What do Oprah Winfrey, Ralph Lauren, and Steve Jobs have in common?

They all started with nothing.

Now, I know what you’re thinking:

“How will I ever be like Steve Jobs?”

The good news is that you don’t have to invent the latest tech gadgets to earn a million dollars.

If you want to build wealth, start by putting your cash to work in diverse investment vehicles.

Whether you’re new to investing or a seasoned pro, you’ll get a lot of value from the 19 investment vehicle examples below.

Let’s dive right in.

In this article

What is an Investment Vehicle?

An investment vehicle is used by investors to build their wealth over the long term. Investment vehicles vary in risk, return, and investment time horizon. Some common types of investment vehicles include CDs, stocks, farmland, cryptocurrency, and real estate.

What are the Best Types of Investment Vehicles?

The best types of investment vehicles are those that can meet or exceed their investment goals, meet your financial needs, and align with your overall risk tolerance.

With that said, here are 19 investment vehicles that can help you increase your net worth:

1. Private Real Estate

Investment Vehicle: Private Real Estate

Pros: Diversification, Passive Income, Capital Appreciation

Cons: Highly Illiquid, Complex, High Upfront Costs

Potential Return: 7.31% to 22.99%+

Time Commitment: 5+ years

Minimum Investment: $10

Best Platform: Fundrise

Private real estate offers attractive diversification and inflation-hedging potential.

Not only does private real estate appreciate in value, but you would also earn an average passive income yield of 6.1%:

And it gets better:

The four main asset classes available to online investors include:

- Bonds

- Stocks

- Private real estate

- Publicly traded REITs

Out of the four asset classes, private real estate offers the highest returns, with the lowest volatility:

Especially during economic volatility and high inflation, real estate investments can perform exceptionally well.

Here’s how a portfolio with a 20% private real estate investment would perform versus a traditional portfolio of just stocks and bonds.

The results show that a portfolio with real estate holdings would provide:

- Higher annual returns (6.2% on average)

- Higher passive income yields (3.3% on average)

- Lower risk (a standard deviation of about 10.38% versus 10.95%)

So if you’re wondering where to put your money during inflation or a recession, then private real estate may be your best bet.

How to Invest in Private Real Estate

Want to build long-term wealth and earn passive income, through real estate investments?

Here’s how:

- Sign up to Fundrise

- Determine which investing strategy is best for you (fixed income, core plus, value add, opportunistic)

- Determine which tax investment vehicle you want to hold your real estate assets in (tax-advantaged like IRAs vs. taxable accounts)

- Research the available investment options

- Link your bank account and fund your Fundrise account

- Invest (start small)

- Hold for the long-term

Fundrise is the investment vehicle for anyone because you can invest as little as $10 or as much as $1,000,000.

It works because Fundrise builds wealth over time and helps you earn passive income.

It’s a win-win situation.

Recommended Reading: Fundrise Review

2. Farmland

Investment Vehicle: Farmland

Pros: Low volatility, low fees, hedge against inflation

Cons: Highly illiquid, no secondary markets, accredited investors only

Potential Return: 11%+

Time Commitment: 3 to 8+ years

Minimum Investment: $10,000 to $25,000 (as high as $40,000)

Best Platform: FarmTogether

Farmland is one of the oldest investment vehicles in existence and it has helped to produce vast wealth over generations.

As you can see, since 1991, farmland returns (depicted in green) have been steadily climbing over time.

Why?

That’s because a growing global population and a shrinking supply of land across the US drive up farmland prices.

It relates back to the law of supply and demand.

Not only does the value of farmland increase, but your overall average annual return is comparable to that of stocks:

You can earn an 11% return on farmland with much less volatility than stocks, for instance.

The biggest downside?

To make money – both passively and long-term – in farmland investing, you’ll need to stay invested for up to 10 years.

How to Invest in Farmland

Want to invest in an asset that has grown substantially over the past few decades – and earned passive income?

Here’s how:

- Sign up to FarmTogether

- Research the available farm properties for investment

- Link and fund your FarmTogether account

- Determine in which tax-advantaged (or taxable) account you want to hold your FarmTogether investments in (e.g. Trust, 401k, IRA, etc.)

- Invest and hold for the long-term

FarmTogether gives access to so many more people to invest in farmland – all from the comfort of your home.

You don’t have to:

- Harvest crops

- Buy the entire farm

- Manage the farmland

All you do is invest your money and wait (patiently!) until you start seeing dividends and capital appreciation.

This could take some time but is certainly worth it.

3. Blue-Chip Art

Investment Vehicle: Blue-Chip Art

Pros: Low volatility, open to all investors, hedge against inflation

Cons: Long lock-up periods, confusing fee structure, unregulated industry

Potential Return: 8% to 30%+

Time Commitment: 3 to 10 years

Minimum Investment: $500

Best Platform: Masterworks

Did you know that blue-chip art is a $1.7 trillion dollar asset class?

Art investments are a great option to:

- Earn a profit

- Beat inflation

- Buffer market volatility

In fact, the art market has outperformed the S&P 500 by 165% in the past 25 years.

While the S&P 500 earned a 10.2% return, the art market on average earned a 13.8% return.

Blue-chip art could also be a great hedge during a recession because of art’s low correlation to the stock market:

The lower the correlation to the S&P 500, the less chance you lose money when the market takes a nose dive.

How to Invest in Blue-Chip Art

Investing in blue-chip art is a great option to diversify your portfolio and build wealth.

Here’s how to get started:

- Sign up to Masterworks

- Confirm your email address

- Complete your investor profile questionnaire (only 2 questions)

- Schedule a phone interview to complete your membership application

- Once accepted as an exclusive Masterworks member, start browsing the available investments

- Link and fund your Masterworks account

- Buy shares of your favorite artwork

If you want to invest in artwork valued at $30 million+, now is your chance.

Thanks to Masterworks, you can now invest in blue-chip art through fractional shares, so virtually anyone can start investing in million-dollar artwork.

Recommended Reading: Masterworks Review

4. Fine Wine

Investment Vehicle: Fine Wine

Pros: Low volatility, hedge against inflation, real asset

Cons: Unregulated industry, illiquid, long-term investment

Potential Return: 12.4% to 100%+

Time Commitment: 2 to 20+ years

Minimum Investment: $1,000

Best Platform: Vinovest

If you’re a wine enthusiast and you want to invest in an appreciating asset, then fine wine could be the right option for you.

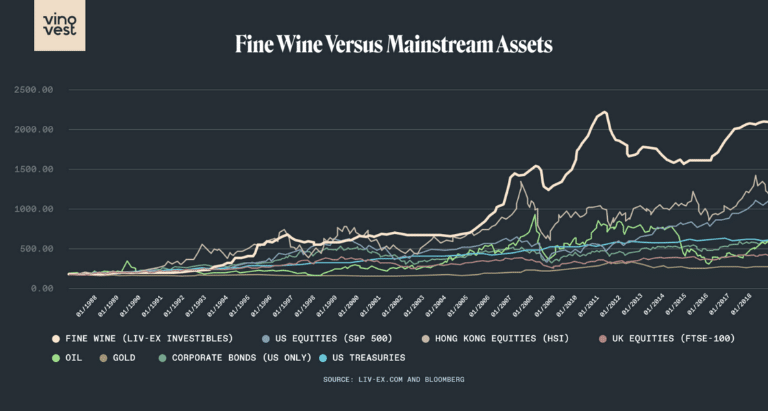

In fact, fine wine investments have steadily outperformed other mainstream assets:

And it gets better:

Take a closer look at the stability of fine wine investments over the first half of 2022 (a very volatile 6 months):

According to the London International Vintners Exchange (aka Liv-ex), fine wine in general (the blue and maroon lines) outperformed other popular asset classes including:

- Gold

- S&P 500

- London Stock Exchange

In general, fine wine is much less volatile over time than stocks.

How to Invest in Fine Wine

Believe it or not, it’s never been easier to invest in fine wine.

You no longer have to do your own research, negotiating, or storing.

Here’s how to get started:

- Sign up to Vinovest

- Complete your investor profile

- Connect your bank account with Vinovest (or credit card)

- Fund your Vinovest account

- Browse the available wines

- Invest

- Stay invested for the long-term

Keep in mind that you’re actually investing in the physical bottle of wine with Vinovest – not just shares of wine.

What’s neat about the Vinovest platform is that your fees pay for:

- Insurance

- Storage costs

- Administrative costs

- Transportation costs

- Regulatory (SEC) filings

- Fine wine seller network

- Fine wine buyer network

So while the fees are a little higher than I like (2.85% for starter accounts), you get much additional value for what you pay.

Recommended Reading: Vinovest Review

5. Exchange-Traded Funds (ETFs)

Investment Vehicle: ETFs

Pros: Beat inflation, long-term growth, liquidity

Cons: Volatility, more risk

Potential Return: 9%+

Time Commitment: Minimal to long-term

Minimum Investment: $100 (or $500 if an IRA)

Best Platform: M1 Finance

If you’re looking to build wealth over time, then one of the best types of investment vehicles is the Exchange Traded Fund (aka ETF).

ETFs are like mutual funds: They are traded on the stock market and typically track an index (like the S&P 500).

Unlike mutual funds, however, ETFs are typically:

- Lower cost

- Lower tax implications

- Sell real-time (not at the end of the day like mutual funds)

ETFs are also different from stocks in that ETFs are like a basket of securities that hold:

- Bonds

- Stocks

- Commodities

- Cryptocurrency

Personally, I like investing in ETFs because they are passive investments and add diversification to my portfolio (since they invest in 100’s of high-quality companies).

The earlier you start investing in ETFs, the faster you can become financially independent.

How to Invest in ETFs

Ready to build your wealth by investing in ETFs?

Here’s the process:

- Sign up to M1 Finance

- Determine your account type (IRA, individual, joint, etc.)

- Connect your bank account to your M1 Finance account

- Fund your M1 Finance account with cash

- Determine how much risk you’re willing to take

- Research your favorite ETFs

- Execute your investments

- Hold for the long-term

If you’re looking for different investment vehicles with diversification already built into them, then ETFs are likely your best bet.

Need expert advice on which ETFs to invest in?

Then consider subscribing to Seeking Alpha and get the absolute best ETF picks and analysis.

6. Your Kids

Investment Vehicle: Your Kids

Pro: Educate kids about personal finance

Con: Requires heavy involvement from the parents

Recommended Age: As young as 10+ years

Minimum Investment: $1 to $20

Best Platform: Greenlight

If you want to leave a lasting legacy, then one of the best ways to invest is in your kids.

Here’s why:

- You develop their thinking skills

- You can set them up for financial success

- You can improve the quality of your child’s life

It’s more important than ever to learn about financial literacy, as only 57% of American adults are financially literate.

If you want to give your kids a leap ahead in life, start teaching them early about financial basics.

A hands-on learning approach works for kids because they develop thinking skills and all senses are engaged through physical participation.

So how do you build a hands-on learning experience for kids when it comes to financial literacy?

Here’s how:

- Pay kids after completing chores

- Teach your child how to save money

- Teach your kids how to gift money to charity

- Watch the stock market fluctuation with your kids

- Have your children research stocks and request trades

All of these steps – and more – are fantastic ways to build the foundation of your kids’ financial literacy.

How to Invest in Your Kids

Teaching your kids about money isn’t always easy.

That’s where the Greenlight Debit Card for Kids comes into the picture.

It’s a tool for parents that gives kids a hands-on money learning experience.

Here’s how to get started:

- Sign up to Greenlight

- Enter a valid US phone number

- Answer a series of personalized questions to set-up your accounts

- Set-up your child account

- Set-up your parent account and wallet

- Link your Parent Wallet with your bank account

- Fund your Parent Wallet with as little as $5

- Send money from your Parent Wallet to your child’s account

- Start teaching your child how to invest, save, make money by doing chores, or give money to your favorite charities

Yes, you read that right, you can actually help your child invest – even if that child is less than 18 years old.

That’s because your child can place trade requests, but you (as the parent or guardian) will have to execute these trade orders.

And… ever have trouble getting your child to do chores?

That’s over now, thanks to the Greenlight chore tracker – for every chore completed by your child, you can pay your child its partial or full allowance.

Recommended Reading: Greenlight Review

7. Yourself

Investment Vehicle: Yourself

Pro: No one can take your knowledge away from you

Con: May have to sacrifice some social interactions

Potential Return: Unlimited

Time Commitment: Minimal to long-term

Minimum Investment: $0+

Best Platform: Udemy

Without a doubt, the best investment is yourself.

Here’s why:

- You can learn new skills

- You can build your career

- You can make more money

- You can gain new experiences

Most importantly – no one can ever take away your knowledge.

And it gets better:

Investing in yourself doesn’t have to cost $1,000’s or even $100,000’s of dollars.

Instead, you can:

- Read books

- Watch YouTube

- Access online programs

For example, you can enroll in an MBA program (taught by an Ivy League professor) for less than $100.

Your success depends on:

- Your ability to learn

- Your determination to win

- Your ability to implement what you learned

In the end, it comes down to how badly you want to learn.

Not the degree, the institution, the fancy course title, etc.

How to Invest in Yourself

You cannot go wrong investing in yourself.

Here’s how to get started:

- Sign up to Udemy

- Browse Udemy’s thousands of classes

- Select a class to join

- Pay for it

- Start learning

As long as you learn consistently – and daily – you can change your entire life’s trajectory.

Stick with your learning and then start implementing what you learned.

8. High Yield Savings Accounts

Investment Vehicle: High Yield Savings Accounts

Pros: FDIC insurance, compounding interest

Cons: Interest rates fluctuate, withdrawal limits (typically)

Potential Return: 2.50%

Time Commitment: Minimal

Minimum Investment: $1

Best Platform: Raisin

Everyone needs an emergency savings fund to build wealth.

So why not make it a win-win by earning a higher interest rate on your savings?

With a high yield savings account, you earn passive income on your emergency fund cash – without even moving a finger!

Here’s an example:

On $1,000, you’d earn $25 in one year – about 20X better than what you’d earn at a regular savings account.

Now imagine if your emergency savings fund had $20,000 of cash… that $25 would translate to $500 per year!

How to Open a High Yield Savings Account

Ready to start earning a little more from your cash by investing it in a high yield savings account?

Here’s how:

- Open an account through Raisin

- Complete the information necessary

- Link your HYSA with your checking account

- Transfer your funds

- Start earning interest

Keep in mind that interest rates fluctuate, so you should expect something like the following:

- When inflation increases – interest rates increase

- When inflation decreases – interest rates decrease

For the most part, however, high yield savings accounts are one of the best investment vehicles to earn the maximum amount of money on your cash.

9. Health Savings Account (HSA)

Investment Vehicle: HSA

Pros: Triple tax advantage, beat inflation

Cons: High deductible health plan, possible penalties

Potential Return: 9%+

Time Commitment: Minimal to long-term (your choice!)

Minimum Investment: $0

Best Platform: Lively

The best-kept secret to building wealth involves the health savings account.

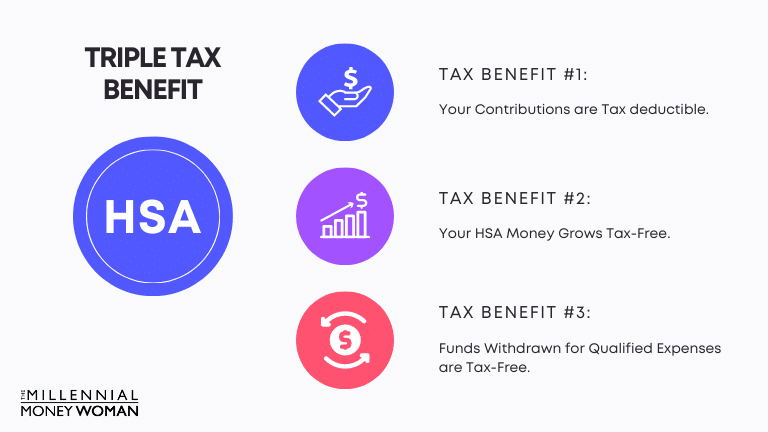

A health savings account (aka HSA) is a type of savings and investment account with a triple tax benefit that helps you set aside money to pay for future medical expenses.

Let me repeat a key phrase in the definition: Tripe tax benefit.

Here’s what a triple tax benefit means:

- You contribute money to an HSA on a pre-tax basis (aka tax-deductible)

- You aren’t taxed on any investment gains

- You withdraw money on a tax-exempt basis (aka you don’t pay taxes as long as the money is used for qualified expenses)

Now, there are certain restrictions with an HSA, however:

To qualify for an HSA, you need to have a high deductible health plan.

This means that HSAs are typically a better investment vehicle for those people who are healthy and don’t see the doctor too often.

An HSA is made up of 2 parts:

- An investment account

- A cash savings account

Typically, you’ll always need to keep about $1,000 (or so) in cash.

The rest of your money is invested… and that’s why HSAs should really be considered as another retirement account and not so much a medical expense account.

HSAs are a great wealth building tool – if used right.

How to Invest in an HSA

If you’re ready to save for your health – and for your wallet – it’s time to open an HSA account now.

Here’s how:

- Sign up to Lively

- Complete your information

- Link your bank account to your HSA

- Transfer funds (up to the permitted annual limit)

- Open an investment account

- Browse your investment options

- Start investing

- Stay invested for the long term

Remember that you can only sign up for an HSA account if you currently have a high deductible health plan (aka HDHP) in place.

Not sure if you have an HDHP?

Call your HR department to confirm.

10. Crypto

Investment Vehicle: Crypto

Pros: Transparency, decentralization, huge gains

Cons: Volatile, little regulation, massive risk

Potential Return: 100%+

Time Commitment: Varied

Minimum Investment: $1

Best Platform: Kraken

If you can handle volatile markets and have some understanding of the tech world, then crypto might be a good choice for you.

For example, check out the volatility of Bitcoin’s price:

Source: Google Finance

On November 12, 2021 Bitcoin hit its all-time high at $64,400 and then shortly afterward plummeted to $18,948.80 on June 17, 2022.

While Bitcoin has made many crypto millionaires, it also had many others lose their money.

How to Invest in Crypto

Ready to start investing in crypto?

Here’s how:

- Sign up to Kraken

- Complete your account

- Link your bank account with your Kraken account

- Fund your Kraken account

- Browse the full list of crypto assets

- Research your crypto investment

- Execute your trade

Just remember that crypto is one of the most volatile investment vehicles out there.

You should only invest as much as you’re willing to lose.

11. Bonds

Investment Vehicle: Bonds

Pros: Low risk, hedge against volatility

Cons: Lower returns, potential tax impacts

Potential Return: 3%+

Time Commitment: Minimal to long-term

Minimum Investment: $100

Best Platform: M1 Finance

If you prefer low-risk environments, then you may want to stash your cash in one of the safer investment vehicles.

One such investment vehicle is bonds.

Bonds allow you to “loan” your money to a company or government in return for interest and repayment of your loan.

If you buy a bond, you’re basically acting as the bank.

Here’s why:

- You’re paid an interest rate

- You are repaid the original loan you gave

- You are paid until the maturity of your bond (aka the end of your contract)

Bonds are much safer than stocks, ETFs, and mutual funds for instance, because they carry the promise of the company (or government) to return your money (plus interest) in a certain period of time.

Stocks, ETFs, and mutual funds on the other hand, don’t have any such promise.

Now, bonds can be risky investments.

Here’s when this could be the case:

- The bonds are low quality

- The bonds have 30-year maturities

- The bonds are from high-risk companies or governments

For example, if a bond’s maturity (aka when you’ll be paid back 100% of your investment) is 30 years from now… then your money could be at risk of inflation.

In other words, $1,000 won’t be worth the same in 30 years from now.

However, if you approach your bond picks wisely, then you can make some money.

How to Invest in Bonds

Ready to invest in bonds?

Here’s the process:

- Sign up to M1 Finance

- Browse the available investment options

- Link your bank account to your M1 account

- Fund your investment account

- Execute your trade

Investing in bonds is a good way to buffer your equity (aka stock) investments during periods of economic uncertainty.

Not sure which bonds to invest in?

Then consider subscribing to Seeking Alpha and get expert advice on bond investing.

12. Mutual Funds

Investment Vehicle: Mutual Funds

Pros: Diversification, risk reduction, low costs

Cons: Tax inefficient, may have high fees

Potential Return: 9%+

Time Commitment: Varies

Minimum Investment: $0 to $500+

Another popular investment vehicle is mutual funds.

A mutual fund is a basket of investments (stocks, bonds, commodities, etc.) that is managed by a company and a dedicated investment manager.

Because mutual funds are managed by a team, they typically cost more in fees than ETFs.

Another thing to consider is the tax consequences of mutual funds.

On the contrary, ETFs, which are almost always passively managed, would likely not incur capital gains taxes.

Here’s an illustration of how mutual funds work:

Personally speaking, I own several mutual funds in my taxable and tax-deferred accounts (like IRAs).

The mutual funds that I own (like SWPPX) are very low cost, passively managed, and tax efficient.

Additional benefits of mutual funds include:

- Liquidity

- Regulation

- Diversification

- Cost-efficiency

- Professionally managed

How to Invest in Mutual Funds

Ready to invest in mutual funds?

Here’s the process:

- Sign up to Vanguard

- Complete your account information

- Link your bank account to your Vanguard account

- Browse the available investment options

- Transfer cash to your account

- Execute your trades

Remember to do thorough research before investing cash into mutual funds.

While some mutual funds are low-cost and track index funds, other mutual funds may be:

- Expensive

- Tax inefficient

- Actively managed

Need expert advice on which mutual funds to invest in?

Then consider subscribing to Seeking Alpha, which can help you find the right funds for your portfolio.

13. Certificates of Deposit (CDs)

Investment Vehicle: CDs

Pros: Low volatility, FDIC insurance, low risk

Cons: Restricted accessibility, early withdrawal penalties

Potential Return: 0.30% – 2.20%+

Time Commitment: 11+ months

Minimum Investment: $1,000

Best Resource: SaveBetter CD Accounts

If you’re looking for an investment vehicle that is low risk and has low volatility, then CDs might be right for you.

A CD, also known as a certificate of deposit is a type of savings account in which you deposit a lump sum of cash in exchange for an interest rate for a fixed period of time.

If you withdraw your cash during this period of time, you may forfeit your interest rate and/or incur penalties.

In most cases, CDs are offered in increments of:

- 6 months

- 12 months

- 24 months

…And so on.

You sign a contract with your local bank and in exchange for giving your bank a lump sum amount of money, your bank agrees to pay you interest on your cash.

If you withdraw your money during the agreed-upon period, you may completely give up your interest rights – and you may even have to pay a penalty.

Here’s how the CD opening process works:

- Deposit a lump sum

- Wait for the CD’s maturity date

- Withdraw your principal + interest

While many local banks offer CDs, online banks may offer higher interest rates (similar to high yield savings accounts).

How to Invest in CDs

Ready to sign-up and stash your cash in a CD?

Here’s the process:

- Find the best CD rates on SaveBetter

- Complete your information

- Select how you want to receive your interest (regularly versus lump sum)

- Connect your bank account with your CD account

- Fund your CD account with a lump sum

- Let your money sit until the CD term is satisfied

Remember that an early withdrawal will result in a penalty – and you’ll likely forfeit (aka cancel) all the interest you were supposed to earn from your CD investment.

14. Money Market Accounts

Investment Vehicle: Money Market Accounts

Pros: FDIC insured, liquidity, competitive rates

Cons: Minimum balance requirements, fees may apply

Potential Return: 2.50%

Minimum Investment: $1

Best Platform: CIT Bank

One of the safest investment vehicles that can protect your capital and give you liquidity is a money market account.

Money Market Accounts are accounts (typically at banks) where you deposit an amount of cash and receive interest payments based on current market interest rates.

Money Market Accounts are often known as MMAs or MMDAs.

They’re very similar to savings accounts or even CDs – and depending on what you’re looking for, an MMA might just be the right investment vehicle for you.

I would point out that MMAs, unlike high yield savings accounts, may not offer the highest interest rate.

However, with MMAs, you can actually go to your physical bank branch to withdraw your money and interact with humans – unlike a high yield savings account.

As with all investment vehicles, there are pros and cons, but MMAs typically are a safer option.

How to Invest in a Money Market Account

Ready to sign-up and open your money market account?

Here’s how:

- Sign up to CIT Bank

- Complete your information

- Link your bank account with your Money Market Account

- Fund your Money Market Account

One of the biggest advantages of a money market account over a CD is that MMA’s are liquid.

So, instead of waiting for a term to mature (like for a CD), an MMA offers you flexibility and instant access to your cash for competitive interest rates.

15. Stocks

Investment Vehicle: Stocks

Pros: Long-term growth, liquidity

Cons: Volatility, elevated risk

Potential Return: 9%+

Time Commitment: Minimal (but for best results, hold for the long-term)

Minimum Investment: $100 ($500 for IRAs)

Best Platform: M1 Finance

If you want to build wealth over the long term, then investing in stocks could be the right option for you.

In fact, the primary source of wealth creation in America comes from investing in the stock market.

And the key is buying and holding stocks for the long term.

Source: Google Finance

For example, if you had invested a one-time lump sum of $1,000 into Apple in January 2005 and let that money grow until August 2022, you now would have $164,371.56!

Or, if you had invested $1,000 every year from 2005 to 2022, you would have $2,794,316.56!

Stocks are an effective investment vehicle to build wealth, earn passive income through dividends, and diversify your portfolio.

How to Start Investing in Stocks

If you’ve ever wanted to be a part-owner of a mega company like Apple or Google – you can do it.

How?

By buying shares of their stock.

Here’s how to get started:

- Sign up to M1 Finance

- Determine which account you want to open (tax-advantaged like an IRA versus taxable)

- Connect your bank account to your M1 Finance account

- Fund your M1 Finance account

- Determine your risk tolerance

- Research your favorite stocks

- Start investing

As the company grows, your stock value can also grow over time.

Need expert advice on which stocks to invest in?

Then here’s a little tip for you:

Subscribe to Seeking Alpha Premium to get the absolute best stock picks there are.

You’ll find expert insights and live stock market news. But beware, Seeking Alpha is highly addictive!

Recommended Reading: Seeking Alpha Review

16. Retirement Accounts

Investment Vehicle: Retirement Accounts

Pros: Long-term savings, compound interest

Cons: Short-term investment fluctuations, investing is an emotional roller coaster

Potential Return: 9%+

Time Commitment: Long-term (until retirement)

Minimum Investment: $1+ (read the fine print)

Best Platform: Robinhood

If there’s one thing the COVID-19 pandemic taught us, it’s that the best investment vehicle for getting ahead is your retirement account.

Retirement accounts include:

- IRAs

- 401(k)s

- 457(b)s

- 403(b)s

- SEP IRAs

- Roth IRAs

- SIMPLE IRAs

…And the list just keeps going.

Sadly, however, 1 in 3 Americans have $0 saved for retirement.

Source: Money

It’s time to change the script and better prepare for your future.

While most experts suggest saving around 15% of your gross annual income, I have a different opinion.

In the future, you may encounter:

- Divorce

- Inflation

- Job layoff

- Medical inflation

- Death of a loved one

- Education inflation for your kids

…And that’s why it’s critical to start stashing more cash away for your retirement when it’s possible.

Personally, I would suggest saving (and investing) at least 30% of your gross annual income.

Of course, the earlier you start saving (and investing) for retirement, the better off you’ll be in the future.

But – it all starts with an action plan today.

How to Invest in Retirement Accounts

Ready to start building a better retirement future and optimizing your investments?

Here’s the process:

- Sign up to Robinhood

- Select your retirement and financial goals

- Complete basic information

- Add a bank account to fund your Robinhood account

- Fund your Robinhood account

Remember the key to building wealth – especially for retirement – all depends on how early you start.

Even if it’s just $10, start your journey now.

Your bank accounts will thank me later.

17. Precious Metals

Investment Vehicle: Precious Metals

Pros: Value appreciation, diversification

Cons: Upfront cost, illiquid

Potential Return: 10% to 13.4%+ (depends on the metal and your time frame)

Time Commitment: None

Minimum Investment: $100

Best Platform: OneGold

One of the most diverse investment vehicles for your portfolio is precious metals.

Precious metals (in an investing sense) typically refer to the following:

- Gold

- Silver

- Platinum

While gold may still be an appreciating asset, you should also consider investing in silver and platinum.

Take a look at silver’s performance over the past 3 decades:

Platinum’s performance over the past 3 decades:

And finally, as a comparison, here’s a chart illustrating the value of gold since 1992:

If you take a closer look at all 3 precious metals, you’ll find that many of the precious metals’ pricing increased during the 2008 Great Recession.

Once the economy recovered in 2009 and 2010, the prices of precious metals declined.

While no one knows where the value of gold or other precious metals will be in the future, this investment vehicle could add a layer of diversification to your current portfolio.

How to Invest in Precious Metals

Ready to start investing in precious metals?

Here’s the process:

- Sign up to OneGold

- Browse the available precious metals

- Connect your bank account with your OneGold account

- Fund your OneGold account

- Buy your precious metals

- Hold for the long-term

- Sell your holdings when ready (can be sold 24/7)

- Withdraw your cash

One reason why I’m a fan of precious metal investment platforms like OneGold is because of their white glove service.

OneGold stores and insures your precious metals in an off-site facility.

When you’re ready to sell, you sell your precious metals at the current market value and keep the profit.

18. Collectibles

Investment Vehicle: Collectibles

Pros: Diversification, appreciation

Cons: Illiquid, complex tax rules

Potential Return: 60% (average ROI)

Time Commitment: Several months to 5+ years

Minimum Investment: $5

Best Platform: Collectable

Believe it or not, collectibles – especially sports collectibles – are becoming very valuable.

In fact, A mint-condition Mickey Mantle baseball card broke a new all-time record recently selling for $12.6 million!

Since the 2020 COVID-19 pandemic, the sports collectible industry took off, and it’s been climbing ever since.

Sports collectibles could include anything from sneakers, to shirts, to baseball cards.

And thanks to modern investment platforms like Collectable, all you need is $5 to start investing.

You buy fractional shares in sports collectible products and make a profit once these goods are sold on the marketplace.

The downside?

To make more money, you’ll have to wait a longer amount of time before selling out of your investment.

How to Invest in Collectibles

Ready to start your collectible investing journey?

Here’s how:

- Sign up to Collectable

- Browse the available investment options

- Connect your bank account

- Fund your Collectable account

- Buy shares starting with just $5

While the collectible market as a whole is generally illiquid, the Collectable Platform actually offers a secondary market, which means you can trade your shares at any time.

So, your investments on the Collectable Platform are actually quite liquid.

19. Rental Real Estate

Rental real estate is one of the top-performing investment vehicles.

Why?

Because you can make money in 2 ways:

- Rental income – Cash flow from rent

- Appreciation – Property value increases over time

Especially over the past few years, rental real estate investing has become very profitable.

As you can see in the graph above, rent (in blue) has been stable over the past few decades.

And historically speaking, rents are somewhat predictable, and rents will be collected even during a recession.

Another thing to consider when investing in rental real estate?

The rapid appreciation of home prices.

As long as you are invested for the long-term, your overall compound annual return can increase significantly.

How to Invest in Rental Real Estate

You can invest in rental real estate for as little as $100.

Here’s how you can get started:

- Sign up to Arrived Homes

- Browse and research the pre-vetted properties

- Determine how much money you want to invest

- Fund your account

- Execute your order

- Sit back and earn passive income

As you may have guessed, investing in rental real estate can be an illiquid and long process (taking up to 5 to 7+ years).

So just be sure that you’re ready to invest for such a time period.

Recommended Reading: Arrived Homes Review

FAQs

What are basic investment vehicles?

The most basic investment vehicles are those without complexity. For example, bonds or savings accounts are basic investment vehicles because they have lower risk and consequently lower returns. Complex investment vehicles typically have more risk and could include stocks and crypto.

What are the most common investment vehicles?

Investment vehicles that are common with both seasoned pros and those new to investing include stocks, checking accounts, ETFs, mutual funds, and real estate. What separates these investment vehicles is their degree of risk, return, and investment time horizon.

What are the 4 investment vehicle types?

The 4 most common investment vehicles that can help you build wealth over time include stocks, cash in savings accounts, real estate, and bonds. Remember to evaluate each investment vehicle based on its degree of risk, investment time horizon, and return.

How many types of investment vehicles are there?

There are so many different investment vehicles available that it’s virtually impossible to count how many you could choose. The most common investment vehicles include cash in savings accounts, stocks, real estate, and bonds.

Closing Thoughts

The key to winning is asset diversification.

So make sure you don’t put 100% of your money in just 1 investment vehicle.

Another piece of advice is to keep an emergency savings fund with 3 to 6 months’ worth of living expenses in a high yield savings account.

Start investing as early as possible and let compound interest build your wealth.

Your bank accounts will thank me later.