, so you need to do your due diligence first.

Owning apartments by yourself can be daunting but you do keep ALL of the profits!

It’s better to have a team around you that include:

- Lawyers

- Accountants

- Financial advisors

You don’t want to manage apartment properties alone.

But, if you do decide to start your own apartment building venture, then here are some important data elements you need to know BEFORE you start investing:

- Lease Audit – review current leases and whether they’re in good standing

- Rent Roll Analysis – confirm when billing goes out and whether there are late/unpaid rents

- Financial Audit Report – review profit and loss statements

- Market Analysis & Report – estimate the occupancy level based on current market trends

- Property Condition Report – assess whether the property is in good condition

- Site Survey and Title Report – confirm you would have the sole legal claim and right to the property

- Apartment Building Appraisal – determine the value of the property

There are some additional reports that you should certainly review before buying an apartment building complex, but these are probably the most important ones.

6. Invest with a Partner

If you want to invest in alternative assets like apartment building complexes, then it’s typically hard to do it all by yourself.

That’s why it’s often better to team up with a partner when owning apartments.

With a partner, you can pool your capital, so you can purchase an apartment building that you may not have had the chance to buy before.

The pros of partnering up:

- Reduced risk

- Increased capital

- Splitting the work

- Extended network to source tenants

However, there are also some disadvantages to partnering up.

The cons of having a partner:

- Disagreements

- Splitting the profit

- Coordination challenges

- Loss of independent decision making

For the most part, however, partnering up typically has more pros than cons.

That’s why it might be better to enter a partnership with someone else – perhaps someone who already has the real estate expertise.

7. Use a 1031 Exchange

You can also invest in apartment buildings through a 1031 exchange.

A 1031 exchange is a tax code, which means you can defer any capital gains taxes on a real estate property in exchange for buying another certain property type.

Most real estate properties, as long as they are not considered your “primary residence” don’t come with tax benefits when you sell them.

For example, if you buy a rental property for $200,000 and sell it for $500,000, then you owe capital gains taxes on the $300,000 gain.

Not with a 1031 exchange.

A 1031 Exchange essentially swaps one real estate investment property for another.

The benefit? You don’t have to pay taxes in the year of the exchange.

For example, 1031 exchanges can only be made using like-kind property (aka you can’t exchange a farm for a vacation property).

The best part? There is no limit on the number of times you can do a 1031 Exchange.

That means, you can do any amount of 1031 Exchanges and never pay capital gains taxes (as long as you follow all 1031 Exchange rules).

To qualify for a 1031 Exchange, you’ll also need to follow a specific timeline.

That’s why I 100% recommend you to work with your accountant and wealth advisor.

They are specialists and can help walk you through this process to ensure you don’t have to pay a tax liability when investing in apartment buildings or other real estate.

8. Invest in a Syndication

An apartment building investment can also be arranged through a syndication.

A syndication pools money from many different investors to buy a property or apartment building.

There are 2 main players:

- The syndicator

- The investor (you)

The syndicator is the general partner, which makes the decisions and actually manages the property.

The investor (you) is the limited partner (aka passive investor) and all you have to do is collect:

- The income stream generated from rents

- The profit from selling the apartment complex

In most cases, you’d earn passive income on a monthly or quarterly basis – depending on your agreement.

Here’s when a syndication agreement is a good option:

- You only want to invest a little

- You don’t want to deal with tenants

- You don’t want to manage real estate

- You don’t have experience managing real estate

The length of time your money is tied up in a syndication also depends on your agreement.

Typically, the lock-up period for your money ranges from 6 months to 10+ years (so read the fine print)!

9. Invest through a Real Estate Fund

Owning apartments doesn’t just mean that you own a physical apartment building.

In fact, you could own apartment complex structures through a real estate fund.

A real estate fund is almost like a mutual fund that has a strict investment focus on managing real estate companies.

The most common types of real estate funds include:

- Real estate mutual funds

- Publicly traded real estate ETFs

- Privately held real estate investment funds

Most funds invest in multiple real estate properties to diversify their risk.

An investment in apartment buildings via a real estate fund can help make investors money because apartment buildings are often long-term appreciating assets.

So, if you decide to invest in a real estate fund, make sure you’re prepared to lock up your money for a long time (5+ years!).

How to Invest in a Real Estate Fund

There are many platforms for you to invest in apartment buildings via real estate funds.

Here are the best ones:

A. CrowdStreet

Minimum Investment: $25,000

Average Returns: 18.8%

Average Fees: 0.5% to 2.5%

Accredited Only? Yes

Yes, you read that right – from 2014 to November 2022, CrowdStreet’s annualized internal rate of return was measured at 18.8%.

There were only a handful of deals that performed at 0% or less.

And only 6 out of 153 deals were a total loss (so 3.9% of the deals resulted in you losing your money).

You can invest in an apartment complex via one of CrowdStreet’s real estate portfolios.

CrowdStreet makes apartment investing easy because of its transparent website.

CrowdStreet invests in a lot of geographic locations around the United States.

Recently, the platform invested in a new apartment build in Austin, Texas, which seems to be a thriving community.

You may have seen Austin, Texas also as a top investment spot for other platforms like Fundrise.

But unlike Fundrise, which mainly invests in the “Sunbelt” area of the United States, CrowdStreet invests in real estate deals across the country.

You should also know that CrowdStreet is extremely selective when it comes to choosing which real estate deal to offer investors on its platform.

In fact, CrowdStreet has a 5% acceptance rate of real estate deals – that’s lower than your chances of getting into Harvard Business School!

One of the very few downsides to this platform (in my opinion) is that it’s only available for accredited investors.

Recommended Reading: CrowdStreet Review

B. LEX Markets

Minimum Investment: $250

Average Returns: 7.31% to 21.9%

Average Fees: 1%

Accredited Only? No

What I like most about LEX Markets is that YOU are in control of your money.

How? Most real estate investment platforms lock up your money for X number of years until the property is sold.

Not with LEX Markets.

LEX Markets has a built-in secondary market that gives you the chance to buy and sell when YOU want to!

LEX Markets also:

- Boasts high annual returns

- Starts with a $250 minimum investment

- Offers investments to non-accredited investors

Check out some of the apartment building complexes and other industrial properties LEX Markets is offering:

I like that the app has so much transparency when it comes to investing in its properties.

You can click on each offering and dive into much deeper detail, as well.

Once you’ve bought a share of a particular investment property, you can then track the performance of that real estate via your Portfolio Analysis tool on your phone:

The app will track the capital appreciation (aka equity gain) of your real estate holding over time.

Keep in mind that it’s not always easy to value an illiquid asset daily – like real estate. So take these valuations with a grain of salt.

Since you are investing in real estate holdings with tenants, you should also expect to receive a steady cash flow.

While typically you’d receive quarterly distributions, these are not guaranteed.

However, LEX Markets requires building owners to pay distributions to you at an equal rate when the building owners pay themselves distributions.

And this is something I, as an investor, appreciate from LEX Markets.

So what if you want to get out of an investment?

You can trade your share in the real estate property by using LEX Market’s secondary market:

The secondary market is open from 9am to 4pm EST and trades just like any other stock in your investment portfolio.

Remember that the secondary market is an escape hatch – it should never be treated as the front door.

That’s because if you sell shares on the secondary market, you’re probably going to lose money.

Best Places to Invest

If you’re looking to invest in apartment buildings, then you also need to consider geographic locations.

As the famous saying goes, “location, location, location!”

Owning apartment complex structures in the middle of nowhere is probably not going to be in your best interest.

So here are the best places to invest in:

- Austin

- Raleigh-Durham

- Nashville

- Orlando

- Seattle

- Atlanta

- Miami

- Dallas-Fort Worth

- Boston-Cambridge

- Salt Lake City

- San Diego

- Tampa-St. Petersburg

- Fort Lauderdale

- San Antonio

- Charlotte

- D.C. Metro

- Charleston

- Inland Empire

- San Francisco-Oakland

- Denver

When investing in apartment buildings, it’s critical to consider the location.

That’s because high-value tenant markets are typically clustered around cities with access to:

- Hospitals

- Universities

- Supermarkets

- Public transportation

You’ll also want to consider other city factors such as:

- Industry growth

- Occupancy rates

- Population growth

- Employment rates

The reason why you want to invest in apartment building complexes in popular cities is that apartments have high turnover rates.

The longer the vacancy period, the smaller your annual return.

That’s why you want to find a city that’s bustling with people.

One thing to note, however, is that your apartment build costs and supplies could be higher in cities versus the countryside.

Apartment Investing Pros and Cons

If you want to invest in an apartment complex, you also have to consider the pros and the cons.

Pros of Investing in Apartment Buildings

First, let’s take a look at the pros of investing in apartment complexes:

- Stable cash flow

- Asset appreciation

- Some tax advantages

- Recurring passive income

- Easier to obtain property financing

Likely one of the best advantages to owning apartment complex buildings is the tax advantage.

Especially in the US, there are many favorable tax laws that help apartment building owners minimize their tax liability.

Here are some tax law examples:

- Cost segregation study

- Deducting expenses against income

- Accelerate the depreciation of the property

It’s recommended that you work with your accountant and CPA to determine how to best work with the tax laws.

Let’s talk briefly about financing options.

Securing financing for apartment buildings is often easier because lenders typically don’t just look at your personal financial or credit situation.

In fact, lenders typically review the profitability of the apartment building itself and its potential profitability to determine whether they will finance you.

Cons of Investing in Apartment Buildings

Now, let’s take a look at the cons if you invest in an apartment complex.

Specifically, investing in apartment buildings without going through a syndication or crowdsourced platform can have some cons:

- Tenants may refuse to pay rent

- Apartment build costs can add up

- Tenants can be difficult to deal with

- Tenants don’t always take care of the property

- Maintenance and apartment upkeep can be costly

As you can see, apartment investing has many advantages, but you also need to consider the disadvantages before committing your hard earned money..

FAQs

Are apartment buildings good investments?

Investing in apartments is a good investment if you’re looking to build passive income from rent and if you’re looking for consistent appreciation of real estate over time. If you buy an apartment building on your own, that could be a lot of work. However, if you pursue apartment investing through a syndicated or crowdsourced platform, owning apartments would likely come without the responsibility of managing tenants.

Is owning apartment buildings profitable?

Yes, owning and investing in apartment buildings can be profitable because you earn a passive income stream and real estate typically appreciates in value over time.

Do apartments appreciate in value?

Yes, apartments and real estate in general increases in value over time. This is called capital appreciation. Investing in apartment buildings also helps you build a passive income stream and diversify your investment portfolio in case of market volatility.

Why are apartments good investments?

Investing in apartments can be a good investment because you build passive income streams, you diversify your investment portfolio, you protect yourself against inflation, and you can make a future profit through capital appreciation.

Are apartments a risky investment?

If you start investing in apartment buildings without a partner and without a syndication or crowdfunding platform, then owning apartments can be a risky investment. It can be risky because tenants may refuse to pay rent and you may have a hard time selling the apartment building.

Closing Thoughts

If you want to make money while you sleep, then investing in apartment buildings might be the right next move for you.

Making an apartment building investment can help you:

- Earn passive income

- Build generational wealth

- Diversify your investment portfolio

The best news is that you don’t have to spend $100,000’s to buy a physical property.

Thanks to technology and platforms like Fundrise, you can spend as little as $10 and invest in a share of a physical home to start earning rental income.

Just always remember to do your research.

Now it’s your turn:

How would you start investing in apartment buildings?

If you already have experience investing in apartment buildings, then let me know some of the ups and downs.