In this post I’m going to show you exactly how to build a stock portfolio from scratch.

In fact:

These are the same strategies that I used to grow my investment portfolio to over $497,578… in less than 5 years.

Let’s dive right in.

In this article

What is a Stock Portfolio?

A stock portfolio (aka investment portfolio) is a collection of your investments. Typically speaking, a stock portfolio is a collection of portfolio stocks, bonds, cash, real assets, etc.

The key to building a sustainable stock portfolio is diversification.

In other words, you’d spread your money across several:

- Stocks

- Industries

- Asset types

- Geographic sectors

Diversification also helps build multiple income streams.

Think of a portfolio like a roof, and your assets (like stocks, real estate, etc.) are all stored under that roof.

It’s helpful to imagine your investment portfolio like this because when creating a stock portfolio, you need to look at everything collectively.

When you look at everything collectively, you can better decide how to invest your assets to meet your goals.

Ultimately, you need to find the right combination of investments that fit your specific goals.

Building a Stock Portfolio that Aligns with Your Risk Tolerance

If you want to build a stock portfolio, then the first thing you need to consider is your risk tolerance.

Risk tolerance is based on how much market volatility you can accept without cashing out your investments because you’re worried about losing money.

In other words, the risk you take will not keep you up at night, worrying about your investment losses.

Risk tolerance is typically based on several factors like:

- Your psyche

- Your time frame

- Your understanding of how the market works

The key to building a successful portfolio is your time horizon.

For example, if you’re 25 years old now and plan to invest until retirement at age 65, then your investment time horizon is 40 years.

Here’s a quick tip:

- The longer your time frame – The higher the likelihood you’ll make more money

- The shorter the time frame – The lower the likelihood you’ll make more money

If you have a long time horizon, you probably won’t have to worry about short term fluctuations.

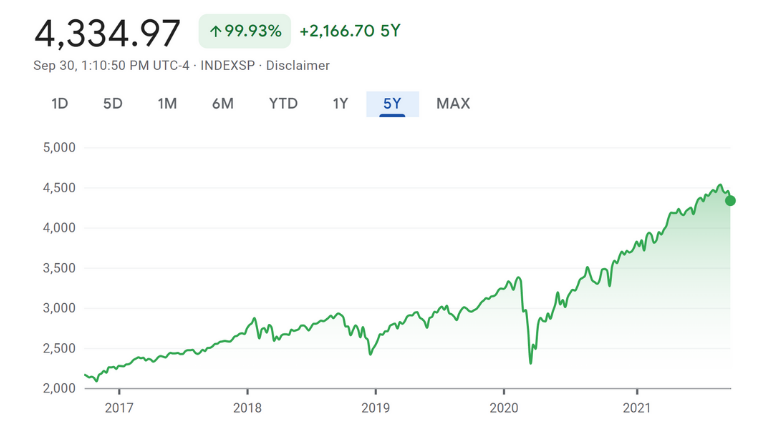

Check out how a short-term fluctuation could give you a little bit of anxiety:

Now check out the long-term view:

If you look at the bigger, longer-term picture, you probably have much less anxiety because the general market trend is up.

So, when you:

- Feel comfortable with market swings – consider investing in more stocks

- Feel queasy with market swings – consider investing in a combination of stocks and bonds

Take some time to really understand your risk tolerance, so you won’t cash out due to fear of losing money when markets are low.

How to Build a Stock Portfolio from Scratch

Creating an investment portfolio from scratch is easy if you follow a step-by-step process.

And that’s exactly what I’m going to show you.

1. Get Expert Advice

There are many ways in which you can build and manage your investment portfolio. So the first step is to get advice from the experts.

Let’s look at a couple of ways to do this.

A. DIY Investing

If you want to set up a stock portfolio on your own, then I highly recommend using incredible resources like Seeking Alpha.

Seeking Alpha helps the everyday investor understand how to create an investment portfolio designed to their specific needs through crowdsourced expert articles.

With crowdsourced articles, you’ll be getting information from people like:

- Industry experts

- Hedge fund managers

- CFAs (Chartered Financial Analysts)

- CPAs (Certified Public Accountants)

- Investment experts around the world

Reading so many viewpoints also helps you in building stock portfolio models.

When you start selecting stocks or index funds, make sure to consider:

- Sector focus

- Company size

- Dividend yield

- Growth potential

- Geographic location

You should also check out Seeking Alpha’s stock ratings for more information on stocks.

Check out the stock ratings for Tesla, for instance:

Under the Rating Summary chart, you’ll see the consolidated information from:

- Experts from Wall Street

- Seeking Alpha expert authors

- Seeking Alpha’s famous Quant algorithm

In fact, over the last 12 years, Seeking Alpha’s Quant algorithm (see Ratings Summary screenshot) beat the S&P 500 every single time.

While portfolio-building might not always be easy, especially when you’re using the DIY approach, you can always use tools like Seeking Alpha to help you make investment decisions on your own.

Recommended Reading: Seeking Alpha Review

B. Financial Advisors

Portfolio-building is more of an art than a science.

That’s why it might make sense to hire a seasoned pro like a financial advisor to help you navigate the markets.

Financial advisors take rigorous classes and pass exams like the:

- CFP (Certified Financial Planner)

- CFA (Chartered Financial Analyst)

If you’re looking for a comprehensive advisor, then consider looking for someone with the CFP(r) designation.

The goal for advisors is to build a comprehensive financial plan around your unique goals.

Financial advisors give you advice on areas like:

- Estate planning

- Risk management

- Planning for retirement

- Tax planning strategies

- Investment management

- Creating a stock portfolio

Oftentimes, however, advisors act more as a psychologist than an investment professional!

That’s because your portfolio of stocks needs to not only make you money but also navigate your psychological concerns when it comes to the stock market.

Financial advisors take payment in 2 ways:

- Fee-only

- Commission-based

Fee-only advisors are my favorite.

That’s because a fee-only structure avoids potential conflicts of interest.

Products that earn advisors a commission could include:

- Annuities

- Insurance products

- Home equity lines of credit

- Some investment products

If advisors earn a commission for every product they sell, then they may not sell you a product that is a “best fit” for your situation.

Instead, they may only sell you a product that is “suitable.”

Choose the client-centric advisor, and not the product-centric advisor.

You can find all of this information by simply scheduling an intro meeting with an advisor (and intro meetings are typically free).

In your first meeting, you can ask the advisor questions like:

- Their experience

- How they are paid

- Their investment philosophy

- Their credentials (CFP, CFA, or other)

C. Robo-Advisors

Robo-advisors create investment portfolios customized to your needs through algorithms.

If you want to automate your investments, then robo-advisors might be the right fit for you.

Strategic portfolio building with robo-advisors comes down to:

- Your data & inputs

- The robo-advisor algorithms

Building stock portfolio decisions using robo-advisors can have both pros and cons, however.

Robo-advisor pros:

- Lower fees

- Tax efficient

- Automatically adjusts your portfolio for you

- You stay in the comfort of your own home

Robo-advisor cons:

- No “human” element

- Not great for day traders

- No comprehensive financial planning

- No personalized investment advice

I’d say the biggest advantage of robo-advisors is that they charge lower fees than the average wealth advisor.

Here’s the difference between fees:

- Robo-advisor fees: ~0.25%

- Real-advisor fees: ~1.00%

A difference of 0.75% can make a BIG difference (we’re talking $100,000’s) over a few decades of investing.

With robo-advisors, you can also create stock portfolio trackers to send you notifications when:

- Stocks hit a certain low point

- Stocks hit a certain high point

So which robo-advisors are the best?

If you’re a beginner investor, then I’d suggest you check out Acorns 👇

Acorns is a robo-advisor app for beginner investors and you can open an account with just $5.

After your $5 investment, there is no minimum investment (so you could invest $0.25 at a time!).

If you’re a more seasoned investor (and if you have a little more cash to start investing), then check out M1 Finance 👇

M1 Finance is a robo-advisor app for intermediate to advanced investors, offering over 6,000 different stocks and ETFs. To open an individual account, you’ll need $100.

2. Determine Your Investing Style

Generally, there are two investing styles:

- Passive investing

- Active investing

Passive Investing

Passive investing is when you buy an asset and plan to hold it for the long term, regardless of market fluctuation.

As a passive investor, you set it and forget it.

The best passive investments for growth include:

- Stocks

- Real estate

- Index funds

Passive investors won’t try to time the market.

They buy and hold.

Active Investing

An active investor is someone who monitors the market on a daily basis, buying and selling assets very often.

Active investors are like day traders: They don’t rest.

Typically, active investors use outside tools like Seeking Alpha to help them make better investment decisions.

Even though I’m a passive investor myself, I use Seeking Alpha as well to stay informed about key market trends and the latest investment insights.

I do not, however, always act on the latest investment insights.

And that’s the concern with active investors:

They may buy on emotion.

Source: Carl Richards

This is the danger of becoming an active investor.

You may allow the media (which often love to post bad news) to control your investment decisions.

However, if you’re a seasoned investor and know what you’re getting yourself into, you could make a lot of money with active investing.

3. Consider Asset Location (Important)

Building a stock portfolio is one of the best appreciating assets you can own.

But to better understand how to create a stock portfolio, you also need to consider your asset location.

Specifically, there are 3 types of investment accounts:

- Taxable

- Tax-Deferred

- Tax-Advantaged

Here’s a breakdown of each type of investment account.

Taxable Investment Account

A taxable investment account is one in which you’re taxed on your contributions AND investment growth, dividends, etc.

In other words, a taxable account gives you no tax break.

On the other hand, tax-advantaged accounts give you a tax break on some of the following:

- Withdrawals

- Contributions

- Investment growth

The type of tax break you get depends on the investment account.

Tax deferred and tax advantaged accounts on the other hand, are investment accounts that offer you tax breaks either when you contribute money or when you withdraw money.

Tax-Deferred Accounts

For tax-deferred accounts (aka traditional accounts), you typically receive a deduction on your tax returns for any contributions you make.

A taxable deduction saves you money in the current tax year.

But, you’ll have to pay taxes on the growth of your investment when you withdraw your money.

Tax-Advantaged Accounts

Tax-advantaged accounts (aka Roth accounts) typically will not tax you on withdrawals of your account. So, you don’t pay taxes on any growth from your investments.

However, with tax-advantaged accounts, you do pay taxes on the contributions you make in the current tax year.

So when should you consider a Roth over a traditional account?

It depends on your current and expected future tax bracket:

Source: Kitces

The reason why you may want to consider a Roth account now is that taxes are at historical lows.

And chances are, tax brackets will go up in the future.

Personally speaking, I only have Roth accounts.

But the decision is a personal one, so you really need to consider your own situation and talk to your accountant.

The good news is that online investment platforms like Acorns offer a variety of accounts such as:

- Roth IRAs

- Traditional IRAs

- Taxable accounts

If you want to access your money penalty-free before retirement, then open a taxable account.

The key is to consider your goals and open an investment account that will work toward your goals (whether they are retirement or non-retirement).

4. Consider Asset Allocation

Asset allocation refers to splitting up your investments among different asset classes.

For example:

- Alternative Assets

- Mutual Funds

- Index Funds

- Stocks

- Bonds

- Cash

- ETFs

You should pay attention to asset allocation because it helps you manage risk and generate your desired return.

Let’s take a deeper look at each of these asset classes.

A. Alternative Assets

Portfolio building doesn’t just have to focus on stocks and bonds.

You can also incorporate alternative assets.

In fact, some financial experts recommend investing 30% of your net worth into alternative investments.

The top assets include:

- Gold

- Farmland

- Fine wine

- Hedge funds

- Rare whiskey

- Rental homes

- Blue-chip art

- Vacation homes

- Sports collectibles

Alternative assets also are some of the best investments to protect against inflation.

That’s because they can outperform a regular portfolio of just stocks and bonds.

In fact, adding just 20% of alternative assets to your regular stock portfolio can increase the returns and simultaneously decrease the volatility.

So get the best of both worlds.

Here’s an illustration that can show this idea in more detail:

With alternatives, your portfolio can be less risky (aka less volatile) and your return can still be higher than if you just had a regular bond and stock portfolio.

If you’re interested in alternative assets, then I highly recommend Yieldstreet which is one of the leading alternative investment platforms.

B. Stocks

To set up a stock portfolio, you should include a number of stocks in your overall allocation.

The ultimate goal with stocks is to sell them later for more money than you originally paid.

And historically speaking, the stock market has always trended upward:

While there will always be an inevitable downturn in the stock market, based on history, the markets will go up – even after a downturn.

If you’re ready to build a stock portfolio, then check out M1 Finance.

M1 is a top robo-advisor that gives you the option to invest in over 6,000 index funds, stocks, and ETFs.

C. Bonds

A bond is when you loan money to a borrower. In exchange, your borrower agrees to repay you 100% of your loan plus interest.

Bonds are less risky than stocks because you are guaranteed a 100% return on your investment PLUS a small interest rate (typically around 3%).

So, always make sure you do your fundamental research first before buying a bond.

Remember that portfolio building is often a balancing act between equities (like stocks) and bonds.

D. Exchange-Traded Funds (ETFs)

Exchange Traded Funds (aka ETFs) are funds that typically track an index (like the S&P 500).

ETFs are similar to stocks but instead of buying just 1 company (as you would with a stock), with 1 ETF, you can gain exposure to 100’s of companies at once (since an ETF is a fund and not a stock).

ETFs often hold multiple:

- Bonds

- Stocks

- Cryptos

- Commodities

ETFs are often great investment vehicles for beginner investors because you get exposure to many different companies with the purchase of just 1 ETF (for example).

Here’s why I like ETFs:

- They are low cost

- They are tax efficient

- They offer diversification

Popular investment platforms like M1 Finance offer over 6,000 ETFs and stocks.

E. Mutual Funds

Mutual funds are similar to ETFs in that they are a collection of investments typically tracking an index.

Mutual funds have many pros such as:

- Diversification

- Professional management

- Automatic income reinvestment

Because mutual funds are managed by professional managers, they typically cost more than ETFs.

On average, the expense ratio (aka the cost to hold a particular fund) is higher with mutual funds than with ETFs because mutual funds are typically managed by a professional team.

And depending on the tax status (taxable versus tax-advantaged/tax-deferred) of the investment account that holds your mutual fund, the mutual fund active management could mean you’ll have to pay taxes.

F. Index Funds

To build an investment portfolio with low expense ratios (aka less money out of your pocket), you should also consider investing in index funds.

An index fund is passively managed and can either be an ETF or a mutual fund that tracks a particular market index.

The most popular type of index fund tracks the S&P 500.

Other popular indices include:

- Russell 2000

- Wilshire 5000

- Nasdaq Composite

- Dow Jones Industrial Average

That’s because an index fund tracks the index.

So, your index fund performance should mirror the performance of the index that it’s tracking.

G. Cash

And finally, if you want to create a stock portfolio that’s diversified, don’t forget to include cash.

It’s recommended to keep around 3% to 5% of cash on hand in your overall portfolio.

The cash will act as “dry powder” for investment opportunities and will help you prepare for a recession.

There are so many account types of cash, such as:

- Money markets

- High yield savings accounts

- Certificates of deposit (aka CDs)

If you want to get the biggest bang for your buck, check out the CIT Bank high yield savings account.

Especially if your investment timeline is short-term (roughly 1 year), then cash would be an appropriate asset.

Asset allocation also helps when building portfolio protection against market volatility.

5. Consider Your Age & Risk Tolerance

If you want to make a stock portfolio, then make sure you consider your age and risk tolerance.

When you’re in your 20s, 30s, or even 40s, you’re young enough to take on more risk by investing in stocks and recovering from investment losses.

That’s because you’ll have time on your side.

As you can see, the earlier you invest, the better off you’ll be for retirement.

On the other hand, if you’ve just retired, then you’re likely looking for assets that carry less risk and that generate income that can recreate your paycheck.

If this is the case, then you might want to invest in:

- Bonds

- Rental properties

- Small businesses

While it’s always good to talk to an investment advisor to help you customize your investment portfolio, there are several portfolio allocation guidelines that can help you construct a stock portfolio.

One such guideline is known as the Rule of 120.

So, if you’re 25 years old, then you’d have 120 minus 25 equals 95% of your money in stocks.

If you’re 15 years old, you’d have 100% of your money in stocks.

While the rule of 120 is just a guideline, it’s also important to consider your own comfort level with taking on risk.

Some common reasons why people invest include:

- Home purchase

- Retirement planning

- Child’s future education

- Self-funding a long-term care event

For example, if your goal is a shorter-term goal (happening within the next 2 to 3 years), you may want to take on less risk.

The key to building a stock portfolio comes down to finding the right balance between the risk you can (and want) to take on and managing your investment return expectations.

6. Choose Suitable Investments for Your Goals

You can create stock portfolio success by better understanding your goals first.

Some overarching goals include:

- Keeping cash

- Portfolio growth

- Preserving your capital

- Producing an income stream

Your goals will determine the types of stocks you include in your portfolio – and in what proportion.

For example, if you want to make an investment portfolio with income generating assets, then you’ll have to do your research and choose suitable investments that produce an income stream like rental real estate.

However, if your goal is to stash cash, then you may want to consider opening a high-yield savings account.

7. Consider Long-Term Investments

Creating an investment portfolio for the long-term means you can afford to take on a little more risk.

Taking on risk means you could:

- Invest in stocks

- Invest in illiquid assets

- Invest in alternative assets

Essentially, you can afford to put a bigger chunk of your money into investment vehicles that can give you a higher return when you retire.

Examples of Long-Term Investments

Some examples of long-term investments include:

- Gold

- Stocks

- Fine art

- Index funds

- Mutual funds

- Individual stocks

- Rental real estate

- Retirement accounts

Remember that portfolio-building comes down to diversification and managing risk appropriately.

Recommended Reading: Best Long-Term Investments

8. Don’t Focus on Short-Term Gains

Setting up a stock portfolio successfully also comes down to focusing on long-term wins rather than short-term gains.

Creating an investment portfolio for the short-term may cause you to:

- Experience volatility

- Sell during down markets

- Become anxious because you’re tracking daily price movements

If you’re investing for the short term (1 to 3 years), it’s better to avoid riskier investments.

Riskier investments could cause you to lose your money and you’ll need time to recover from these losses.

Examples of Short-Term Investments

If you want to build a short-term portfolio, then a portfolio of stocks is not your best bet.

Instead, consider investing in:

- CDs

- Money market accounts

- High yield savings accounts

- Municipal or treasury bond funds

When you’re looking for short-term investments, make sure to find one that offers a high rate of return.

That’s why I highly recommend SaveBetter, which combines the best deals possible with the highest interest rates.

9. Diversify Your Investments

If you’re building an investment portfolio, you need to diversify your investments.

By diversifying, I don’t just mean across different asset classes (like we spoke about before).

Diversification is about how different investments serve different roles in your portfolio.

Your assets should be diversified across:

- Sectors

- Industries

- Geographies

In fact, portfolio stocks are effectively diversified with as few as 30 stocks.

Source: Investopedia

The number of stocks in your stock portfolio depends on:

- Your risk level

- Your overall wealth

- Your investment time horizon

When you spread your money across different investments, you’ll minimize the damage of a potential loss impacting your entire portfolio.

And, diversifying your investments means that you’re building portfolio resilience.

10. Periodically Rebalance Your Stock Portfolio

Building investment portfolio models also means that you’ll have to periodically rebalance your stock portfolio.

Rebalancing your portfolio refers to buying and selling stocks in your portfolio to maintain your original investment allocation.

For example, if you start with a portfolio that’s 80% in stocks and 20% in bonds, then fluctuations in price can cause your initial weighting (so the 80/20) to change over time.

If you’re looking to rebalance your portfolio, then you’ll have to determine which stocks are:

- Overweight

- Underweight

A stock would be overweight if it originally only took up 5% of your portfolio but over time, due to price increases, was worth 7% of your portfolio.

Rebalancing your portfolio is no joke and can take a little time – especially if you’re a beginner.

If you’re not ready to commit that time and energy, then check out M1 Finance.

With M1, you are investing on your own but not by yourself.

M1 offers automatic portfolio rebalancing so you don’t have to worry about spending the time to do that.

Especially if you’ve only had a certain stock for less than 1 year and decide to sell it, you may owe taxes.

Keep reading, because in the next step I’ll go into more depth about lowering your taxes.

11. Don’t Forget About Taxes

When you’re building a stock portfolio, it’s also important to consider taxes.

Think back to Step 3 of this process (asset location).

Asset location refers to the tax status of your investment accounts.

So, you could have the following types of accounts:

- Taxable

- Tax-deferred

- Tax-advantaged

In taxable accounts, you need to consider the tax implications when you make a trade.

The 2 most common types of taxes include:

- Short-term capital gains – Selling a capital asset after owning it for one year or less results in a short-term capital gain. Taxed as ordinary income.

- Long-term capital gains – Selling a capital asset after owning it for more than one-year results in a long-term capital gain. Subject to a tax of 0%, 15%, or 20% (depending on your income).

So, if you’re seeking tax alpha (aka paying less in taxes), the “best” type of tax is capital gains taxes.

With ETFs, you won’t have that issue.

You can also offset gains with losses and vice versa.

So, if you take a $10,000 capital gain and take a $9,000 capital loss, you actually pay for only $1,000 of capital gains.

Even better, if you take a loss in the current year, you can actually offset your ordinary income (like your salary) by up to $3,000 in any single tax year (as of the writing of this article).

These strategies typically refer to a tactic that is called tax loss harvesting.

Tax loss harvesting can be tedious, especially if you’re doing it all on your own.

Just keep in mind that your losses will be disallowed if you sell a stock and replace it with a very similar investment within 30 days before or after that sale.

This is called the “wash sale rule.”

12. Have Your Exit Strategy in Place

Portfolio stocks can be very volatile, so you can’t just let your emotions control when you buy and sell.

That’s where your stock exit strategy comes into play.

Typically, that criteria is already in place before the investor buys the stock.

Some common criteria to trigger an exit include:

- New company leadership

- The company missing earnings estimates

- The stock reaching a target price (high or low)

A stock exit strategy will help you avoid selling (or buying) out of emotion like fear.

Emotional investors often fail in the long term.

That’s why building portfolio models that are successful means you’ll need your exit strategy too.

Stock Portfolio Examples

Building portfolio resilience starts by diversifying your investments.

Here are some stock portfolio examples and how they look, based on their risk allocation.

Aggressive Portfolio

An aggressive portfolio is often ideal for:

- Someone younger

- Someone with a high risk tolerance

- Someone with a long time horizon (15+ years)

Here’s an example of an aggressive investment portfolio:

Moderate Portfolio

A moderate portfolio, on the other hand, might be ideal for:

- Someone approaching retirement

- Someone with a lower risk tolerance

- Someone who has a medium time horizon (5 to 10 years)

Here’s a look at a typical moderate portfolio construction:

Conservative Portfolio

And finally, a conservative portfolio might be ideal for:

- Someone who is in retirement

- Someone who is looking to generate income

- Someone who doesn’t want to lose their money

Here’s an example of a conservative portfolio:

The best type of stock portfolio allocation depends on you and your personal situation.

That’s why it might help to talk to a financial advisor, to help guide the conversation.

FAQs

How much money do you need for a stock portfolio?

You can start building a stock portfolio for as little as $5. However, you’ll start to see a big difference the more money you invest. The key is making regular contributions to your stock portfolio and staying invested for the long term.

What is a good stock portfolio?

A good stock portfolio depends on how well-diversified it is. This means you are invested across multiple sectors, industries, and companies for example. A diversified portfolio lowers volatility and mitigates the impact of a loss in one particular stock.

What is the best way to build a portfolio?

First, understand your risk tolerance and your goals. Second, determine whether you want to invest in taxable or tax-advantaged accounts. Third, diversify your portfolio. Fourth, monitor your investments.

What is the ideal portfolio mix?

The ideal portfolio mix takes into account your own goals, situation, and what you want to accomplish with your invested money. For many who are in their 20’s, a portfolio with 90% stocks and 10% bonds might work. For those nearing retirement, a portfolio with 60% stocks and 40% bonds may do the trick.

The Bottom Line: Anyone can Build a Stock Portfolio

Building a stock portfolio might sound like A LOT of work, but if you follow this step-by-step guide, you’ll find it a lot easier.

Regardless of whether you’re looking to invest your first $100 or your first $1,000, building a stock portfolio now can pay you in dividends (no pun intended!) in the future.

Now it’s your turn:

What elements of building a stock portfolio did I miss?

Let me know in the comments section below.