It’s no secret that the economy is going through some serious ups and downs at the moment.

In fact, you can see that:

- Stocks are volatile

- National debt is soaring

- Unemployment is ticking up

And you might feel a sense of uncertainty in the air.

So if you’re worried about the next recession and want to learn how to best prepare for it, then you’ve come to the right place.

Let’s get started.

In this article

What is a Recession?

A recession is a temporary period of decline in the stock markets and economy that can last for months or years.

Additional indicators that could suggest you’re in a recession include:

- Rising unemployment

- Decreasing stock prices

- Decreasing real estate value

- Decreasing consumer confidence

Consequently, a recession could seriously impact your personal finances.

That’s why it’s important to prepare for a recession today.

How Long Does a Recession Last?

According to the National Bureau of Economic Research, a recession typically lasts around 11 months.

However, recessions are not made equally.

Recessions can be:

- Long and mild

- Short and mild

- Long and severe

- Short and severe

What Happens During a Recession?

Here’s what you’ll see during a recession:

- Increased lay-offs

- Decrease in wages

- High unemployment

- Increased government debt

- Stocks and bonds fall in value

- Decrease in consumer spending

Basically, the economy takes a nosedive when you’re in a recession.

The Bottom Line:

When the economy recovers, the negative trends of the recession will also start to recover. You just have to focus on the long term.

How to Prepare for a Recession

Here are 7 proven strategies on how to prepare for a recession.

Using these strategies will give you the best chance of financially surviving the economic storm.

Are you ready? Let’s dive in.

1. Diversify Your Income

Have you ever heard of the saying:

“Never put all your eggs in the same basket?”

Well, the same goes for your income streams.

Imagine this:

Depending on 1 income stream during a recession… and then facing the reality of being let go from your job.

Without income, it’s going to be pretty hard paying for your regular living expenses.

Not to mention the difficulty of finding a job during tough economic times.

You run the biggest risk when you rely on one income stream.

If you want step-by-step guidance on creating multiple income streams, consider enrolling in the Income Multiplier Course.

In this course, I’ll show you my proven 4-stage process to help you build multiple income streams that can earn you over $10,000 per month.

2. Keep Investing

You can make the big bucks, if you keep investing during the downtimes.

Think about buying stocks like buying clothes:

- Do you want to buy on sale?

- Do you want to buy at full price?

Chances are, you’ll probably want to buy clothing on sale.

The same concept goes for stocks.

Stocks are cheap to buy in a recession.

Let me explain.

Source: Macrotrends

The shaded, grey areas in the graph indicate a recession.

Now take a look at what follows a recession – a stock market increase.

In fact, the stock market performance after a recession generates, on average, a 339% return over a 6.6. year period.

You can’t win if you try to time the market (e.g. getting out of the market before it crashes and buying at all-time market lows).

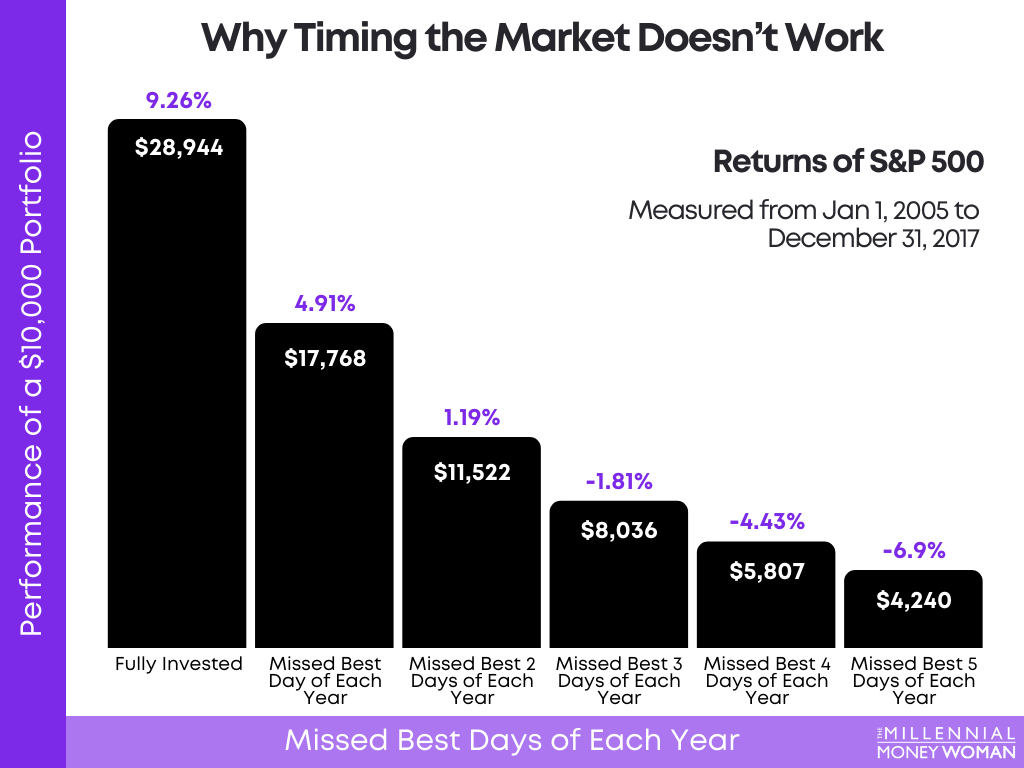

Take a look at the chart below to see why timing the market doesn’t work:

As you can see, if you had stayed invested, at the end of these 13 years, you would have made an average annual return of 9.26% versus if you just missed the 2 best days of each year in the market, your returns would have been just 1.19%.

Yikes.

So how do you avoid timing the market?

By sticking to your dollar cost averaging strategy (DCA).

3. Stick to Your Budget

If you want to prepare for a recession, you need to stick to your budget.

Here’s a simple formula for sticking to your budget:

Expenses < Income = Becoming a Millionaire

In other words, your expenses must be less than your income.

Sticking to your budget – and not spending more than you earn – is going to be SUPER helpful, especially when a recession is looming on the horizon.

By sticking to a budget, you can free up a lot of your money to:

- Pay off debt

- Invest for retirement

- Use toward emergency savings

If you’re ready to start a budget, consider using the top-rated budgeting app, YNAB 👇

Here are a few of my favorite YNAB features:

- Easy to sync outside accounts

- Can directly import bank transactions

- Customized budgeting recommendations

- YNAB website offers excellent financial advice

YNABers typically save about $6,000 on average within the first year.

And you can also get a free 34-day trial to check out what YNAB is all about and whether the app fits your style.

If you need help getting your budget under control, this app is certainly worth checking out.

Recommended Reading: YNAB Review

4. Cut Down Expenses

In addition to sticking to your budget, it’s also important to avoid allowing lifestyle creep.

Lifestyle creep happens when you spend more money as you earn more money.

Since the chances of your income being slashed are higher during a recession, you want to make sure you can live without certain expenses.

That’s why it’s important to learn how to cut costs before a recession hits.

Here are some easy ways to cut costs fast:

- Cut the cord

- Find a roommate

- End subscriptions

- Go thrift shopping

- Bargain with your utility companies

Beware of little expenses.

A small leak can sink a great ship.

If you need help reducing your utility company payments, then you may want to check out Rocket Money 👇

Rocket Money can cut the following costs for you:

- TV bills

- Wifi bills

- Service bills

- Internet bills

The only time you pay is when Rocket Money successfully negotiates (and lowers) your bills for you.

5. Beef Up Your Emergency Fund

Before you even think about investing, first consider how much cash you have saved up.

Pro tip: To have a “good” emergency savings fund, you’ll want to have 3 to 6 months’ worth of your living expenses saved up.

So, if you spend about $3,000 per month on basic living expenses, including:

- Rent

- Taxes

- Groceries

- Student loans

Then your emergency savings fund should have between $9,000 to $18,000 saved in cash for emergencies.

"The average duration of unemployment was 7.7 weeks in May 2020."

Since the chances of being unemployed during a recession are far higher (and may take much longer than the average 7.7 weeks)…

You may want to make sure you have enough money to hold you over a “dry spell” or no-income period.

Now, 3 to 6 months’ worth of living expenses is a lot of cash.

I have a trick to optimize your stashed cash to earn a little extra.

Pro tip: If you want to earn passive income with your emergency fund…

Consider stashing your emergency fund in a high-yield savings account like the ones offered by Raisin.

With the current interest rates, you can get over 5% APY.

A 5% rate on $10,000 of cash would earn you $500.

For doing absolutely NOTHING.

6. Pay Off High-Interest Debt

Debt can be a heavy burden during a recession, where fears of unemployment and no income may be in the air.

If you carry high-interest debt, now is the time to get out of debt ASAP.

Below are some examples of high-interest debt:

- Payday loans

- Credit card debt

- Other personal loans

Pro tip: Start paying off debt with interest rates of 10% or more as fast as possible.

7. Start a Side Hustle

If you’re serious about preparing for a recession, start building your side hustle as soon as possible.

Why?

So you can build up extra income before the economy turns sideways.

Here are a few side hustles and their monthly income potential:

- Blogging – $0 to $5,000+

- Email marketing – $0 to $,5000+

- Affiliate marketing – $0 to $10,000+

- Freelance writing – $1,000 to $5,000+

Now keep in mind, you probably won’t see numbers even close to the numbers above within the 1st, 2nd or likely even 3rd year of pursuing your side hustle.

But, if you are consistent, committed and stick with your plan then chances are, you’ll likely succeed.

Life gets easier when you make more money.

If you’re ready to start a side hustle, consider enrolling in the Income Multiplier Course.

This course shows you how to start a side hustle that can out-earn your 9 to 5.

8. Live on 1 Income Stream

One of the best ways to prepare for a recession is if you and your partner live below your means by:

- Saving 1 income stream

- Living off of the other income stream

Living off of only 1 income stream can help you with the following:

- Pay off debt

- Save for retirement

- Keep investing during a recession

- Increase your emergency savings fund

This rule of thumb only works if you live with your partner and both of you are earning income.

The Bottom Line:

If you practice living off of only 1 income stream when times are good, it’s going to be very easy for you and your partner to live off of 1 income stream, should (worst case) 1 of you lose your jobs during a recession.

9. Invest in Yourself

One of the key outcomes of a recession is high unemployment.

And even though you may be completely crushed that you were let go from your job, you can actually use that opportunity to invest in yourself.

That’s of course assuming you have:

- Paid off your debt

- Additional income streams

- Bulked up your emergency fund

In fact, you can position yourself to be an extremely desirable employee if you continue developing your:

- Skillset

- Network

- Education

- Qualifications

Remember that when you add value to the job market through an improved skill set or qualifications, money will typically follow.

Preparing for a Recession: FAQs

What should I do with my money before a recession?

Below are some things you can do to optimize your wealth before a recession.

These steps include:

- Pay off high-interest debt

- Continue investing in your education

- Invest in reliable, stable and dividend producing stocks

- Build an emergency fund with 3 to 6 months’ of living expenses

And remember, as you move into a recession, a good money-making strategy is buying index funds (for example) when they are “on-sale” or when their prices are significantly lower.

What’s the best thing to do in a recession?

If you’re already in a recession, then there are several steps you can take to maximize your financial picture.

Below are some steps you can take when you are in a recession:

- Pay off debt

- Invest what you can

- Decrease your expenses

- Maintain a long term vision

- Continue investing in yourself

- Increase your emergency savings

The key is to maintain a long-term vision – a recession is temporary (based on historical data) and chances are, the economy will recover even stronger than before the recession.

How do you survive a recession?

You can survive a recession if you prepare properly beforehand.

Some steps you can take include:

- Invest in yourself

- Stick to your budget

- Build passive income

- Live below your means

- Build an emergency fund

- Diversify your investments

Here’s what’s important: Don’t sell your investments out of fear when the markets are down.

Remember that what goes down, must come up (and vice versa, too).

Closing Thoughts

Although none of us have a crystal ball to predict the future, it’s so important to have a game plan ready before a recession actually happens.

There is no need to worry about a recession if you have taken the steps above.

Instead, focus on things to thrive while the stock markets are tumbling lower:

- Invest in yourself

- Build passive income

- Invest when markets are low

One thing to keep in mind is this: Recessions are temporary.

Preparing for a recession today will help you stick through the storm tomorrow.

Your bank account will thank you later.