There are hundreds of compound interest investments out there. However, not all of them are worth your time and money.

That’s why I created this list of the best compound interest investments and accounts.

Here, you’ll find all the information you need to find the best investment for you.

What is Compound Interest?

Compound interest helps you earn interest on the money that you originally invested and the interest that you earn on that investment.

Basically, you’re earning interest on your interest.

Understanding how to earn compound interest comes down to understanding the difference between simple versus compound interest.

With simple interest, you simply earn interest on your original deposit, regardless of how much accrued interest your account has.

With compound interest, you’ll earn interest not only on your original deposit but also on your accrued interest.

That’s why, long-term, compound interest can literally help you build generational wealth.

What are the Best Compound Interest Accounts?

If you want to earn compound interest, it’s time to implement the strategies I’m about to show you.

I’ll share exactly where to invest for compound interest for both traditional and alternative assets.

Let’s get started.

1. Private REITs

Investing with compound interest doesn’t just stop with stocks and bonds.

In fact, one of the best compound interest accounts you could open to diversify your portfolio and earn high returns is a real estate investment account.

If you love:

- Real estate

- Collecting passive income

- Earning compound interest

And if you hate:

- Dealing with tenants

- Physically repairing property

- Managing real estate in person

…Then you should consider becoming a private market online REIT investor.

What’s a REIT you might ask?

A REIT (aka real estate investment trust) is a company that owns and manages several properties to produce passive income for its investors.

REITs can specialize in things like:

- Hotels

- Hospitals

- Apartment complexes

- Commercial construction

There are 2 types of REITs:

- Publicly traded – Are available to the public (in the stock market)

- Privately traded – Are more complex, and not available to everyone

If you have the extra cash and want to make a little extra passive income on the side, then check out Fundrise 👇

Fundrise is one of the best real estate crowdfunding platforms, with over $1 billion of assets under management since it was founded in 2012.

With Fundrise:

- Anyone can invest

- You can earn passive income

- You can start investing with $10

The best part?

Private market REITs offer lower risk profiles than stocks and some publicly traded REITs:

And especially in years where the stock market (like the S&P 500) takes a nosedive due to poor performance, REIT investments could really hold up your portfolio.

In 2022, Fundrise returns across all 429,627 accounts averaged 5.52% – versus the roughly -19% returns from both public REITs and the stock market.

If you want to make cash passively, then investing in income generating assets like the real estate projects offered by Fundrise could be a great fit for you.

Recommended Reading: Fundrise Review

2. Farmland

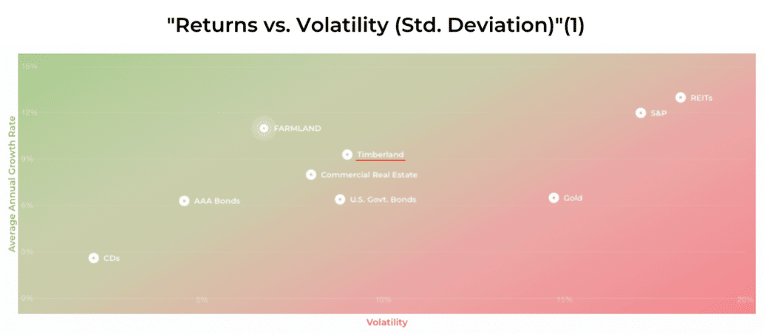

One of my favorite compound interest investments for accredited investors is farmland and timberland.

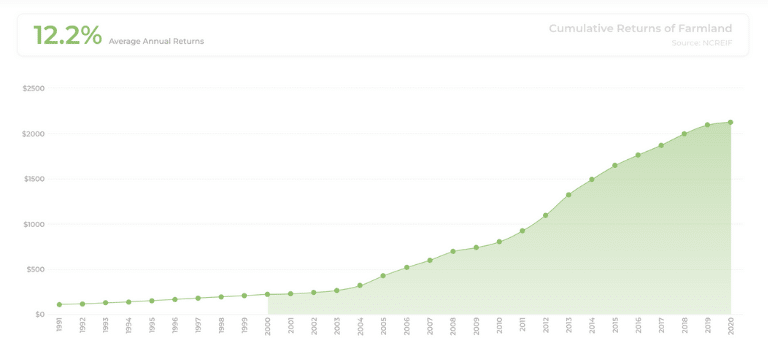

Since 1990, farmland investments have outperformed many major investment classes.

In fact, if you had invested $1,000 in 1991 – and kept it invested – then your farmland investment would now be worth just over $21,500 today.

Investing in farmland is one of the best investments during inflation as well.

As you can see, farmland averaged roughly 11% in annual returns – which can beat inflation, especially given the high inflationary numbers of 2022.

Coupled with a growing global population and demand for food production, farmland investments truly does offer a diversified investment opportunity with higher returns and lower volatility.

Investing in assets like farmland is a great alternative investment, especially if you’re looking to out-earn inflation and generate high returns.

Ready to invest in farmland?

If so, check out the FarmTogether platform 👇

FarmTogether truly makes farmland investing easy – and it’s all online.

The only caveat to invest with FarmTogether is that you have to be an accredited investor.

Accredited Investors:

- Have gross income of $200k+ per year (if single)

- Have gross income of $300k+ per year (if married)

- Net worth over $1 million (excluding your primary residence)

If you have the extra cash, you can invest in crops like:

- Rice

- Corn

- Timber

- Soybean

And on average, farmland returns yield roughly 10% per year!

So, if you want to invest in one of the best compound interest investments, investing in farmland through crowdfunding platforms like FarmTogether could be a good next step for you.

3. Index Funds

One of the best compounding interest investments without a doubt is the index fund.

An index fund can either be a mutual fund or an ETF that tracks the returns of a total market index.

Index funds that generate compound interest include:

- Total market index funds

- Broad market index funds

- Industry sector index funds

In other words, index funds can track a variety of indices – ranging from blue-chip companies like Apple (so the S&P 500 index fund) all the way to small startups (like the Russell 2000).

Index funds are great for beginners because:

- They are low cost

- They harness the power of compound interest

Plus, as long as you’re invested over the long term, you can actually make A LOT of money.

Source: Google Finance

Of course, the market will always have ups and downs, but the market has always gone up – at least from a historical perspective.

For example, if you’d invested $1,000 in 1985 and left it in the stock market until November 2022, you’d have a final value of around $69,730.

So you would have made a 6,873% gain on your $1,000 initial investment.

And it gets better: Investing in index funds is actually really easy.

Here’s how to do it:

- Select a stock trading platform

- Research the available investments

- Decide how many shares you want to buy

- Start dollar cost averaging your purchases

- Remember to stay invested for the long term

So what’s the best stock trading platform?

For beginner investors, I always recommend Acorns 👇

Acorns is an online investing platform where you can:

- Start investing with just $10

- Invest in fractional shares (so you can buy small portions of multiple stocks)

- Automatically invest $0.01 to $1.00 after each purchase with the RoundUp Feature

It might not sound like a lot – but if you keep investing every little cent you have, over time, you can make a fortune thanks to compounding interest.

If you want to get rich off stocks, then one of your best bets is buying index funds for the long term.

4. Rental Homes

Investing in rental real estate is probably one of the most common ways to earn compound interest and passive income.

Rental real estate investing is also a way for you to build multiple streams of income and not solely count on your salary to make ends meet.

That’s because with rental estate you can make money in 1 of 2 ways:

- Rental income – monthly rental cash flow

- Property appreciation – property value increases over time

Especially over the past 10 years or so, rental real estate investing has become a very profitable investment:

The best part about rental real estate is that rental income is a very stable source of income – even during a recession.

Of course, not only do you earn rental income, but you also have a shot to earn extra cash through the appreciation of property value.

In fact, over the past 10 years, property value has appreciated by about 6.49% per year:

While most rental real estate investments will require you to pay $1,000s upfront, you can actually get away with just $100 if you sign up to the rental real estate investing platform, Arrived Homes.

Arrived Homes is an online rental real estate investing platform where you can invest in multiple properties across the United States.

With Arrived Homes, you can invest in a variety of single-family homes across the US and build out your passive income portfolio.

Recommended Reading: Arrived Homes Review

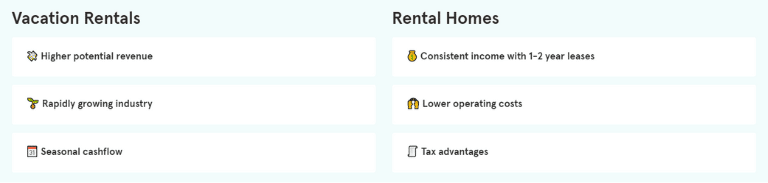

5. Vacation Rentals

If you’re more of a risky investor and want to generate compound interest then you might want to check out vacation rental real estate.

Vacation rentals could offer:

- More cash flow

- Increased future returns

- More seasonal cash flow

Here’s a comparison between vacation vs. single-family rental properties:

Vacation rentals offer much higher cash flow opportunities than single-family rental homes.

In fact, if you invest in a full-time rental, you could earn 130% more revenue than traditional rentals.

But, you need to make sure to understand the risks that are associated with owning a vacation rental property.

Especially with increased work flexibility and the “Work From Home” trend, the value of vacation rentals has arguably soared.

So how do you get started investing in vacation rentals?

By signing up to platforms like Arrived Homes 👇

Once you’ve found your vacation rental property, the rest of the investing process is actually pretty straightforward:

- Browse

- Select a property

- Buy shares for $100

- Start earning income

As with all real estate investments, remember that your money will be illiquid for several years (up to 5).

6. Fine Art

Investing in fine art is another way you can take advantage of an asset that compounds over time to build your net worth.

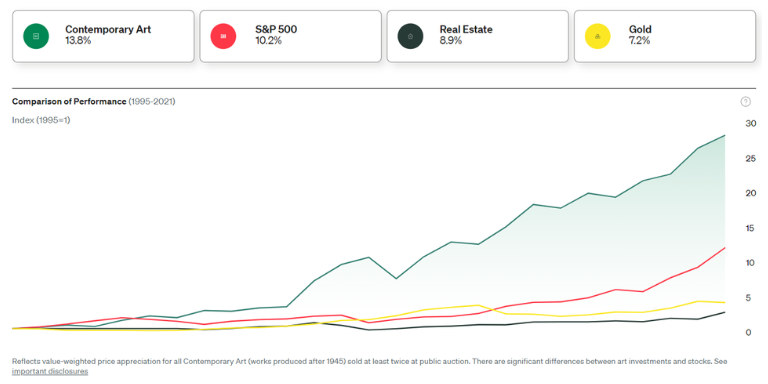

In fact, did you know that blue-chip fine art has outperformed the stock market by over 250% since 2000?

If you have some spare cash and you’re willing to take on a little more risk, then fine art investments could be a good fit.

If chosen carefully, fine art investments can help you:

- Beat inflation

- Appreciate in value

- Outperform the stock market

In fact, check out how fine art has beat inflation over the past few years:

However, fine art also comes with its share of risks.

Some risks include:

- It’s hard to value

- Difficult to predict returns

- Art is an unregulated industry

I should also note that your money is locked up for lengthy periods (sometimes up to 5+ years) without generating income during that lock-up period.

But – you could earn a potential 15.3% per year in gains on your artwork.

That’s significantly more than the average annual return of 7% to 9% in the stock market.

So how do you get started with art investing?

By investing with the top-tier fine art investing platform called Masterworks 👇

With Masterworks, you can invest in iconic, masterpieces from artists like:

- Banksy

- Andy Warhol

- Pablo Picasso

And if you want to sell your shares, you can use the secondary market.

Otherwise, if you hold on to your shares, Masterworks has boasted a 29.03% net annualized return for their customers.

Recommended Reading: Masterworks Review

7. Small Businesses

If you’re looking to invest in one of the top compound interest investments, then you should consider small business investments.

In fact, investing in small businesses can help you build a passive income stream and fight against inflation.

Check out how small businesses have outperformed the stock market over time:

The Russell 2000 is typically the benchmark index used to represent small businesses across the US.

Notice, however, that the purple line is much more volatile than the blue chip, large cap companies represented by the S&P 500.

That’s because small businesses can be risky because they:

- Are illiquid

- Are new to the market

- Don’t have a proven track record

Now the good news is that thanks to small business investment platforms like Mainvest, all you’ll need is $100 to start investing in small businesses – and not $1,000’s!

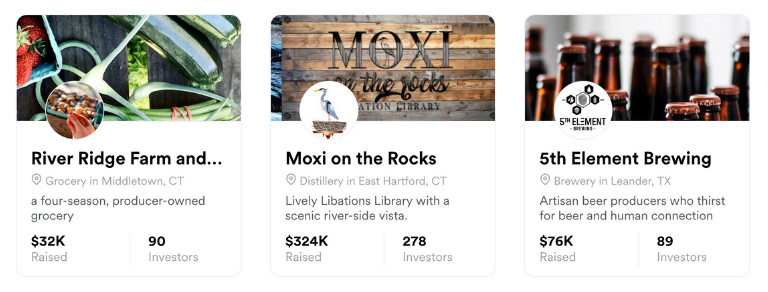

Only 5% of businesses that apply to be featured on the Mainvest platform are actually approved. Some businesses include:

- Bakeries

- Breweries

- Cannabis dispensaries

Plus, you don’t pay any fees. The companies that are approved on Mainvest pay the fees – so whatever return you make from your small business investment, you keep.

8. Fine Wine

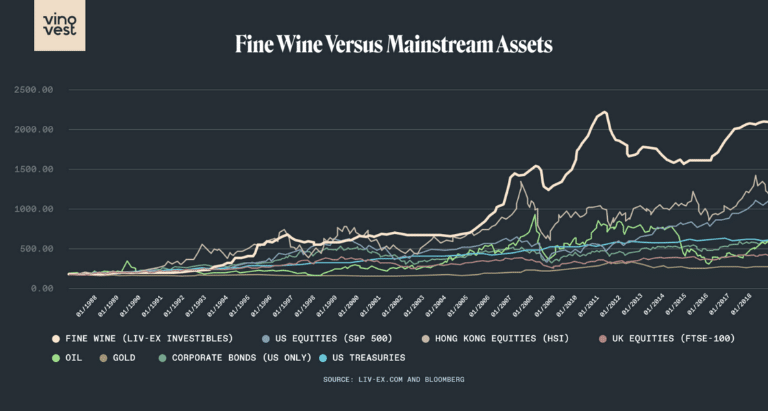

Did you know that fine wine investments have consistently outperformed mainstream assets like oil, gold, and stocks?

Check it out below:

Here’s why fine wine is actually a good investment option:

- Portfolio diversification

- Protection against inflation

- Not correlated with the stock market

Now, the good news is that investing in fine wine actually isn’t as hard as it once was, all thanks to technology.

To start investing in wine, check out Vinovest 👇

Vinovest curates a customized wine portfolio based on your risk tolerance and preferences – and it’s completely free to get started!

Vinovest will literally take care of everything for you including:

- Wine storage fees

- Transportation fees

- Insurance on your wine

- Fine wine seller network

- Fine wine buyer network

Instead of buying shares of wine, you’ll actually buy the physical bottle, which is then stored in an off-site facility until you decide to sell it.

Remember to invest for the long term with fine wine. It often takes years for fine wine to appreciate in value.

Recommended Reading: Vinovest Review

9. Rare Whiskey

Just like fine wine investments, you might also want to consider investing in rare whisky to generate compound interest.

In fact, over the past 10 years, the value of rare whiskey has appreciated by 586%!

And compared to other well-established asset classes like gold and oil, rare whiskey has out-performed these as well over the past decade.

Similar to investing in fine wine, you could also start investing in rare whiskey through the Whiskeyvest platform.

Whiskeyvest is actually a new off-shoot of Vinovest.

Through the online platform, you can invest in some of the world’s rarest whiskeys.

Whiskeyvest will use its expert knowledge to help you compose a portfolio of rare whiskey that suits your investment needs.

You’ll purchase the physical cask of rare whiskey, and Whiskeyvest will store, insure, and transport that cask for you.

Remember to invest only in rare whiskey if you have spare cash.

This is a long-term investment (likely up to 20+ years) and it’s illiquid.

10. Exchanged-Traded Funds (ETFs)

If you’re wondering how to get compound interest with low cost and diversified investments, then check out ETFs.

Exchange traded funds (aka ETFs) track an index (like the S&P 500, my favorite).

ETFs don’t seek to outperform the market – instead, they simply follow the market.

They are one of the best compounding interest investments simply because ETFs are:

- Liquid

- Low cost

- Diversified

And similar to stocks, ETFs can be bought or sold during trading market hours (9:30am to 4pm EST).

The type of ETF you choose for your portfolio depends entirely on your goals and risk tolerance.

Some ETF types include:

- Bond ETFs

- Currency ETFs

- Sustainable ETFs

- Tech-heavy ETFs

- Geographic based ETFs

You can do more in-depth research (like historical performance, investor insights, etc.) about your favorite ETF if you sign up to Seeking Alpha 👇

Seeking Alpha is an investment research platform for investors who are looking for impartial and quantitative investment information.

Recommended Reading: Seeking Alpha Review

11. Mutual Funds

A mutual fund refers to a professionally managed pool of money from many different investors to buy assets like stocks, bonds, and commodities.

Unlike ETFs, which are passively managed investments, mutual funds actually have people actively working in the background to generate high returns.

Because mutual funds provide professional investment management, they are typically good compound interest investment instruments for beginners.

Mutual funds are compounding interest investments that are typically more diversified than stocks, so mutual funds often are less volatile than stocks.

There are thousands of mutual funds, and that’s why I’d suggest you sign-up to specialized investment services like Seeking Alpha.

Seeking Alpha is an investment platform that takes an impartial approach to evaluating investment instruments, outperforming the S&P 500 90% of the time.

So, if you’re ever concerned about which mutual fund is the best choice for you, check out Seeking Alpha’s advice.

Especially if you’re looking to invest $1,000, then mutual funds could be a great option since they take a diversified investing approach.

12. Dividend Stocks

One of the best compound interest investments, hands-down, is dividend stocks.

Dividend stocks offer passive income to shareholders in the form of dividends when the companies distribute their profits.

Dividend stocks are like the one-two punch of compound interest investing.

Here’s why:

- You earn passive income

- The underlying asset can increase in value

Dividends are typically paid every quarter – depending on how the company itself performs.

In fact, during periods of market volatility (like the Great Recession), dividend stocks actually increase their dividend payout to reassure investors that the company is not going under.

Check out the history for AT&T dividends, for example:

In the screenshot above, you’ll see that during the Great Recession in 2008, AT&T actually increased its dividend.

This is typical dividend behavior for blue chip, mature companies.

Why?

Because they want to keep their investors.

Check out this other screenshot from the Walgreens dividend history:

Once again, you can see that during major financial crises like the Great Recession in 2008 and the COVID crash in 2020, Walgreens raised its dividend to keep investors on board.

So, don’t just find the company with the absolute highest dividend yield.

Do your research about the company’s fundamentals too, which includes:

- Cash flow

- Debt picture

- Management team

Because there are virtually 100’s if not 1,000’s of dividend-paying stocks out there, I’d recommend you subscribe to Seeking Alpha.

Not only does Seeking Alpha analyze the top dividend stocks for you, but you can literally dig into the quantitative data for each dividend stock.

Unlike growth stocks, dividend stocks are:

- Less sexy

- Less volatile

- More mature

Buying dividend-paying stocks is a great way to prepare yourself for a recession.

A compound interest account that is composed of dividend stocks has potential to:

- Beat inflation

- Beat market volatility

- Earn passive quarterly income

Ready to start investing in compound interest investments like dividend stocks?

Start by signing up to M1 Finance 👇

M1 Finance is a free online investment app, where you’ll have access to over 6,000 stocks and ETFs.

All you need is $100 to start investing.

13. Growth Stocks

While dividend stocks are certainly one of the best compound interest investments, you shouldn’t forget about growth stocks either.

Growth stocks are shares of companies that are still in their early stages of development. These are riskier investments but have strong prospects for future profit.

Growth stocks – like the name says – have A LOT of growth potential…

…But that also means that growth stocks come with their own risks.

Some growth stock risks include:

- Volatility

- More expensive

- No dividend payouts

Since growth stocks have a lot of growth potential, they’re typically more expensive than dividend stocks, which typically represent mature companies.

Examples of growth stocks typically include:

- Startups

- Tech companies

- Software companies

Check out the growth of the Tesla stock:

As you can see, Tesla’s stock price has skyrocketed!

But, notice how long it took for the stock to take off…

So, if you want to be a growth stock investor, you’ll typically have to stay invested for the long term.

Since growth companies prefer to use their capital to invest in the business instead of paying shareholders, you won’t receive dividend payouts or returns until you sell your shares.

14. Bonds

If you’re looking for a simple way to generate compound interest and diversify your portfolio, then consider investing in bonds.

Bonds are loans you give in exchange for earning a fixed income stream (interest) and full repayment of your initial investment.

Bonds are typically issued to investors to raise funds for:

- Projects

- Companies

- Governments

The issuer (the entity that creates the bond) promises to repay your full investment and interest over a certain amount of time.

That’s where bond maturities come into play.

A bond maturity defines the period during which you receive interest payments on your bond investment.

Once the bond reaches maturity, you are repaid and the contract is complete.

There are different types of bonds such as:

- Treasury bonds – Safest, lowest interest rate

- Municipal bonds – Safe, low dividend yields

- Corporate bonds – Risky, higher interest rate

The interest rate you earn on your bond comes down to the risk of the bond.

The riskier the bond type (like corporate bonds), the higher your interest rate.

Bonds are typically the most conservative investment you can make – aside from cash.

Check out the performance of bonds versus the S&P 500:

The only times when bonds typically outperform the stock market is during times of massive volatility.

That’s why bonds are a great portfolio diversified.

If you really want to dig into the various types of bonds out there, then consider signing up to Seeking Alpha.

Seeking Alpha offers research articles from investment professionals, historical data, charts, etc.

If you like digging into the data before investing, then Seeking Alpha is probably the best investment research platform for you!

15. Private Equity

Another compounding interest account that could help you earn massive annual returns is private equity investing.

Private equity (aka PE) investing is an alternative form of investing where private equity companies buy and manage private companies before selling them or going public through an IPO (initial public offering).

After buying a “stake” in a company, private equity firms typically operate and manage these companies with the goal of growing the companies before selling their stake.

And private equity can certainly pay you in dividends (no pun intended!). Check it out:

Private equity markets have outperformed public markets (especially during market downturns like the Great Recession in 2008) consistently – and that’s after fees!

One major downside to investing in private equity investments is the high fees – often these can start at 2% and range up to 20% or more.

To compare, investing in index funds, you’d probably pay 0.1% or less in fees.

However, you’d also probably make less in returns.

You should invest in private equity if you’re:

- Risky

- Accredited

- Have extra cash

- Like investing in future unicorns

Just remember that private equity investments can be risky because PE is speculative.

You can get started in private equity investing with platforms like Yieldstreet.

16. Marine Financing

Investing in compound interest investments can also include alternative investments like marine financing.

Marine financing focuses on financing marine vessel activities over the long-term.

Some examples of marine financing include:

- Vessel acquisition – Buy vessels for certain activities

- Vessel construction – Fund construction of vessels

- Vessel deconstruction – Fund deconstruction of vessels to sell parts at auction

Keep in mind that vessels are often as long as the Empire State Building is tall – and vessels must be built to move 400,000 tons of cargo.

You could generate significant returns through marine financing simply by knowing that over 90% of what we consume is brought to us by ships.

In fact, the sea trade industry ultimately supports all other industries in the world by transporting goods from continent to continent.

And, in 2017, the sea trade industry was valued at about $12 trillion US dollars.

Since 2003, the global shipping industry went though a 5-year super-cycle, mainly driven by the industrialization of China.

In 2008, the Great Recession brought global trade to a near standstill, which in turn triggered a near collapse of the shipping industry.

However, with the shipping industry rebounding, you could invest in marine financing ventures to earn potential high profits through alternative investing platforms like Yieldstreet 👇

If you are an accredited investor, you can invest in marine financing opportunities (as well as other private market placements).

Most marine financing opportunities on Yieldstreet are short-term (generally between 1 to 3 years) and backed by an asset (the ship itself).

Recommended Reading: YieldStreet Review

17. Legal Financing

Compounding interest investments can also take alternative routes, like legal financing.

Legal financing is when you loan money to a law company to fund a lawsuit.

In exchange for funding someone’s lawsuit, you will receive a percentage share of the final settlement.

Of course, if there is no settlement, you lose your money.

Legal financing is a risky endeavor, but you could make some serious money if you participate.

If you’re interested – and you qualify as an accredited investor – then check out Legal Finance Fund by Yieldstreet 👇

The typical type of lawsuit your money would be funding would include:

- Securities fraud

- Contract violation

- Business disputes

- International arbitration

- Qui tam (whistleblower)

Engaging in such mega lawsuits often requires MILLIONS of dollars to pay for research, consultants, expert witnesses, and law firm overheads.

To reduce the $1,000,000+ upfront legal fees to plaintiffs, law firms have engaged in contingency fee arrangements.

Contingency fee arrangements mean that law firms often absorb the upfront cost.

However, through legal financing arrangements, law firms can find alternative financing methods to help them settle a potentially multi-million dollar lawsuit.

18. Structured Notes

Another compound interest investment you could add to your portfolio is structured notes.

Structured notes refer to a variety of financial debt investments whose returns are tied to the performance of an underlying stock.

For example, the performance of the note is determined by the value of the underlying stock – like Mastercard stock.

While structured notes can have a “sexy” ring to them, they do tend to be a little riskier.

Structured notes also give you downside protection value.

For example, if the downside protection value is 25% and your income yield is 3%, then the value of the underlying stock can fall 25% from its value on the day you purchased the note – and you won’t be impacted.

If the value of the underlying stock falls below 25% from its value on the date of the note purchase, then your principal, income, etc. will be impacted.

Check out this example illustrated below:

You’ll see that your 3% income yield will not be impacted UNTIL the underlying stock performance drops below the 25% threshold.

Structured notes can either be:

- Growth focused

- Income focused

Structured notes give you an income stream and they typically protect you from the downside of market volatility.

If you want to take the risk and invest in structured notes, then check out Yieldstreet 👇

Yieldstreet is an online alternative asset investing platform for accredited investors.

As a reminder, accredited investors:

- Have gross income of $200k+ per year (if single)

- Have gross income of $300k+ per year (if married)

- Net worth over $1 million (excluding your primary residence)

So, if you want to diversify your portfolio a little more and take a little extra risk, you might want to dabble in structured notes (although I suggest investing only what you can afford to lose).

19. Precious Metals

Another one of my favorite compounding interest investments is precious metals such as gold, silver, and platinum.

Each precious metal type performs differently, depending on market conditions.

Check out how silver, gold, and platinum performed back in 2020:

Based on the chart above, silver proved to be the top-performing precious metal.

Especially during difficult economic times, precious metals often aren’t as impacted by the market.

In fact, top financial professionals recommend their ultra-wealthy clients invest up to 10% of their net worth in precious metals.

Precious metals can help you:

- Combat inflation

- Diversify your portfolio

- Increase your net worth

Gold prices have also consistently outperformed inflation over the past almost 2 decades:

So if you’re looking to invest in precious metals like gold for as little as $1, now you can with OneGold 👇

OneGold is an online precious metals investment platform, where you can buy gold, silver, and platinum directly.

The precious metals are:

- Insured

- Safely stored

- Accessible 24/7

OneGold shared that in the past 50 years, gold has averaged a 10.9% return, while silver has averaged a 13.4% annual return.

20. Health Savings Account (HSA)

If you’re wondering how to earn compound interest, then you should also consider investing in your Health Savings Account.

A health savings account (aka HSA) is an investment account where you can set money aside, invest it, and use it for qualified medical expenses.

You want to use your HSA like another investment account and grow it for your retirement.

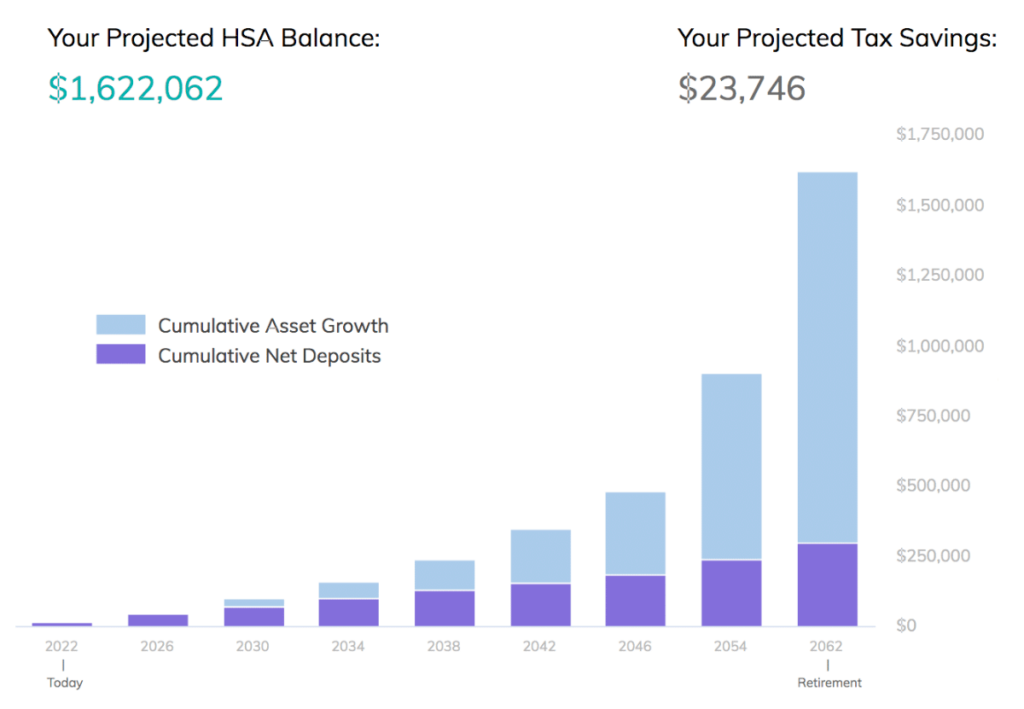

Check out how much money you could save in your HSA if you started contributing at 25 to age 65, earning an average 7% annual return:

That’s right – you could have over $1.6 MILLION saved in your HSA – and 100% of that could also be tax-free.

Ready to set up your own HSA?

(And no, you don’t need your employer to set up an HSA for you!).

Check out Lively’s award-winning HSA platform 👇

With Lively, you pay $0 to open your account – and you can choose how you want to invest:

- Either by yourself (if you’re an experienced investor)

- Or by using a robo-advisor (they’ll charge you a small fee)

HSAs are one of the best compound interest investments for the long term.

21. Retirement Accounts

The earlier you start investing in your own retirement, the earlier you can become financially independent.

Not everyone gets this memo, however.

In fact, 1 in 3 of Americans reported they have $0 in retirement savings accounts.

Especially with 4-decade high inflation and wage stagnation, it’s more important than ever to start saving for retirement.

The key to building a successful retirement savings account is saving as early as possible.

In fact, the earlier you start saving, the more money you’ll have to spend during retirement. Check out this graph:

Image Source: Vanguard

If you save $10,000 per year for just 15 years (and invest it with a 6% return), then you could have over $1 million dollars by the time you presumably retire at 65.

Compare that to starting your retirement journey at 35, saving $10,000 per year for 30 years, then you’d have just under $840,000.

That is the power of compound interest investments.

Now check out how much $1 could be worth by the time you retire – and it ALL depends on when you invest:

Compound interest is literally the eighth wonder of the world – just like Albert Einstein once said.

Are YOU ready to start investing for retirement?

Here’s how to get started:

- Sign up to M1 Finance

- Determine which account you want to open (tax-advantaged like an IRA versus taxable)

- Connect your bank account to your M1 Finance account

- Fund your M1 Finance account

- Determine your risk tolerance

- Research your favorite stocks

- Start investing

Your retirement is no joke. Start preparing for it – now.

22. Self Directed IRAs (SDIRAs)

A self directed IRA (aka SDIRA) is an individual retirement account that can hold alternative investments that a typical IRA cannot.

An SDIRA could hold alternative assets like:

- Fine art

- Startups

- Vineyards

- Real estate

- Show horses

- Bowling alleys

- Precious metals

- Private hedge funds

The list goes on. So, if you like dabbling in alternative investments and earning a tax benefit, an SDIRA might be the right fit for you.

Ready to open an SDIRA? Then check out RocketDollar 👇

Opening an SDIRA with Rocket Dollar is actually pretty easy.

Just keep in mind that the same annual investment limit applies to SDIRAs as it does to traditional/Roth IRAs:

- $7,000 if you’re 50+

- $6,000 if you’re under 50

Another neat thing is that you can open a Roth SDIRA (so after-tax) or a Traditional SDIRA (pre-tax).

23. High Yield Savings Account

Learning how to get compound interest doesn’t have to be complicated. In fact, one of the best compound interest investments is a high yield savings account!

A high yield savings account (aka HYSA) gives you a much higher interest rate than your regular savings accounts.

One thing to note for this compound interest investment, however, is that most HYSAs are found online versus your brick-and-mortar stores.

The most important thing to remember is that the interest rates on the HYSA are variable.

Especially if you’re saving up (or already have) an emergency savings account, a HYSA can be a perfect fit.

So for example, if you need $3,000 to live per month, then your emergency savings fund should probably range between $9,000 to $18,000.

Especially if you’re saving up your first $10,000 in a year, then make sure to choose an HYSA to get the biggest bang for your buck.

If you’re ready to put more money in your wallet, then I highly recommend checking out SaveBetter 👇

SaveBetter is a website that curates the highest-interest compound investment vehicles at the time of your search.

For example, in late 2022, Save Better displayed the top high yield savings investments:

And the best part about signing up to high yield savings accounts?

Almost all are 100% free to sign-up (and most don’t even charge maintenance fees). Just make sure you read the fine print!

If you’re ready to get the biggest bang for your buck, then check out SaveBetter now.

24. Money Market Account

A money market account (aka MMA) is an interest-bearing account that is very similar to a high yield savings account.

However, there are 2 major differences between an MMA and an HYSA:

- MMAs offer check-writing ability

- MMAs offer debit card privileges

So in essence, an MMA combines checking and savings account characteristics.

The reason why MMAs are one of the best compound interest investments is that they offer higher interest rates than what you would earn in a regular savings account.

While MMA’s offer similar variable interest rates as do high yield savings accounts, there are 2 main downsides:

- You’re typically limited to 6 monthly transactions

- Some MMAs require a large deposit to open the account

So, the best thing I can tell you is to read the fine print before you open an MMA.

You can find the best MMA accounts by going to SaveBetter.

25. Certificates of Deposit (CDs)

A certificate of deposit (aka CD) is an account where you save money for a fixed period of time. During this time, you cannot withdraw the money and in return you earn a fixed interest rate.

The period of time in which your money is locked up in a CD varies, but typically is:

- 6 months

- 12 months

- 36 months

Typically, the longer you hold your money in a CD, the higher the interest rate. However, you’ll be sacrificing liquidity with a CD.

You might also give up your money’s purchasing power by sashing it as cash (meaning your money could be eaten up by inflation) versus investing the cash and earning returns higher than those offered by CDs.

To get around the liquidity factor for CDs, you could always check out “no penalty CDs:”

Notice, however, that no penalty CDs offer much lower interest rates than traditional CDs… so at that point, it might just make sense to check out High Yield Savings Accounts (HYSAs), instead.

Here’s a good illustration of how a CD compares to an MMA and an HYSA:

However, if you’re an investor who does not like taking risks, a CD could be the right fit.

If you’re ready to open a CD, check out SaveBetter’s top tier online CD selection.

26. Sports Collectibles

Another one of my favorite compound interest investments is sports collectibles.

Thanks to alternative investment platforms like Collectable literally anyone can start investing in sports collectibles for as little as $5!

It’s possible to buy collectibles so cheaply thanks to fractional investing.

So, instead of owning the full card – or shoe, or belt, or picture, etc. – you’ll own a very small fraction of it.

Here are some examples of sports collectibles you could own:

And here’s why sports collectibles could be a great compound interest investment:

- You have liquidity

- You could beat inflation

- You could beat the stock market

For example, sports collectibles (specifically sports cards) have massively outperformed both gold and the S&P, especially in the past few years:

The Collectable investment platform has, on average, exited sports collectibles with an average 60% ROI.

Compare the 60% return on investment to the average 7% to 9% average return on investment that you’d likely get with the stock market.

27. P2P Lending

Another compound interest investment that could earn you potentially high returns and a passive income stream is peer-to-peer lending.

Peer-to-peer lending (aka P2P) is when you, along with hundreds of other private investors, lend money in exchange for repayment of your loan plus interest.

With P2P, you’re basically the bank:

- You make a loan

- You earn interest from your loan

- You should receive the full payment of your loan after the term is expired

With popular P2P platforms like Groundfloor, you can actually start lending with as little as $10.

Your loan would be borrowed by home flippers across the country.

As of the date of this article, you could make loans across 31 states in America:

The home flippers would use your money to:

- Buy a fixer-upper home

- Fix up the home

- Rent it out

- Sell it

Assuming all goes well, you should be repaid your initial loan plus interest. Typically, you could earn returns between 7% to 26%.

The loans you make are given “grades” ranging from A to G. Here’s an example of a loan that’s graded a “C.”

The closer the loans are graded to a “G” level, the higher the risk (and thus, the higher the potential return).

The closer the loans are graded to an “A” level, the lower the risk.

Just keep in mind that the biggest risk with P2P compound interest investments is that the people who borrow your money are much more likely to default on paying back your loan.

So make sure you only invest as much as you are willing to lose.

28. Your Business

Investing in your business is arguably one of the best compounding investments.

Especially if you want to make money in the long run, becoming a business owner is your best bet.

And, it shouldn’t be a surprise that most millionaires are business owners.

In fact, about 66% of millionaires are business owners.

Building a business is like investing in a compounding interest account:

- You start out small

- It takes a long time to see the results

- You can become unbelievably wealthy

Here’s the best news: You don’t have to go to college and get an MBA for $100,000s to learn the ins and outs of business.

In fact, you can get an entire MBA packed in just 1 course from online platforms like Udemy 👇

Professor Chris Haroun, the creator of this course, taught at renowned schools like Stanford.

Now, in this MBA course, he gives you his knowledge from experiences including:

- Start-up experience

- Hedge fund industry experience

- Consulting experience at Accenture

- Work experience from Goldman Sachs

- A Columbia University (Ivy League) MBA

Here are some of the things you’d learn with the MBA course:

And the best part?

Instead of spending hundreds of thousands of dollars for an MBA, you can grab the course between $24 to $130.

While you might not be physically investing in a compounding interest vehicle, you can never go wrong in investing in your business and in yourself.

29. Yourself

If you’re wondering how to invest with compound interest, then it’s also worth approaching this question from an “out-of-the-box” point of view.

Specifically, instead of opening an actual investment account, you should consider investing in yourself.

Undoubtedly, investing in yourself is one of the best long-term investments you can make, with virtually a 100% guaranteed return.

Do you feel stuck in your career?

Do you want to learn a new skill to make more money?

Then check out resources like Udemy 👇

Udemy is an online platform that offers courses to students worldwide.

For example, if you’re looking to switch to coding and make 6-figures, you might just want to check out some of Udemy’s top coding courses – with some starting at just $14.99.

The Bottom Line:

You can never go wrong with investing in yourself. The ROI you’ll get will be 10X the amount of money that you invested.

Can You Get Rich from Compound Interest?

Compounding interest investments can absolutely make you rich. In fact, the famous Albert Einstein once said “Compound interest is the eighth wonder of the world.”

Here’s how you can harness the power of compound interest:

- Start investing as soon as possible

- Invest in high return investment vehicles

- Invest your money consistently and over time

- Resist the urge to withdraw your money and stay invested

The key to getting rich from compound interest comes down to one thing: Time.

That’s why you need to invest when you are in your 20s – even if it’s just $100.

In fact, check out this chart below.

Aria’s 10 extra years of investing means that she has about $598,692.56 more than Alex.

Ultimately, learning how to invest in compound interest from an early age can lead to exponential growth in your wealth over time.

FAQs

What types of investments give compound interest?

Investments that earn compound interest range in returns between 1% to 20% and higher. Examples of compound interest investments include a checking account, high yield savings account, certificate of deposit (CD), investment account, real estate investment account, and a small business investing account.

Where do I start compounding interest?

You can start building your compounding interest investments by opening a high yield savings account online or by starting an investment account. As soon as you put money into these accounts, compounding interest will start building your wealth over time.

Is compound interest a good investment?

Yes, compound interest is an investment that can grow your wealth exponentially in the future. However, if you decide to rack up debt (like credit card debt), then compound interest could work against you as well, because the interest will be applied to your unpaid loan balance.

Do banks offer compound interest accounts?

Yes, banks offer compound interest accounts in many different forms. For example, you could open a high yield savings account, money market account, or a certificate of deposit (CD) which can compound daily.

What are the disadvantages of compound interest?

One of the major disadvantages of compound interest is that it takes a very long time to see the benefit. In fact, it can take up to 10 years or longer before you start seeing the powerful impact of compounding interest, so maintaining a long-term mindset and accepting delayed gratification is key.

Closing Thoughts

Investing money into the best compounding interest accounts can help you build a financial empire.

That’s because a compound interest account can make you money for free.

Hopefully this article gave you a peek into the best compounding interest investments such as:

- Stocks

- Index funds

- Small business investments

- Private market commercial real estate

Honestly, out of all the compound interest investments, my favorite is investing in index funds.

Of course, there is no right or wrong answer on how to invest in compound interest investments – you just have to consider your own personal situation and make a decision that works for you.

Now it’s your turn:

Which compound interest investments did I miss?

And, I’d love to know which of the compound interest investments you liked the most.