Best Budgeting Tips and Tricks

Key Takeaways

- Automate your savings and investment strategies

- Consistently track and review your actual budget

- Always, always aim to spend less than you earn

Free Budgeting Templates

Sign up below to receive my free budgeting templates and my latest content updates.

I remembered a success story – from a client of mine – that I think everyone should live by.

It was the story of a 50-year-old man. He lived in a trailer park in a small town in New Jersey.

This man:

- Retired at 45

- Had over a $1.5 million net worth

- Lived like he had a negative net worth

How did he manage to amass more than $1.5 million in net worth?

When I asked him this question, after the first meeting, he mentioned he followed his father’s money budgeting tips and lived like he earned only $10,000, when in reality he was earning $60,000.

During his life, this man:

- Couponed

- Lived a frugal life

- Meticulously tracked his budget

- Invested and saved every cent he had

- Never touched his investments, letting that money grow

And now?

Thanks to following his dad’s simple budgeting tips and consistently following that budgeting advice, he’s retired, living debt-free, and essentially is a multi-millionaire.

Let’s check out some of the best budgeting tips that this man lived by and a few other money budgeting tips that anyone can implement successfully.

But first, let’s answer the question below.

Why is Budgeting Important?

Budgeting is the art of crafting a spending plan for the money you earn so that you have enough cash to pay for the things you need and want.

Sticking to a budget will give you the financial freedom to pay off debt, stay out of debt and work toward your long-term financial goals.

“A budget gives you freedom.”

In other words, a budget gives you control and oversight over your income and spending.

Let’s check out a few other benefits of budgeting:

- Organization

- Control over your money

- Eye-opener to your current spending

- Guides you to your long-term financial goals

- Helps you avoid spending on things you don’t need

Now that you’ve explored the budgeting benefits, let’s actually review some of those budgeting tips we were discussing earlier.

The simple budgeting tips and tricks below will make your life easier and will help you move 1 step closer toward the ultimate prize: Financial freedom.

Best Budgeting Tools

If you have not started a budget yet, then I highly encourage you to take a look at these 2 budgeting software applications.

When you see your income and expenses neatly laid out before you – it can be a game changer.

Best Budgeting App for Beginners: Simplifi

Simplifi is an entirely new personal finance app designed for mobile phones and is available to use on IOS, Android, and web platforms.

Simplifi’s designed to help you easily stay on top of your finances and reach your financial goals with confidence!

Best Budgeting Platform: Quicken

For the advanced budgeter: No other personal financial management application offers the depth and breadth of tools found in Quicken.

It’s the best-selling personal finance software in the US and has helped over 17 million customers take control of their finances.

7 Best Budgeting Tips and Tricks

To grow our wealth, we need to stay on top of our finances.

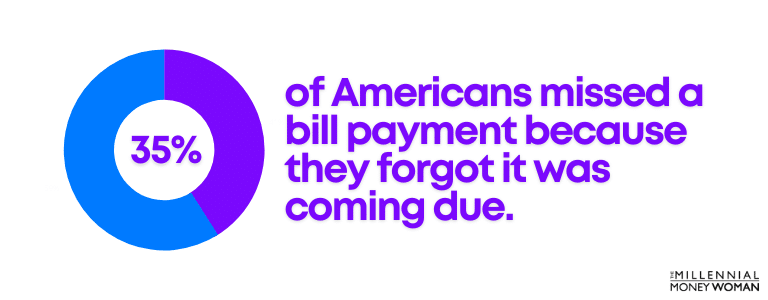

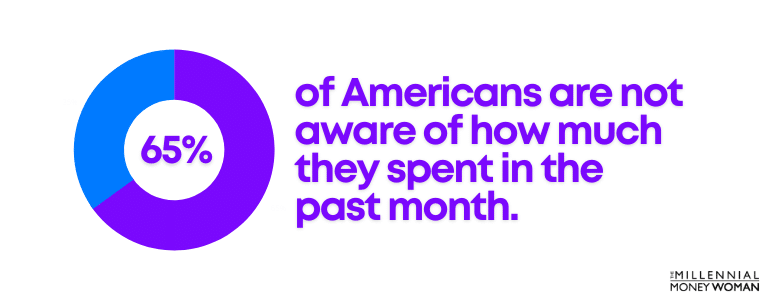

Ideally, we should know exactly how much we spend at the end of every month.

Image: The Millennial Money Woman | Source: Mint

However, studies reveal that 35% of Americans missed a bill payment just because they forgot it was coming due. Yikes.

Let’s see which money budgeting tips below could help you save the most money and make your life easier.

Budgeting Tip #1: Automate Saving/Investing

One of the best budgeting tips is to automate your savings and investing plan.

This means: Pay yourself first – before you spend your income on any other bills. You owe it to yourself.

“Out of sight, out of mind.”

If you don’t actively think about saving or investing – if you automate these processes – then chances are, you won’t feel that “pain” of seeing your money go toward your savings or investment plans. You’re investing and saving consistently.

If you’re looking to automate your investments on a small-scale, I’d suggest to start your investment journey with Acorns.

Acorns is a micro-investing platform that gives you the chance to build your wealth – without having to invest $1,000’s or even $100’s (you can start with as small as a $5 investment).

And if there’s one thing I learned: Consistency is key to building your wealth over time.

Budgeting Tip #2: Spend Less than you Earn

Ok, I’m going to expose my inner nerd: Who here has watched Star Trek and knows about Spock?

For those of you who don’t know Spock: He is a Vulcan, which is a species that is known to be logical and without emotion.

If you were Spock, and didn’t have emotion, it would be easy for you to simply spend less than you earn.

“However, we’re not Spock and humans are very emotional beings, which is a major reason why we often spend more than we earn.”

This is where following my personal budgeting tips will come into play: Don’t spend money on stuff you don’t need.

This “stuff” includes:

- Fancy clothing

- Excessive vacations

- Fancy, schmancy cars

- Eating out – way too often

You don’t need any of that “stuff” to live a normal life.

Why not tone your expenses down a notch or two?

Use that “saved” money for:

- Paying off debt

- Investing and saving for retirement

- Building up your emergency savings fund

If you’re used to spending money on fancy things, it’s not going to be easy to dial back the spending – because you’ve likely made that spending pattern a habit.

This is where a budgeting app like Simplifi can massively help you, by visually laying out how much you spend, how much you earn and where you can slash costs.

It will take time. But stick to your plan!

Budgeting Tip #3: Make Budgeting a Habit

Have you ever played a sport? Were you one of the best in your category?

Now I want you to think about this: What did you do to become one of the best – if not the best in your category?

Chances are, one of your answers will involve the concept of consistent practice – unless of course you’re a child prodigy.

The same idea [practice] applies to your budgeting journey.

“Perfect budgeting practice makes perfect.”

That means the following:

- Push yourself to budget

- Consistently track your income and expenses

- Try to find ways to improve your current budgeting practices

- Discuss how to improve your budgeting techniques with friends

The hardest step is beginning to budget.

The best step is to continue budgeting – and never stopping.

Keep this in mind: It takes about 2 months to develop an automatic behavior.

That means you’ll have to practice your budgeting game for roughly 2 months, until budgeting becomes second nature.

Go get ‘em!

Budgeting Tip #4: Cash Only Budget

In my opinion, a cash only budget is another key to success if you follow my simple budgeting tips.

That means no:

- Checks

- Debit cards

- Credit cards

Why should you stick to a cash only budget?

Because psychologically speaking, it’s easier to stick to a cash budget because you’ll physically see the cash leaving your hands as you spend down your monthly “budget allowance.”

“The cash only budgeting method is a great strategy for those who are trying to get out of credit card debt.”

The great part about the Cash Only Method?

Once you’re out of cash for the month – you’re done with spending.

Moral of the story: Instead of reaching for your checkbook, credit or debit card – switch to spending just cash for a few months until you come into the habit of spending what your monthly budget allows.

Physically seeing that crispy dollar bill leaving your possession and into the hands of someone else hurts… it’s not fun… and it will prevent you from spending too much.

Budgeting Tip #5: Avoid Credit Cards

This is probably the best advice I’ve received: Trust yourself before you spend yourself.

In other words, make sure you trust yourself with credit cards before spending money on useless stuff and getting stuck knee-deep in debt.

That’s when you practice discipline and self-control.

“Credit Cards are like a double-edged sword.”

You have easy access with a credit card but at the same time, credit cards make it so easy to go over budget and spend.

Why?

Because you don’t actually see how much money is leaving your hands after every purchase (unlike the cash only budgeting method, which I described in step 4).

Budgeting Tip #6: Divide your Monthly Income Per Day

So let’s say you aren’t paid weekly or bi-weekly. Instead, you are paid monthly.

The awesome part?

- You see a fat balance deposited into your bank account each month

The not-so-awesome part?

- It gets pretty rough trying to budget out your month with only 1 monthly deposit

So what do you do if you’re paid monthly?

“Divide your monthly income by the number of days in the month to set a daily spending cap.”

You’ll have those necessary expenses you will have to get out of the way first:

- Monthly rent

- Monthly utilities

- Monthly car loan

- Monthly student debt payments

And here’s what I mean when I say give yourself a daily spending cap: After having paid off these major monthly expenses, only then do you calculate your daily spending cap.

The daily spending cap could apply to some of the following expenses:

- Entertainment

- Groceries

- Supplies

- Travel

To win with these money budgeting tips, though, you have to stay consistent.

Remind yourself of your goals every morning when you wake up: If it’s to pay off your credit card debt, or saving $20,000 this year toward retirement – whatever your goal is.

Stick to these personal budgeting tips and tricks – your consistency will pay off.

Budgeting Tip #7: Living on Commission Income

Living off of a commission can be pretty sweet.

Examples of careers that offer commissions include:

- Some financial services agents

- Some real estate agents

- Some insurance brokers

- Most sales positions

- Some travel agents

When is living off of commission scary?

- As you start out and build your career

- You essentially are paid minimum wage and work the longest hours

When is living off of commission the best?

- After having established rapport and trust in the community

- After building a network of referrals and contacts

- After building a stream of recurring income

Typically, making a good living off of a commission-based income takes time, since you’re building new relationships.

And to build effective relationships (personal or professional, as is the case here), it just takes time.

Ok, so let’s say you have a pretty awesome commission job.

How do you budget for the unexpected, lump-sum income over the year?

“If you’re living on commission, front load your savings goal. Save up to 30% of expected income for savings and investments.”

What do I mean by front-load your savings goal?

That means as the beginning of the year rolls around – aggressively save your money. Live on as little as possible.

Once that goal of 30% saved is accomplished, then you can start living a bit more lavishly.

Work off of the lowest-earning month and by using that baseline for budgeting your expenses, chances are, you’ll be playing the game a bit conservatively.

“However, a conservative player can win big in the game of finance.”

Trust this simple budgeting tip if you’re on a commission-based income – it will pay you back in dividends (no pun intended).

If you’re paid on a commission basis, chances are, you’ll be responsible to pay your own taxes – unless the taxes are taken out of your commission prior to seeing that check in your bank account (which rarely is the case).

If you do open savings accounts to hold your tax bills, house bills, etc. I’d suggest to look into opening a high yield savings account, like with CIT Bank.

Closing Thoughts

A budget is not scary. It’s not difficult. And it certainly shouldn’t be put “on hold” simply because you’re trying to avoid looking the problem in the eye: Your spending.

“A budget is a tool for your millionaire toolkit.”

And trust me, if my client from the trailer park in New Jersey could save and invest to earn a net worth of over $1.5 million, then you can absolutely do the same.

All it took him (and all it should take you) is consistently following these simple budgeting tips and discipline.

Let me tell you what budgeting doesn’t require:

- Ingenuity

- Talent

- Skill

Following (and sticking to) my money budgeting tips and tricks should be the foundation for what you need to become another success story like my client.

Trust me, it’s not easy to follow a budget – especially if you’ve never set one up for yourself, before.

You’re not alone, though.

Image: The Millennial Money Woman | Source: Mint

Following my money budgeting tips above will boost your confidence and will hopefully help you take one step closer to becoming a millionaire.

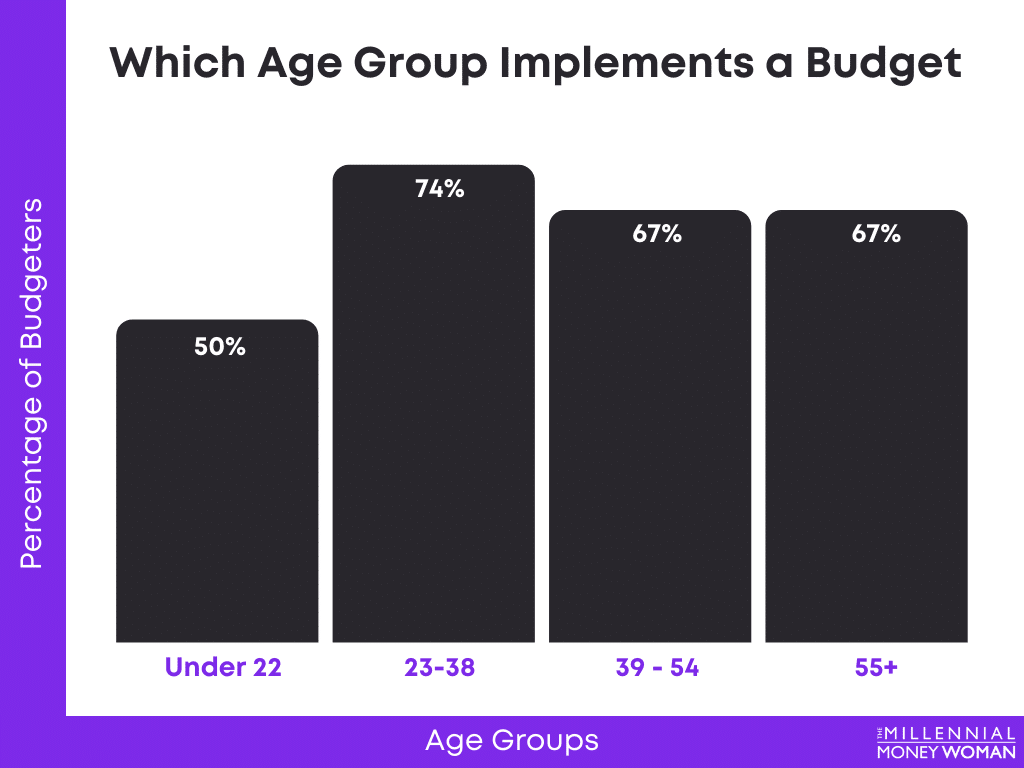

Before I end this post, though, I wanted to leave on a high note: Millennials are the most likely generation to follow a budget. Check out the chart, below.

Image: The Millennial Money Woman | Source: Debt.com

A budget is worth your time and effort and following my simple budgeting tips, downloading Simplifi or simply tracking your expenses in an Excel spreadsheet will make your life a lot easier.

Your bank accounts will thank me later!

What other budgeting tips would you add?

Related: 5 Best Money Saving Tips

Related: Holiday Budgeting Tips