Building generational wealth is difficult. It’s a process that requires hard work, patience, and sacrifice.

But luckily, there are plenty of opportunities. All it requires is a roadmap.

And that’s exactly what you’ll find in this post.

You’ll discover:

- What Generational Wealth Means

- Why Generational Wealth is Important

- How to Build Generational Wealth

- How to Pass on Generational Wealth

Let’s get started.

What is Generational Wealth?

Generational wealth occurs when assets are passed down to your heirs. These assets typically include investments, family businesses, jewelry, property, etc. A key to maintaining intra-generational wealth depends on how well you prepare your heirs to manage this newfound wealth.

Why is Generational Wealth Important?

Generational wealth is important because it gives you the freedom of choice. You can live and not worry about debt, working a job you hate, or affording the rent. The key to maintaining intra-generational wealth is understanding how to manage the inheritance.

How to Build Generational Wealth

The formula for building generational wealth is simple: Spend less than you earn, save and invest.

If you want to leave a lasting legacy, then continue reading because I’m going to show you exactly how to build generational wealth.

1. Invest in Your Children

The key to building generational wealth is investing in your child’s financial education.

Why?

Because a whopping 70% of intra-family wealth transfers fail.

Source: FPA

The reason why wealth transfers fail is because of a lack of communication with heirs.

That’s why it’s critical to start investing in your kids from an early age.

Start by teaching your money skills such as:

- How to save

- How to invest

- How to spend wisely

- How to work for your money

These skills can be taught to kids at any age with the Greenlight Debit Card.

Investing in your kids can pay dividends.

Start now and you’ll thank me later.

2. Invest in the Stock Market

What is the main source of wealth creation in America?

The answer is investing in the stock market.

In fact, nearly 70% of the wealth gains made in the last 1.5 years by the ultra-wealthy came from the stock market.

Source: CNBC

When it comes to stocks, I’d suggest buying stocks that are high quality and undervalued.

Here’s Elon Musk’s advice on buying stocks:

"Buy stocks in companies that make products and services that you believe in."

If you need expert advice in picking the right stocks, then check out Seeking Alpha.

With Seeking Alpha, you’ll have access to:

- Instant stock news and updates

- Latest quantitative stock reports

- Professional opinions and insights

…But what if you find picking stocks too time-consuming and want a more passive approach to investing?

In that case, investing in low-cost index funds is a great place to start.

Index funds offer long-term growth and are relatively cheap when compared to other investment options.

I am a big believer in index funds because they are:

- Diverse

- Passive

- Low cost

- Easy to manage

If your goal is to create generational wealth, then investing in the stock market is a great option because of the long-term growth.

3. Invest in Real Estate

Investing in real estate is one of the most common ways to build wealth.

In fact, 90% of millionaires got their wealth by investing in real estate.

So why real estate?

It comes down to 2 reasons:

- Rental income – Cash flow from rent

- Appreciation – Property value increases over time

Not only would you make money in your sleep through rental income, but you would also build wealth with the increasing home values.

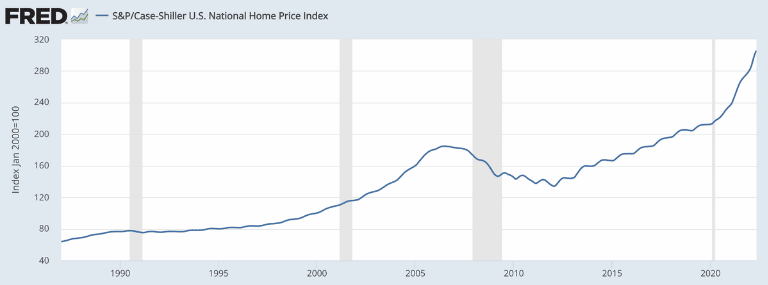

Source: FRED

The chart above illustrates how home prices have increased over time.

So how do you get started with real estate investing?

You can start investing in real estate through crowdfunding platforms.

And one of the best – and most popular – real estate crowdfunding platforms is Fundrise.

Fundrise is a great option if you want to:

- Diversify your portfolio

- Earn a passive income stream

- Protect your investments during a recession

- Invest in real estate without putting in the hard work

What I like most about Fundrise is that you can start investing with just $10, while most real estate investment deals start with minimums of $5,000+.

Recommended Reading: Fundrise Review

4. Build a Business

If you really want to maximize your chances of creating generational wealth, you should build your own business.

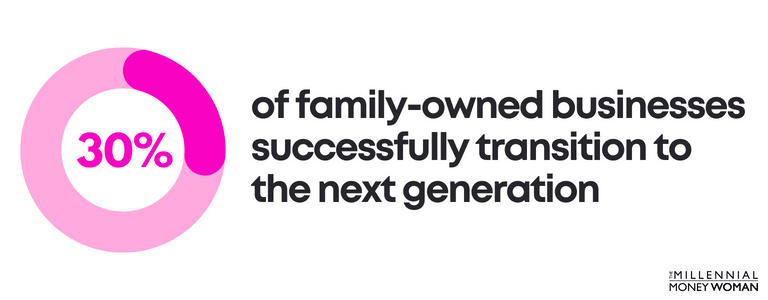

And, family-owned businesses do have the potential for success, as more than 30% have successfully transitioned to the second generation.

Source: Family Business Center

As long as you communicate your values and your abilities with the next generation, there is a pretty high chance that your business will pass onward.

Building a business takes a lot of time and effort (and patience!), so don’t expect to see results immediately.

As long as you keep an open line of communication with your kids, then a family business could be one of the best ways to create generational wealth.

5. Invest in Life Insurance

A top generational wealth building strategy is buying life insurance.

While life insurance has a bad reputation, it’s necessary to leave behind a legacy.

Here’s why life insurance is critical to your wealth plan:

I like life insurance because the death benefit (which is tax-free) protects your family in the case of an untimely death.

Life insurance protects your:

- Income

- Lifestyle

- Debt obligations

To qualify for life insurance, you need to go through what’s known as “underwriting.”

In other words, you’ll have to undergo medical tests by the insurance company to confirm you’re not just buying life insurance now because you have a terminal disease and will pass away in the near future.

It has to be legit.

And, the younger you are, the less chance of you being unhealthy.

Out of all life insurance types, term life is the:

- Simplest

- Cheapest

- Most straight-forward

So how do you get started with term life insurance?

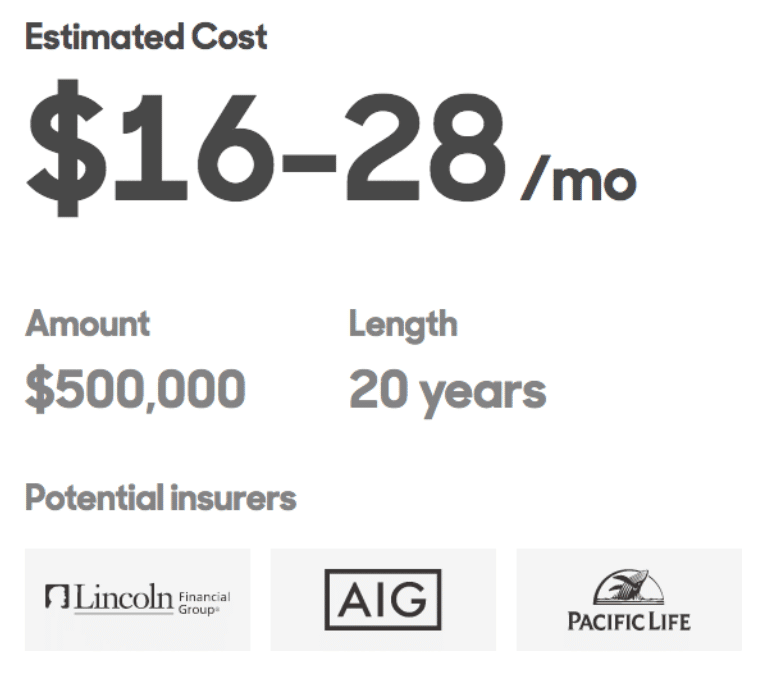

The process is very simple. You can start by getting a free quote from Policygenius to see how much a $500,000 death benefit 20-year term life policy might cost you.

Here are the parameters I ran for myself:

Spending $16 to $28 per month ($192 to $336 per year) on a $500,000 death benefit and 20-year policy is worth the money to me.

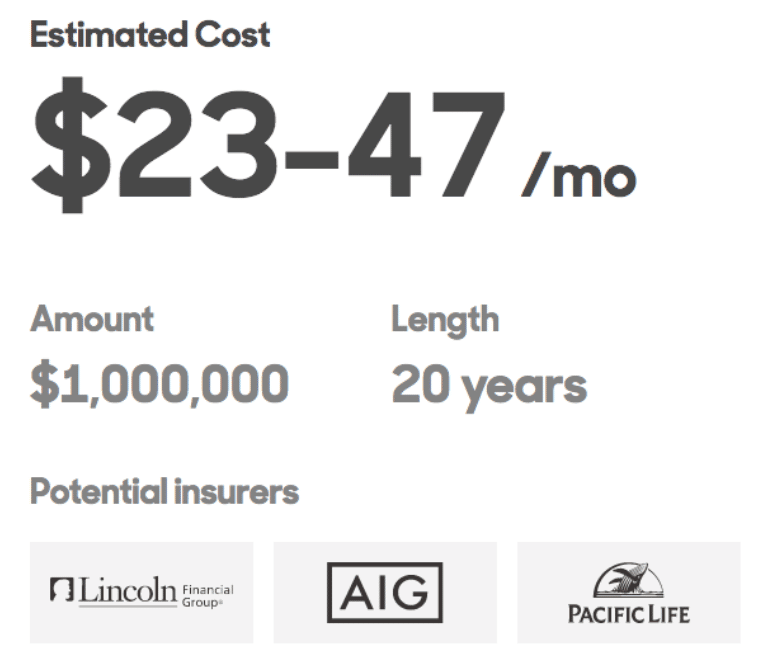

What about a $1 million dollar life insurance policy?

Spending $276 to $564 per year on a $1 million term life policy is certainly worth it to me.

If you pass away in the 20-year term, your heirs receive the money.

If you live past the 20-year term, the life insurance expires – but you get to live!

It’s a win-win.

Ready to protect your family’s generational wealth?

Start by running a free quote with Policygenius.

The team of experts at Policygenius is on hand to guide you through the application process step by step.

Related: How Much Life Insurance do I Need?

6. Create Multiple Streams of Income

If the pandemic taught us anything, it’s that your full-time job is never guaranteed.

That’s why it’s critical to create multiple streams of income if you want to start building generational wealth.

Multiple streams of income are a form of self-care.

In fact, Do you know how many income streams the average millionaire has?

The answer is 7!

So why build multiple streams of income?

It’s called diversification.

Remember the saying “don’t put all your eggs in one basket?”

The same goes for your income streams – don’t just rely on your full-time job to supplement your income, because you could be fired in an instant.

Below are some income stream examples:

- Dividend Income – Income from stocks

- Rental Income – Income from rental real estate

- Earned Income – Income from jobs/side hustles

- Royalties – Royalties from books, inventions, etc.

- Business Income – Income from business profits

- Interest Income – Income from savings accounts, bonds, etc.

- Capital Gains – Capital gains from selling highly appreciated assets

Start investing in passive income streams today to build generational wealth tomorrow.

7. Pay Yourself First

If you want to take care of your family by building generational wealth, then you actually have to take care of yourself first.

It’s that simple.

Here’s how:

- Invest in your IRA or 401(k)

- Pay off all high-interest debt

- Build an emergency savings fund

- Invest the second you get your paycheck

The trick to creating generational wealth is to invest your money before you even have the chance to spend it.

It’s called out of sight, out of mind.

Automating your investments is key to building long term wealth.

8. Invest in Appreciating Assets

Did you know that Warren Buffett, Michael Jordan, and the millionaire next door have something in common?

They all invest in appreciating assets.

In fact, if you want to create generational wealth, investing in appreciating assets is a must.

You can join the ranks of the top 1% by investing in appreciating assets if you:

- Are consistently investing

- Stay focused on the long-term

- Don’t withdraw your investment in the short-term

Remember: Building generational wealth is a long term game.

Here are some of my favorite appreciating assets:

- Fine wine

- Farmland

- Blue-chip art

- Private real estate

The earlier you start building your wealth, the greater your fortunes will be.

9. Pay Off Bad Debt

You cannot build generational wealth if you have bad debt.

But what exactly is bad debt?

Bad debt has a variable and high, typically over 10%, interest rate. Bad debt also refers to debt on depreciating assets.

Here are some of the most common examples of bad debt:

- Auto loans

- Payday loans

- Credit card debt

- Loan shark deals

Paying off bad debt first before you start investing can be critical because it can:

- Reduce stress in your life

- Improve your credit score

- Increase your future investments

- Help you gain financial independence

- Set you as a great role model for your kids

- Give you pride to take control of your finances

Paying off debt will also require you to start budgeting, trim excess spending, and use your savings to pay off debt.

Once you have paid off your debt, it’s time to stash extra cash in an emergency savings account before you start investing.

In theory, paying off debt is straightforward but in practice, it can be a little more difficult.

Related: How to Get Out of Debt Fast

How to Pass on Generational Wealth

Now that you know how to create generational wealth, it’s time to create a plan of action to pass on your wealth to your heirs.

Here’s exactly what you need to do to ensure a smooth transition to the next generation:

1. Create a Solid Estate Plan

Creating an estate plan is one of the best things you can do to protect your family.

But what is an estate plan?

An estate plan is a complete set of documents where you plan the transfer of assets upon your death. The goal of an estate plan is to preserve your wealth.

Estate plans come in all different shapes and sizes.

The most common types of estate planning documents include:

- Wills

- Revocable Trusts

- Irrevocable Trusts

- Beneficiary designations

- Durable power of attorney

- Guardianship designations

- Healthcare power of attorney

While trusts may be for more complicated estates, you should really consider drafting the remaining documents.

Why?

Because when you pass, without any estate planning documents in place, all of your assets will be distributed by the government, and your assets may not be distributed as you wish.

That’s why it’s SO important to update your estate documents regularly.

With that said, you can start creating your estate plan with companies such as Trust & Will 👇

At Trust & Will, their top goal is to make the process of setting up your will, trust, or nomination of guardianship as simple and straightforward as possible.

- They are rated 4.9 out of 5 stars on Trustpilot

- They’ve got something for everyone and plans start at $39

- Get a complete and customized Estate Plan online in about 15 minutes

By giving attention to your future and your children or your beneficiaries’ future, you can live more in the present because you know no matter what, your finances are in order and in proper alignment with your desires.

That means your children, pets, assets, future, and legacy will be handled the way you want.

Make sure your family is protected. Learn more about Trust & Will today.

2. Draft a Will

Anyone – regardless of their wealth – should draft a Will.

A Will is a part of your overall estate plan that details how – and to whom – you wish to distribute your assets when you pass away.

Here’s why a Will is a great tool to have:

- Help your family locate your assets

- Provide specific instructions for your last wishes

- Designate a trusted person to handle your estate

- Communicate your wishes regarding your children’s care

The good news is that simple Wills typically don’t cost a lot of money – and you can often draft them online.

That’s why I recommend Trust & Will.

In just 10 minutes’ time, you can finalize your Will.

When your loved ones are in a time of distress and sadness, a Will can provide some relief.

The main point: Draft a Will now – don’t wait.

3. Introduce Your Kids to Your Wealth Manager

While it might not make sense to your kids, it’s a good idea to introduce your future heirs to your financial professional network.

Make sure to introduce your kids to:

- Your wealth manager

- Your accountant / CPA

- Your estate planning attorney

When that terrible time comes, at least your heirs will know exactly who to contact because you’ve made sure to establish that relationship beforehand.

This simple strategy will save a lot of stress.

4. Fund Custodial Accounts or 529 Plans

A key to building generational wealth and passing it down is investing early for your kids’ education.

One way to build such a legacy is by investing in:

- Custodial Accounts

- 529 Plans

Both of these accounts can help you fund your kids’ future endeavors (especially when it comes to education), while still retaining some control over their money.

#1: Custodial Accounts

The first account type is the custodial account.

A custodial account is an investment account for the benefit of your kids. However, you can control this account until your kids are either 18 or 21 (depends on the state you live in).

Custodial accounts are often called UTMAs (Unified Transfers to Minors Act) or UGMAs (Unified Gifts to Minors Act).

A custodial account doesn’t just hold stocks and bonds – it can also hold real estate, or fine art for example!

The downside of custodial accounts?

Once they turn 18, your kids will have to pay taxes on dividends, interest, earnings, and likely on withdrawals from the custodial account.

If you’re interested in opening a custodial account, then I recommend checking out uNest.

#2: 529 Plans

The second account type is the 529 Plan.

A 529 Plan is a tax-advantaged college savings plan. You can set up an account for yourself, your child or even your niece and nephew.

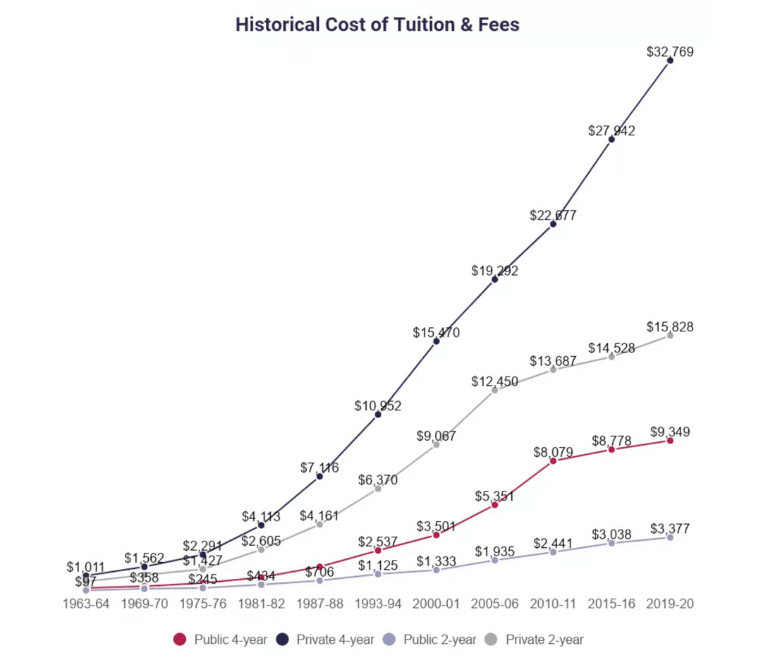

Investing for your child’s education is likely one of the best things you can do, as the cost of tuition has increased significantly:

Source: Education Data

A 529 Plan can help your child avoid student debt, which can significantly move them ahead in life.

If you want to build a legacy – then one of the easiest places to start is your child’s education.

5. Name Beneficiaries for Your Accounts

An easy way to control your money from the grave is by simply naming your intended beneficiaries on each of your accounts.

These accounts could include:

- IRAs

- 401(k)s

- Annuities

- Life insurance

- Cryptocurrency

- Checking and Savings

- Real estate partnerships

Take the time to review your assets and the beneficiaries that are listed on each asset.

That way, if your primary beneficiary predeceases you, you can still ensure your money goes to the next beneficiary: The contingent.

When you pass away, your beneficiaries should receive your assets without any glitches (knock on wood!).

6. Review Your Estate Plan and Beneficiaries Annually

Life will probably throw you a bunch of curveballs.

For example:

- You might get divorced

- A beneficiary may pass away

- You may have a falling out with a beneficiary

If these life changes happen, it’s very important to update your beneficiaries on your assets – from your life insurance to your Will.

That’s why it’s critical to set aside some time every year to review your estate plan and your beneficiaries with your estate planning attorney, your wealth advisor, etc.

You want to ensure your money goes to the people you want it to when you pass away.

7. Teach Your Kids About Personal Finance

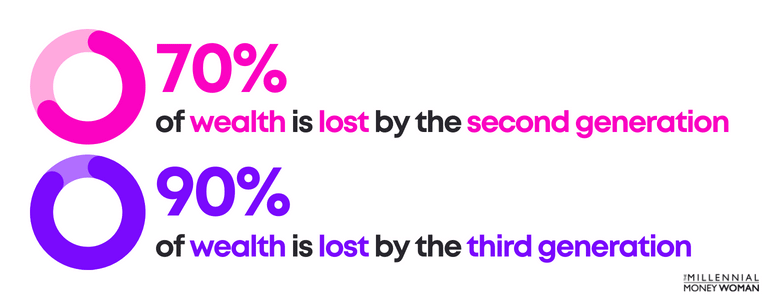

Did you know that 70% of wealth is lost by the second generation?

And 90% of wealth is lost by the third generation?

Source: Yahoo Finance

These statistics are shocking – especially seeing that 90% of your wealth could be lost completely by the third generation.

Yikes.

And it all comes down to a lack of communication.

If you intend to create and keep generational wealth, you need to talk to your heirs.

Here are some topics to discuss:

- Your values

- What wealth means to you

- How you gained your wealth

- Financial planning strategies for your heirs

- What you would like your heirs to do with your money

Sometimes, however, your heirs may be resistant to your advice and your suggestions.

However, even before you consider passing wealth along to your heirs, you should consider teaching your kids about personal finance.

And one of the best platforms that can teach your kids about finance is Greenlight 👇

The Greenlight App gives parents the ability to teach kids – hands-on – how to:

- Save

- Invest

- Manage money

- Give money to charity

- Be responsible with money

Greenlight is a debit card for kids coupled with a phone app that can be installed on both the parent and child phones.

Parents can then set spending controls or parents could incentivize their kids to save money or even do chores!

If you want to start creating generational wealth and ensure your money stays in your family for many generations to come, then Greenlight can teach your kids how to handle money from an early age.

FAQs

Do I have generational wealth?

As long as you can pass down your wealth to future generations, you have generational wealth. If you want to maximize the amount of money you pass down, you should start building generational wealth now by eliminating debt, building multiple income streams, and investing in appreciating assets.

What amount is generational wealth?

The next few decades will see the largest wealth transfer in America’s history, with about $68 trillion being transferred to Generation Xers, Millennials, and charities. However, on average, an American family passes around $50,000 down to younger generations.

How many generations does generational wealth last?

Sadly, if you don’t prepare your heirs for an inheritance, generational wealth will not last long. In fact, up to 60% of generational wealth transfers fail due to a lack of communication. Shockingly, 70% of wealth is lost by the second generation and 90% of wealth is lost by the third generation.

What is generational wealth gap?

The generational wealth gap refers to the amount of wealth in one generation over the wealth in another generation. To build your wealth, start by investing in appreciating assets, in multiple income streams, and consider building your own business.

How is generational wealth transferred?

Generational wealth can be transferred in several ways. One tax-free way would be through the death benefit of a life insurance policy. Another way would be by gifting assets such as business interests, real estate, or simply cash to your beneficiaries.

What generation holds the most wealth?

Baby Boomers hold the most wealth compared to any other generation. In fact, the pandemic saw Baby Boomers’ wealth increase by $71 trillion. Unfortunately, Millennials have much less wealth than any other generation did at the same age.

Closing Thoughts

Building wealth for your future generations will take time, hard work, and lots of patience.

Before you even start thinking about building generational wealth, you need to think about yourself first:

- Are you following a budget?

- Have you paid off all bad debt?

- Do you have an emergency savings fund?

Think of building generational wealth like when you’re in an airplane:

You have to put the air mask on yourself first and then help out your kids.

The same thing works for building generational wealth.

Your bank accounts will thank me later.

Now I’d like to hear from you:

What generational wealth building strategies are you going to try?

Maybe it’s investing in your child’s education, or maybe it’s investing in appreciating assets.

Either way, let me know in the comments section below!