Today I’m going to reveal the 21 highest paying passive income apps in 2024.

In fact, these apps could earn you between $10 to $1,000+ per month!

The best part?

You can download the apps below for free and start earning passive income right away.

Let’s dive right in.

In this article

Sneak Peek: Top 3 Passive Income Apps

Best overall app 👇

Best app for earning rent 👇

Best app for earning dividends 👇

Passive Income vs Active Income

There are 2 income categories:

- Passive income – Money earned from an investment, or work completed in the past, that continues to make money without additional effort

- Active income – Money earned via work, such as doing a job in exchange for a paycheck, or operating a business in exchange for payment

Many wealth experts (myself included!) suggest building passive income streams as a way to become financially independent.

Why?

Because passive income could help you make money literally while you sleep.

On the other hand, active income makes money only when you directly trade your time for money.

The 21 Best Passive Income Apps

While these passive money making apps likely won’t make you a millionaire overnight, they can help you increase your income, and make money while you sleep.

With that said, here are the 21 best passive income apps:

1. Fundrise

Pro: Earn passive income

Con: Highly illiquid

Potential Return: 7.31% to 22.99%+

Time Commitment: 1 to 6+ years

Minimum Investment: $10

Fundrise is one of the best passive income apps because you have the chance to earn real money for your upfront investment.

If you love:

- Passive income

- Real estate investing

…Then Fundrise is the right app for you.

This app gives you the chance to invest in income generating assets like real estate.

Here’s what you can invest in:

- Hotels

- Retail space

- Office buildings

- Shopping centers

- Multi-family properties

- Single-family properties

- Other commercial properties

Fundrise currently has over 419,000 clients (and growing).

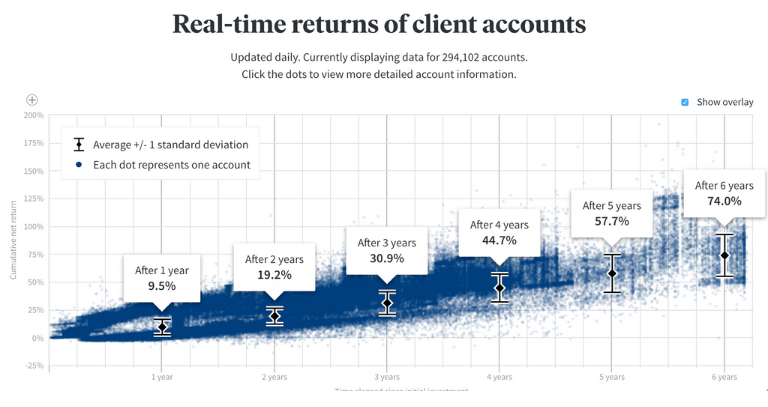

Take a look at the investment returns below:

Unlike regular real estate transactions where you’d have to put at least a 20% downpayment, with Fundrise all you need is $10.

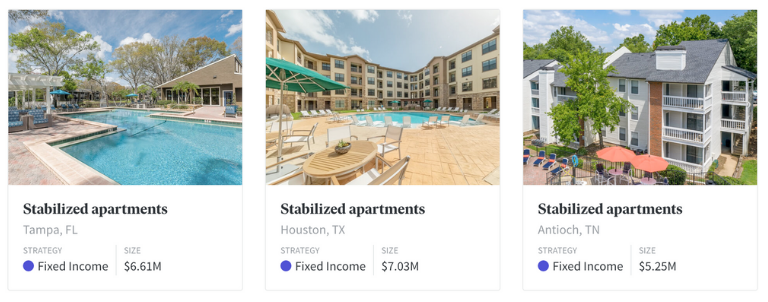

Here’s an example of the variety of real estate projects you can invest in:

Once invested, you’ll start seeing passive income in the form of dividends.

There are two ways you can process your dividends:

- If you need the money – Deposit the dividends directly in your bank account

- If you don’t need the money – Reinvest the dividends through a “dividend reinvestment program”

Fundrise as well as other alternative investment options could be a good way to diversify your portfolio, hedge against inflation, and earn passive income.

Favorite Feature

One of the coolest features offered in Fundrise is the real estate portfolio calculator.

Check out how an investment portfolio can be transformed with the following allocation:

- Stocks – 60%

- Bonds – 20%

- Real Estate – 20%

The real estate portfolio is shown in orange while the traditional portfolio (just investments) is shown in grey.

Based on this calculation, you’ll see that real estate:

- Reduces risk

- Increases annual returns

- Increases passive income

You can adjust the toggles to see how a portfolio with 90% real estate, 5% stocks, and 5% bonds performs as well (check it out below):

Awesome right?!

And that’s why I like this feature: You can gauge your potential real estate portfolio returns.

Recommended Reading: Fundrise Review

Pro: Earn quarterly passive income

Con: Illiquid

Potential Return: 5.4% to 13.1%+

Time Commitment: 5 to 7 years

Minimum Investment: $100

With Arrived Homes, virtually anyone can invest in multiple rental properties across the United States for as little as $100.

You, being the investor, actually don’t have to do anything (except invest and collect passive income!).

That means you don’t have to:

- Deal with tenants

- Manage the property

- Ask for rent payments

The home investment process actually takes less than 4 minutes.

Based out of Seattle, Washington, Arrived Homes has transformed the rental real estate investing process.

They do all the work upfront:

- Selling the home

- Buying the homes

- Managing the tenants

- Vetting the best tenants

- Maintaining the property

- Analyzing the best homes

- Establishing an LLC in which to hold the homes

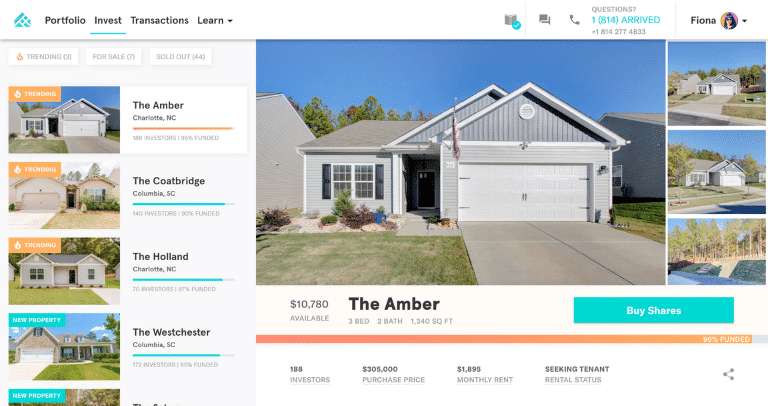

Typically, you’ll have up to 7 homes to invest in, at a given time.

The Arrived Homes website provides in-depth information regarding each home, projected rental profits, home value appreciation in the home’s location, etc.

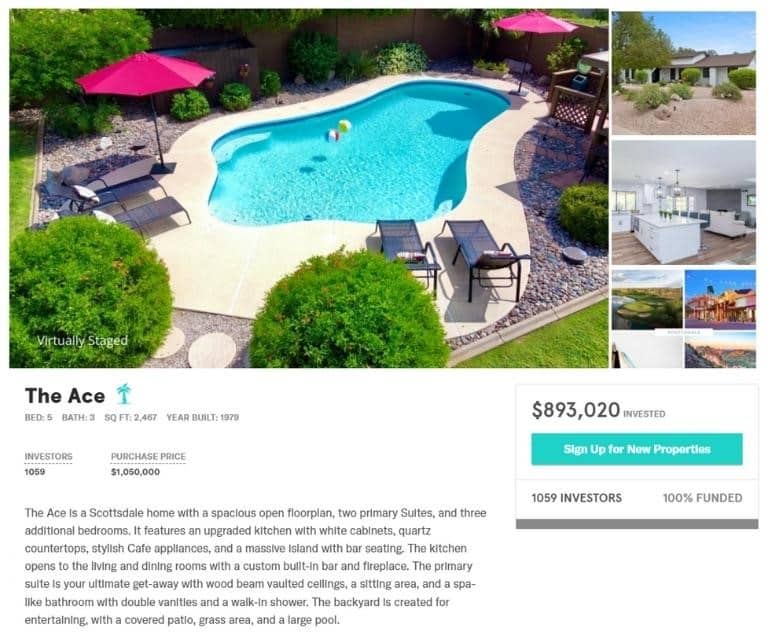

Here’s an example:

Once you invest in a home (you can invest anywhere from $100 to $20,000 per home), you can expect to earn some of the following benefits:

- Passive income

- Tax advantages

- Property appreciation

- Portfolio diversification

- Protection against inflation

- Low investment minimums

Just remember that you’ll likely have to wait 5 to 7 years before the home is sold and you’re returned your principal (aka original) investment.

Favorite Feature

Arrived Homes recently rolled out this latest feature:

Instead of investing in just rental properties, you can also now invest in vacation rentals as well.

The benefits of investing in vacation rentals include:

- Increased potential revenue

- Rapidly growing industry

- Seasonal cash flow

Of course, you could always diversify your real estate investments and invest a little in rental homes and a little in vacation rentals.

Below are some of the available vacation rentals at the time this article was written:

If you click on a vacation rental, you’ll see much more detail about the property itself.

And, Arrived Homes does a great job breaking apart the data so you know when to expect the most amount of money.

For this particular vacation rental, it appears that the cash flow is seasonal and you can expect the most amount of money in late February to April time (perhaps Spring Break?).

Whichever investment you decide to pursue – vacation rental vs. rental property – make sure you do your research.

Recommended Reading: Arrived Homes Review

3. FarmTogether

Pro: Invest in an appreciating asset

Con: High up-front investment

Potential Return: 5% to 11%+

Time Commitment: 5 to 10 years

Minimum Investment: $5,000+

Accredited Only: Yes

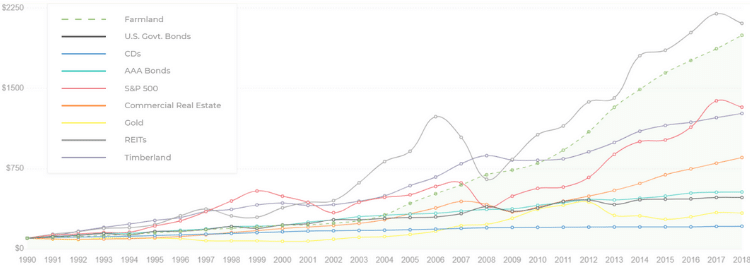

FarmTogether invests in farmland and timberland, which are two of the best appreciating assets as you can see here:

Farmland, illustrated by the green, dotted line, has grown in value even more consistently than stocks (shown by the red line).

So if you had invested $10,000 in farmland back in 1991, you would now have $215,800 today.

That’s because the average value of farmland increases by 6% annually.

The only downside here is that FarmTogether is strictly available to accredited investors only.

Favorite Feature

As a beginner farmland investor, I appreciate FarmTogether’s in-depth Learning Center.

The Learning Center provides plenty of resources for beginner and advanced investors about farmland investing.

You’ll learn about market research on crop yields like:

- Corn

- Apples

- Pistachios

You’ll also learn about the divided US agricultural regions:

You can also learn about:

- Soil types

- Pest management

- Nutrient management

…And the list goes on.

I mean, who knew there were 6 different soil types?!

So, if you’re ready to invest but want to increase your knowledge about farmland and timberland – the Learning Center will help tremendously.

4. Groundfloor

Pro: Earn passive income

Con: No guaranteed returns

Potential Return: 6% to 14%+

Time Commitment: 6 months to 21+ months

Minimum Investment: $10

Groundfloor is a passive income app for peer-to-peer lenders looking to invest their money in short-term real estate debt.

Basically, you are the bank.

By investing $10, you are technically lending $10.

The borrower promises to repay you the $10 plus interest (which is your passive income).

The chart above shows how saving and investing your money can generate high returns.

Your money would be used to:

- Buy a fixer-upper home

- Fix up the home

- Rent it out

- Sell it

And it gets better:

Groundfloor has over 200,000 users and invests in properties across 30+ states.

Keep in mind that on peer-to-peer lending platforms, you do run the risk of not receiving your money.

Favorite Feature

As you start investing in Groundfloor properties, make sure you look at the Loan Type.

Depending on the loan type, you could:

- Earn more passive income

- Lose all your money

Generally, the riskier the loan, the higher the return.

That’s why you should look at the risk/reward scale:

If your investment is designated as a “green” investment aka Grade A investment, you’ll have less risk and less return.

On the other hand, if your investment is designated as a “red” investment aka Grade G investment, you’ll have more risk and more return.

You’ll find these designations on each real estate offer:

As you can see, each investment Grade above offers a rate of return that’s proportional to the risk that you’re taking.

5. Masterworks

Pro: High profit potential

Con: Illiquid

Potential Return: 29%+

Time Commitment: 3 to 10 years

Minimum Investment: $500 (typically)

Investing in fine art used to be a tradition of the exclusive, high-roller world of the ultra-wealthy.

Not anymore.

Investing in art is now easier than ever, thanks to the online investing platform, Masterworks.

Masterworks offers multi-million-dollar artworks from artists like:

- Banksy

- Andy Warhol

- Jean-Michel Basquiat

…And you can actually invest in these artworks!

In fact, since Masterworks was launched in 2017, the platform has offered over 100 paintings to investors.

Masterworks joins efforts with a team of analysts from the Citi Private Bank sector to consider which paintings are the best for Masterworks investors.

One reason why Masterworks is an attractive asset for investors is that art can be used as a hedge against inflation.

The chart above illustrates how assets perform during high inflationary environments, like what we saw in 2022.

And over the past 26 years, fine art has consistently outperformed the S&P 500 as well as other asset classes:

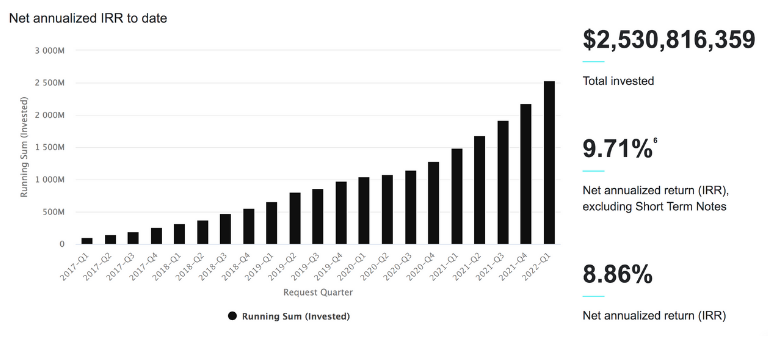

Since 2018, Masterworks’ net annualized realized returns averaged to just over 29% (which is very good).

So how can you invest in a $30 million+ painting?

It’s all thanks to fractional investing.

Masterworks lets you invest in $20 increments with a minimum investment often depending on your overall net worth (typically around $500).

Favorite Feature

Art is an illiquid asset and to make a profit, you’ll likely have to keep your money locked up for 5+ years.

And that’s why the Masterworks Secondary Market feature is so cool.

The secondary market often is where you buy/sell art shares at a discounted price.

If you’re a buyer, you might actually discover some undervalued shares of artwork that could appreciate in your portfolio over time.

Bottom line, the secondary market is like an escape hatch and not a front door to art work investing.

Recommended Reading: Masterworks Review

6. M1 Finance

Pro: Earn passive income from dividends

Con: Investments are never guaranteed

Potential Return: 7% to 9%+

Time Commitment: You choose

Minimum Investment: $100 for regular accounts; $500 for IRA accounts

One of the best ways to build wealth is by investing in the stock market.

In fact, many millionaires get rich off stocks – so long as they hold their investment over time.

And you can too with apps like M1 Finance.

M1 Finance has transformed the robo advisor and the fractional share investing market.

Since its inception in 2015, M1 has exploded and has reached $5 billion of assets under management.

The best part?

M1 Finance does not charge broker fees or commissions (and that can save you a lot of money – especially as you invest more cash).

M1 offers 4 features:

- Investing

- Borrowing

- Credit Card

- High Yield Savings Account

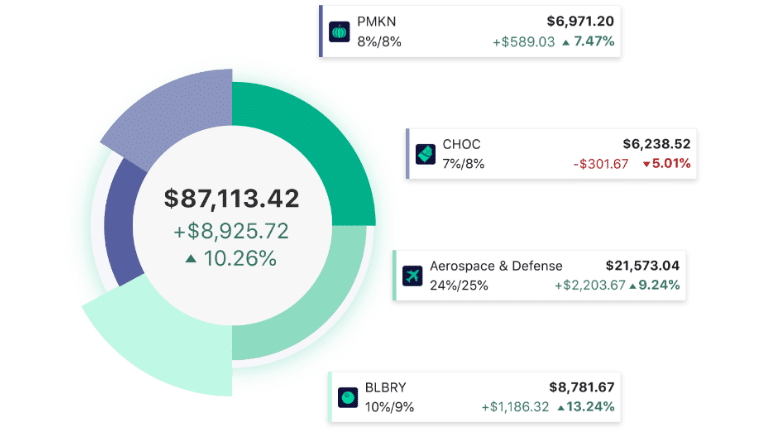

However, M1 was first known for its concept of investing “pies.”

In other words, your “M1 Pie” is your overall investment portfolio.

You can choose from 6,000+ ETFs and stocks, so there is a lot of choice.

If you’re feeling paralyzed by the amount of choice, M1 also provides some pre-made and specialized “M1 pies” for you too:

M1 Finance will be rolling out more specialized pies in the near future as well.

Favorite Feature

Are you dedicated to investing in the stock market?

If so – you should probably check out M1 Finance’s newest addition:

The Owner’s Rewards Card.

With this Visa card, you can earn up to 10% in cash back rewards on everyday purchases when you spend at select companies.

When you collect cash back points, you can automatically reinvest these into your M1 Finance Pie and build wealth with every card swipe.

Personally, I think the cash back and automatic reinvestment feature is a fantastic way to build wealth.

7. Vinovest

Pro: Hedge against inflation

Con: Unregulated industry

Potential Return: 12.4% to 100%+

Time Commitment: 5 to 20+ years

Minimum Investment: $1,000

Vinovest is the world’s first fine wine robo advisor, composing a customized wine portfolio just for you.

Before Vinovest curates a wine portfolio for you, you’ll first have to answer some questions about your risk tolerance.

The riskier you are, the more likely the Vinovest experts are to put you into a portfolio consisting of fine wines from emerging wineries.

If you’re more conservative, your portfolio will consist of wines from established, blue-chip wineries.

Want to know the best part?

Investing in fine wine is actually a great way to diversify your investments and protect against market volatility.

Because fine wine has a low correlation to the market (like the S&P 500 index), you can expect to earn money when the market loses money.

Keep in mind that you’ll be investing not in fractional shares of fine wine, but you’ll actually be investing in physical wine bottles.

And one of the benefits of using Vinovest is that your wine bottles are:

- Insured

- Transportation-ready

- Stored in secure facilities

Remember that fine wine investing is a long-term commitment, however, so to make a profit you’ll likely have to stay invested for up to 20+ years.

Favorite Feature

Out of all the passive income apps, Vinovest is likely one of the most customer centric.

When I called Vinovest, I spoke to a customer service representative who was extremely knowledgeable and well-spoken.

My representative had a background in both finance and fine wine and she knew what she was talking about.

You can also book a one-on-one video chat with a Vinovest advisor to learn more about:

- Wines

- Wine brands

- Investing strategies

Finally, Vinovest also offers an air of exclusivity to its clients, where you are invited to exclusive events around the US.

While these events subsided during the height of the pandemic, these events are once again offered to Vinovest investors.

If you like a customer-focused passive income app, then Vinovest might definitely be a good match for you.

Recommended Reading: Vinovest Review

8. Titan

Pro: Low cost investment management

Con: No tax-loss harvesting strategy

Time Commitment: Low

Minimum Investment: $100

When you think of hedge fund investing, you’ll probably think of:

- Ultra exclusive investor clients

- Minimum investments of $1 million+

- Crazy fees (2% of assets + 20% of profits)

To say that hedge fund investing is a luxury for the average person is an understatement.

But… not so fast…

Thanks to a FinTech firm called Titan, you can invest in hedge-fund-like assets with an in-house investment team for a minimum of just $100.

The Flagship fund tracks large cap growth companies while the Opportunities fund tracks small to mid cap growth companies.

On average, the portfolios hold between 15 to 25 stocks.

Some of the assets that you can invest in, include:

- Crypto

- Offshore assets

- Large Cap stocks

- Small Cap stocks

While Titan is not exactly a hedge fund per se, it is an active investment robo advisor platform that seeks to invest in aggressive and high-growth investment opportunities.

And typically, Titan either performs in line with its benchmarks or outperforms its benchmarks.

Favorite Feature

For those interested in crypto and active hedge fund management, Titan offers a succinct weekly newsletter called “Three Things.”

In this newsletter, you’ll learn about the top 3 things for the week when it comes to the world of:

- Crypto

- Finance

- Economy

Even if you’re not ready to sign-up to be a customer with Titan yet, the newsletter might be worth checking out if you want to learn more about money and the markets.

9. RVshare

Pro: Receive $1 million liability insurance

Con: RV wear & tear

Potential Return: Up to $60,000

Have you ever dreamed of earning an extra $40,000 to $60,000 per year?

Thanks to one of the most lucrative passive income apps, RVshare, now you can.

RVshare is an app where you can rent out your RV for money.

You can market your RV as one of the perfect ways to road trip to national parks like:

- Sequoia

- Yosemite

- The Grand Canyon

And believe it or not, you can actually make a lot of money for each day your RV is rented.

In fact, you could make as much as $120 per night – if not more!

The amount of money you earn on your RV really depends on several factors.

Some include:

- Size of your RV

- The distance of the trip

- The condition of your RV

- RV type (tow vs. drivable RV)

As potential customers explore the RVshare website, they are given guidance as to which type of RV would be best for them.

And the guidance doesn’t stop there for RVshare customers.

In fact, by renting your RV through the RVshare platform, customers receive 24/7 emergency roadside assistance.

Some RVshare services that are also provided to customers who rent on the platform include:

- Towing

- Tire service

- Lockout service

- Emergency fuel delivery

The app makes it easy for you to rent out your unused RV to make extra money and it also makes the RV experience great for customers.

Favorite Feature

As an RV owner, I would always want to make sure my RV is taken care of – even when it’s in the hands of customers paying me $40,000+ per year.

And that’s where RVshare also steps it up.

Owners gain access to the RVshare Protection Plan, which is free.

The plan includes:

- Up to $1M in liability insurance coverage

- Up to $300,000 in comprehensive and collision coverage based on the value of the RV

- Free 24/7 roadside assistance and free towing and tire service for RVshare customers

- Campsite liability coverage up to $10,000

The RVshare Protection Plan covers RVs that are 15 years old or newer, with a stated value of $300,000 or less.

If your RV is older than 15 years, only liability coverage is available on your RV, providing renters with liability-only protection for the length of their trip.

The plan won’t include comprehensive or collision coverage for your RV.

While your RV will inevitably be exposed to wear and tear, not only will you make some extra money through RVshare, but your RV (and you!) will also be covered through the RV Protection Plan.

10. DoorDash

Pro: Set your own schedule

Con: Customers may be difficult

Potential Return: Up to $2,000/month

Time Commitment: Few hours a day

One of the highest-paying passive income apps you can get your hands on is DoorDash.

Now, I’ll be completely honest:

DoorDash isn’t 100% a passive income paying app because you’ll have to do some work (like picking up food and driving it to the person who ordered it).

But, it’s another great app that helps you earn up to $1,000+ per week!

To get started with DoorDash, all you need are 3 basic things:

- You must have proper documentation

- You must be 18 years or older

- You must have a vehicle

Here’s a myth buster:

You actually don’t need a car to become what they call a “Dasher.”

You could have a scooter or even a bicycle!

As a Dasher, you can literally set your own schedule and work when you want.

DoorDash is basically like an Uber for food:

- You accept or decline certain food orders

- You work when you want to work

- You can work internationally

In fact, DoorDash works in the US, Canada, and Australia.

While DoorDash is available in pretty much every big city across the 3 countries that I just mentioned, here is a pretty comprehensive list of the top cities:

The trick to earning the most amount of cash with DoorDash actually comes down to a few things:

- The city you’re in – The more popular, the more money you make

- The time of day you’re dashing – To make more money, work during prime time (lunch or dinner)

- The DoorDash Promotions You Participate in – DoorDash sometimes offers promotions to Dashers, which help you earn extra cash

There are Dashers who have earned between $15 to $25 per hour (aka $1,000 per week) with DoorDash!

The other neat bonus feature with DoorDash?

As a Dasher, you get some quirky financial discounts with services like TurboTax and Seed.

While DoorDash might not exactly be a passive income app – it is a way to make a lot of extra cash per month.

Favorite Feature

Imagine a world where you work and get paid for that work on the same, exact day.

Now you can – with DoorDash.

In fact, you can get paid instantly with the “DasherDirect” card.

You don’t have to pay a fee for direct deposits on your Dasher Direct card – plus you get cash back rewards on partner brands when you spend your Dasher Direct card.

This new feature is great for people who want to be immediately rewarded for their efforts (and it’s a great way to stay motivated, too).

Door Dash calls this feature “Cash after every Dash.”

And obviously, for those of you who love shopping (whether it’s for the latest fashion trend or for regular groceries), you also get cash back rewards points.

Talk about another way to make passive income!

11. Neighbor

Pro: Make money by renting out extra space

Con: High processing fee

Potential Return: Earn $12 to $100+ monthly

If you’re looking for an app that doesn’t require start-up capital, then check out Neighbor.

Neighbor calls itself the “Air BnB of storage,” a way for you to make extra cash by renting out unused space in your home.

The app’s primary objective is simply connecting people within a community to help each other store items and make money on the side.

Signing up is free and all you need is some free storage space in your home, garage, or even outside (like a parking spot).

The best part?

You can set your own schedule and use this passive income app as a way to make extra cash.

After signing up as a Neighbor host, you’ll have to:

- Link your bank account

- Post pictures of your storage space

- Use the Neighbor App to process transactions

Of course, you’ll want to do some market research to make sure your prices are fair.

You can also browse the Neighbor App to see the available storage spaces in your neighborhood and how hosts promote these spare spaces.

Look at the number of available storage spaces!

Neighbor will charge you (as the host) a 4.9% processing fee and $0.30 per reservation.

So in reality, you’ll receive monthly rental income minus the Neighbor fees.

Another neat feature of Neighbor is the Payout Protection.

The Payout Protection plan guarantees your payments – even if the renter fails to pay.

Personally speaking, Neighbor is one of my favorite passive income apps that takes minimal effort.

Favorite Feature

The best feature on the Neighbor App is the liability protection for the hosts.

Especially in today’s world where everyone wants to sue everyone else, it’s so important to have an eye on insurance coverage.

And once again, Neighbor has you covered.

In fact, Neighbor has you covered for $1 million in personal liability insurance.

As long as a claim is related to a storage reservation, the personal liability coverage comes into effect for every Neighbor host in every US state.

This extra $1 million personal liability coverage will act as a secondary insurance coverage, after your homeowners insurance policy pays out.

The best part?

The extra insurance is free to every host.

12. Ibotta

Pro: 300+ partner brands

Con: Multiple ads

The best passive income app for cash back rewards is arguably Ibotta.

Ibotta is one of my favorite money hacks because you can earn actual cash directly in your bank account after making purchases on everyday items.

In fact, depending on the partner brand, you can earn up to 30% cash back at thousands of top retailers.

You can earn rewards as fast as within 24 hours of purchasing an item.

The best part?

You can earn cash back rewards either through your phone or your desktop.

However, make sure to always ask for a receipt if you’re shopping in-person – because the receipt will be your golden ticket for cash back rewards.

Ibotta does have an extra step involved in the cash back process compared to other cash back apps.

And that step is uploading and submitting an image of a receipt.

Once you have a minimum of $20 in your Ibotta cash back account, you withdraw your earnings or keep building up the cash.

Favorite Feature

Ibotta is continually developing and getting better.

For example, not only do you get cash back rewards if you shop in grocery stores or online, but now you can also get cash back rewards if you buy gift cards.

In fact, you can earn up to 10% cash back on gift card purchases at 120+ stores and restaurants.

You can either buy the gift cards directly from the online Ibotta website or you can even go in-store and buy the gift cards to receive your cash back rewards.

As long as you are not going out of your way to buy extra items, then Ibotta is such a great way to earn passive income.

13. Rocket Money

Pro: Only pay if Rocket Money is successful

Con: May have to spend extra time canceling

If you’re looking for a passive way to save the maximum amount of money, you have to take a look at your subscription lifestyle.

In fact, forgotten subscriptions can cost you more than $1,100 per year!

That’s where Rocket Money comes into the picture.

Rocket Money can save you thousands each year because it can negotiate and even cancel unwanted subscriptions – all for you.

This means you don’t have to spend hours on the phone dealing with customer service representatives, wasting your precious time.

Instead, Rocket Money takes over to negotiate lower monthly bills for you – or even cut them completely.

Not only do you save money from lower or even canceled bills, but Rocket Money also tracks your income and expenses.

What I like about this app is how visually appealing the income/expense tracker is:

You can also set budget alerts like a low checking balance alert.

You can also create different savings “buckets” like:

- Vacation savings account

- Emergency savings account

- New vehicle savings account

As you deposit money into each savings bucket, your budget tracker can remind you when or even how much you have to deposit in each bucket to reach your goal.

Some additional perks with Rocket Money include:

- Tracking your credit score

- Creating a customized budget

- Negotiating lower bills on your behalf

- Understanding and growing your net worth

If you’re new to budgeting and financial goal setting, I think Rocket Money does a great job of breaking down budgeting concepts into simple terms and fantastic visuals.

Favorite Feature

My favorite Rocket Money feature is that you don’t ever have to negotiate or deal with a service provider again.

Rocket Money does it all for you.

In fact, Rocket Money’s team consists of professional negotiators who will call your service providers (phone, internet, cable, etc.) to either lower or completely cancel your bills.

If Rocket Money isn’t successful – then you don’t pay.

Only if Rocket Money lowers or cancels a bill will you pay a percentage of what you saved.

14. Drop

Pro: Earn cash back rewards by shopping

Con: Only available in the US and Canada

Drop links to your credit or debit card and rewards you on everyday purchases.

In fact, Drop is best for:

- Foodies

- Shop-a-holics

- Desktop shoppers

- Phone savvy shoppers

From your Uber ride to your favorite Starbucks coffee, you can link your purchases with online offers and you’ll earn rewards points through Drop.

Why would anyone download Drop?

Well the genius behind Drop is that you earn money on items that you would normally have to purchase anyway – with or without Drop.

So basically you get more money in your pocket!

After downloading the Drop app, you’ll want to link your card first.

Once you link your card with Drop, your expenses will be tracked through the App.

When you spend money on qualifying purchases, Drop will send rewards points your way.

You can literally earn points on anything from grocery shopping and eating out to your next tropical vacation.

But, you don’t just earn points when you make purchases….

…You can also earn points through other savvy ways like participating in Drop activities (like games and surveys).

So let’s say that you’re waiting in line to board your plane for your tropical vacation getaway and you’re a little bored.

Why not whip out your Drop app, play a game to pass the time – and earn more money?

I’d say that’s a win!

You can also earn points by simply shopping on your desktop and downloading the Drop extension on your browser.

Favorite Feature

The reason why Drop is one of my favorite apps is because of the many popular brands Drop is partnered with.

When you earn points, you can redeem your points at popular brands like:

- Uber

- Expedia

- Coinbase

- Wal-Mart

- Lululemon

You will need a minimum of 5,000 Drop points to cash out and redeem the points (and 1,000 Drop points = $1).

And while points don’t expire, if you’re inactive for 6+ months, you may be charged an account maintenance fee.

15. Collectable

Pro: Portfolio diversification

Con: Available only in the US

Potential Return: 9.74%+

Time Commitment: Days to years

Minimum Investment: $5

Have you ever collected sports cards, autographed sports t-shirts, or other types of sports memorabilia?

If you did, then your collectibles might be worth a lot of money.

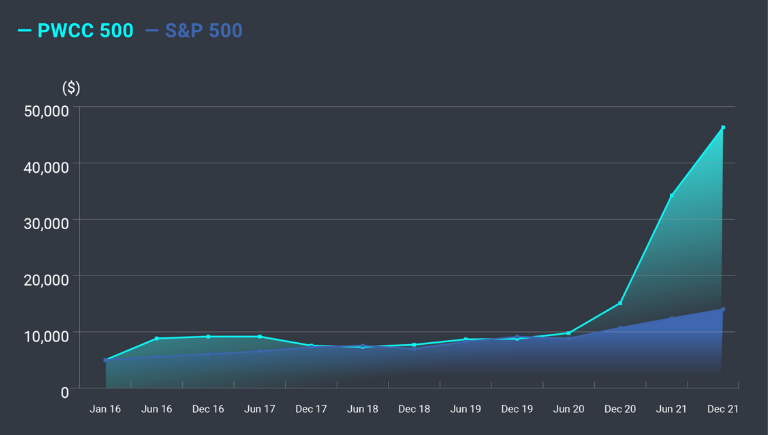

In fact, sports collectibles are one of the fastest-growing industries today.

Over the past 5 years, sports collectibles have massively outperformed the S&P 500, generating returns almost 200% greater than the S&P 500 in December 2021.

However, it’s not always easy to get started with sports investing.

Enter Collectable.

Collectable’s specialty lies in identifying and converting sports memorabilia into fractional share ownership.

That’s why regular investors like you and me can invest as little as $5 in NBA record holder Stephen Curry’s Nike sneakers worth a whopping $110,000.

Collectable actually stores the sports memorabilia while investors are given the chance to buy shares.

Favorite Feature

Trading sports memorabilia can be very lucrative but the downside is that your money can be locked up for a while (we’re talking a few years).

That’s why my favorite feature on Collectable is the secondary market.

The secondary market is the chance for investors to raise cash if they need liquidity ASAP.

These should only take about 5 minutes to complete, however.

Accounts are typically verified within a few minutes before you can access secondary market trading.

Pro: Can be used worldwide

Con: Won’t make you rich

Potential Return: $5 to $140 per month

Imagine earning passive income by literally renting out your internet.

Now you can, thanks to Pawns App by IPRoyal.

Here’s how to start sharing your internet connection:

- Install the app on the devices you want to use

- Connect these devices to your internet

- Run the Pawns App to share your internet connection

Now you may be wondering: Is my data safe?

The answer is yes – Your personal data will not be shared with anyone (and I’ll review this in more detail in the Favorite Feature section).

Want more good news?

Pawns App works in multiple locations – virtually anywhere in the world:

Luckily, you don’t just have to be located in the US to make your first dollar online.

Here are some ways that could boost your earnings:

- The location of your IP address (some locations might be preferred to others)

- The more unique IP addresses, the better

- The higher your wifi speed, the better

And quite frankly, depending on these 3 main factors, you could actually earn up to $50+ per month!

Basically, the longer you stay online and run the app, the more you earn.

As soon as you make $5, you can withdraw the money from your account.

Your payouts could either be in:

- PayPal

- BTC currency

- Virtual gift cards

In addition to sharing your internet and taking surveys, you could also earn money by referring friends – and earn 10% from their earnings!

Your wifi bill will pay for itself!

Favorite Feature

There may be a common misconception about this automated income site.

Specifically: When you share your wifi connection, you also share your personal data.

This is not true. Pawns App doesn’t gather any personal data.

The only data used is the data necessary for the service to work:

- Your IP address

- Your email address

- Your preferred payout method

The internet connections are inaccessible to outsiders and are fully encrypted.

That’s why you can make money from home without any security risks.

17. Roofstock

Pro: Tenants come with your property purchase

Con: High up-front costs

Potential Return: 10.7% to 12.2%+

Time Commitment: 5+ years

Minimum Investment: $5,000+

Roofstock is a passive income app that pre-vets both home tenants and property management companies.

In fact, Roofstock claims it’s the No. 1 platform for remote real estate investing across the United States.

The second you buy a home from Roofstock, you’ll start earning passive income.

Why?

That’s because Roofstock sells you the home – with the tenants already inside, paying monthly rent!

Roofstock calls its properties SFRs (aka Single Family Residences).

There are over 16 million SFRs in the US, with a market capitalization of $4 trillion dollars.

Since it was founded in 2015, Roofstock has raised over $240 million to expand access to the SFR sector.

Roofstock vets the following:

- Tenants

- Each SFR home

- Property management companies

You can check out the SFRs on the Roofstock website:

In fact, you don’t even have to visit the home if you don’t want to, because Roofstock offers:

- Photos

- 3-D home models

- Complete inspection reports

Even though you don’t have to visit the home, I would probably suggest you try to schedule an appointment to see the property in person if at all possible.

Once you’ve settled on a home, you can either buy a home with a cash wire or if you finance.

Customized financing options are available on the Roofstock website (check out the screenshot below).

The beauty of Roofstock is that the homes are “rent-ready.”

After closing on a home, you can start collecting rent immediately because your home purchase automatically takes ownership over the previous rental agreement contract.

While finding, vetting, and onboarding reliable tenants is the hardest part of becoming a landlord, Roofstock does this for you in advance.

Favorite Feature

Roofstock is arguably the best passive income app for landlords.

But what if you prefer to take a hands-off approach?

If you don’t want to:

- Buy a property

- Manage your tenants

- Deal with a property management company

…Then you may want to check out the “Roofstock One”, instead.

Roofstock One is an offshoot of the original Roofstock platform.

Here are the differences:

- The minimum investment is $5,000

- You invest in SFRs using fractional shares

- Roofstock One is for accredited investors only

If you prefer to diversify your risk exposure when it comes to real estate, then Roofstock One is likely the better platform.

That’s because you’re not invested in 1 particular home.

Instead, you can invest across a number of properties.

18. Kraken

Pro: Large product selection

Con: High instant buy fees

Time Commitment: You choose

Minimum Investment: Depends on deposit method ($1 minimum for ACH)

Founded in 2011, Kraken is one of the world’s largest and oldest crypto exchanges with the widest selection of digital assets.

Based in San Francisco, Kraken supports over 190 countries and has over 9 million users subscribed (and counting).

If you’re looking to build your investment portfolio using digital assets like crypto, then Kraken could be the right choice for you.

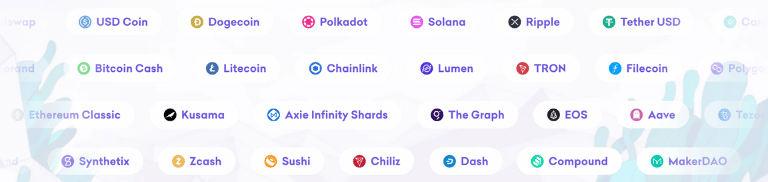

In fact, with Kraken, you’ll have access to 185+ crypto assets:

The real benefit with Kraken is that you can exchange your fiat currency directly with a crypto asset.

Some of the accepted fiat currencies include:

- Euro

- US Dollar

- Canadian Dollar

- Great British Pound

You could also directly exchange 1 crypto asset into another crypto asset.

Especially if you’re a beginner when it comes to crypto trading, you’ll appreciate the 24/7 Kraken support system.

You’ll also be happy to hear that Kraken takes a comprehensive approach to protecting your investments in crypto assets and NFTs.

In fact, about 95% of all crypto deposits are kept in cold storage that is:

- Offline

- Air-gapped

- Geographically distributed

And finally, a word on fees.

Kraken fees are actually pretty low compared to competitors.

Depending on the platform you use (Kraken Pro versus Kraken), trading fees range from 0% to 0.26% (Kraken Pro) and up to 1.50% (Kraken).

Favorite Feature

If you’re serious about crypto investing then you might like Kraken’s Cryptowatch.

Cryptowatch is a paid service on the Kraken platform.

It is a premium trading terminal providing live crypto market data, charting, and trading services for 25+ crypto exchanges.

The live data is directly provided by the crypto exchanges via their APIs (Application Programming Interface), covering 4,000+ crypto markets.

Especially if you’re a visual learner and want to be involved in the day-to-day crypto trading action, Cryptowatch is probably a good match.

If you’re very serious about crypto, then Kraken also offers other features in addition to Cryptowatch like margin trading (which is very risky) and the Kraken Pro platform.

19. Yieldstreet

Pro: Wide array of alternative investments

Con: Most investments are only available to accredited investors

Potential Return: 8% to 25%+

Time Commitment: 3 months to 5+ years

Minimum Investment: $500

Founded in 2015 and based out of New York City, Yieldstreet is an online crowdfunding platform where investors diversify their portfolios in alternative asset classes.

Some of these alternative asset classes include:

- Crypto

- Fine art

- Legal finance

- Private equity

- Marine finance

- Venture capital

- Structured notes

- Commercial real estate

The good news is that Yieldstreet is available to both accredited and non-accredited investors.

The best part?

You can also make up to 25% in annual returns with Yieldstreet.

Especially given modern markets, it could be an idea to invest a small portion of your money with platforms like Yieldstreet.

Here’s when this platform could be a good option for you:

- You like taking risks

- You don’t need liquidity

- You’re an aggressive investor

- You want to earn passive income

- You want to diversify your portfolio

- You don’t have major high-interest debt

- You’re an intermediate to advanced investor

One downside that I must point out is the fees.

Yieldstreet does charge fairly hefty fees (we’re talking between 1% to 4% or more, depending on your investments).

Favorite Feature

If you’re still on the fence about investing in alternative assets, then one tool that might give you more insight is Yieldstreet’s Portfolio Simulator.

Here, you can see how building a portfolio of alternative investments could improve your earnings and your portfolio value.

If your focus is to build an income generating portfolio, then you may want to look at the “Payments” tab:

Since both short-term and supply chain notes offer only 6-month target terms, you’ll only see payments last for exactly 6 months.

Recommended Reading: Yieldstreet Review

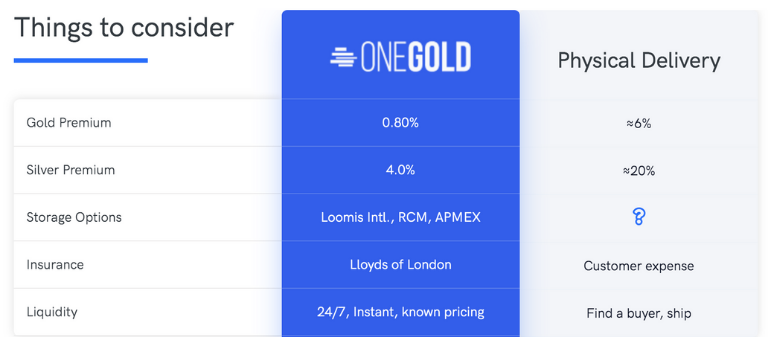

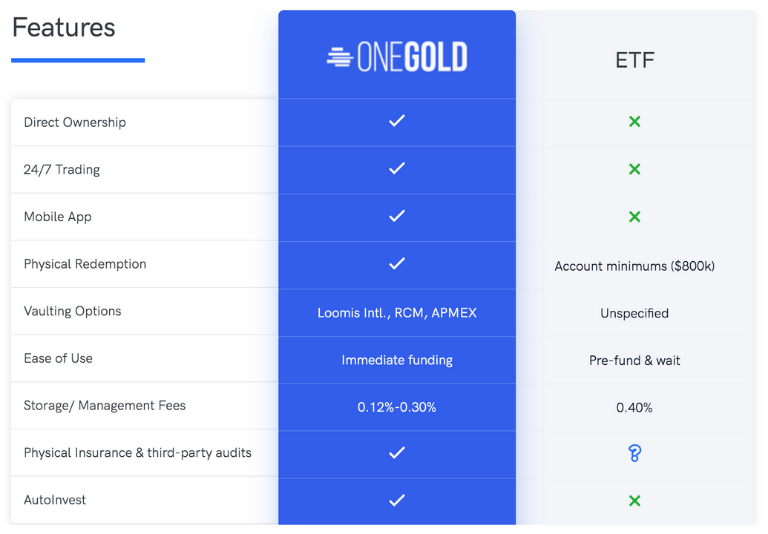

20. OneGold

Pro: Metals are insured

Con: Fees are higher than normal

Potential Return: 10.9% to 13.4%+

Time Commitment: Days to years

Minimum Investment: $1

OneGold is a digital precious metals trading app where you can:

- Buy precious metals digitally

- Sell your precious metals 24/7

- Store your precious metals internationally

OneGold takes care of the insurance as well, using Lloyds of London to cover your precious metals.

You also have the option to take physical delivery of your precious metals if you want to personally store your metals.

If you’re still a little weary of investing in physical bullions, then you may want to consider investing in a gold ETF (which are often great alternatives).

However, one of the biggest downsides to precious metals ETFs is that you won’t have direct ownership of the precious metals.

Favorite Feature

If you’re really excited about investing in precious metals, then you might want to check out OneGold’s Bullion Card.

This is a Visa credit card where you earn points as you spend.

As you earn points, you can either invest these into Gold, Silver, or Platinum.

And, you also won’t have to pay interest on any purchases for the first 12 months.

Here’s how the simple process works:

- Spend money on everyday items using the Billion Card

- Earn points (up to 4% back in Gold and Silver)

- Redeem your points by investing in precious metals using your OneGold account

This is a great feature if you’re truly committed to building your precious metals reserves.

21. Acorns

Pro: Low investment minimum

Con: No individual stock/mutual fund options

Potential Return: Depends on your portfolio choice (conservative versus aggressive)

Time Commitment: No lock-up periods

Minimum Investment: $5

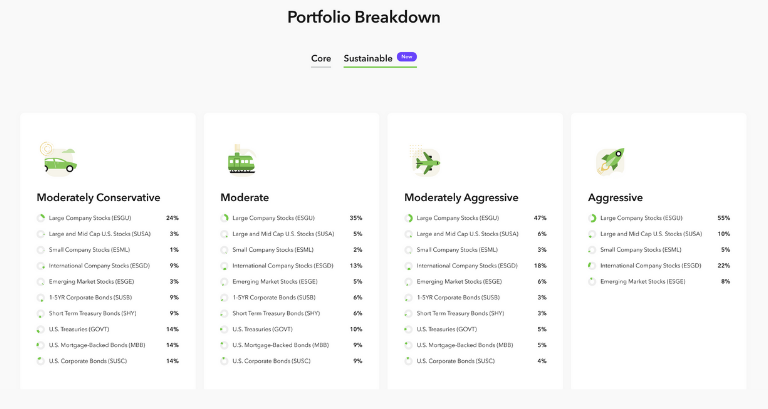

Acorns has over 11 million sign-ups and is considered one of the best ways for young adults to build wealth.

It makes investing simple – especially for beginner investors.

Instead of having the option to invest in 1,000’s of stocks, you are given 5 pre-set “core” portfolios.

These portfolios range from conservative (mostly bonds) to aggressive (mostly stocks or ETFs).

Recently, Acorns also rolled out a sustainable portfolio selection:

Acorns is one of the best apps for passive income generation because it provides a limited number of options.

As you start investing more, you’ll start seeing that your portfolio will grow and generate dividends over time.

Favorite Feature

My favorite Acorns feature is the “Round-Ups” feature.

Round-ups are typically calculated in cents.

For example, if you buy an ice cream for $3.37, then the round-ups feature would round-up your purchase to $4.00 and withdraw $0.63 from your linked account and invest that money in your Acorns account.

Here’s how your round-up transactions would look:

The other neat feature that accompanies the Acorns “Round-Ups” feature is the Round-Ups Multiplier.

Let’s go back to our example with the ice cream.

Instead of just withdrawing the regular round-up of $0.63, with a 2X round-up multiplier, Acorns would withdraw $1.26 from your account.

This feature is basically “round-ups” on steroids and will fast-track your savings goal.

Closing Thoughts

While these passive income apps might not make you a millionaire overnight, they can set the foundation for you to:

- Build wealth

- Pay off debt

- Save more money

In fact, if you invest the money from the passive income apps, you could become financially independent!

Remember, every little bit counts!

Your bank accounts will thank me later.