Today I’m going to show you how to invest in a small business.

The best part about investing in small businesses?

You can receive quarterly passive income from the business’s revenue. As they grow, so does your return.

Let’s dive in.

What is Small Business Investing?

Small business investing involves investors contributing funds to a small business with high growth potential through either debt or equity investing, or a combination of both.

The goal is to earn returns through either a percent of profits from business revenue or from repayment of principal and interest on loans.

Want to Make More Money?

Join 30,000+ others who receive my weekly newsletter, where I share the secrets to creating modern wealth 👇

What Types of Investments Can You Make in Small Businesses?

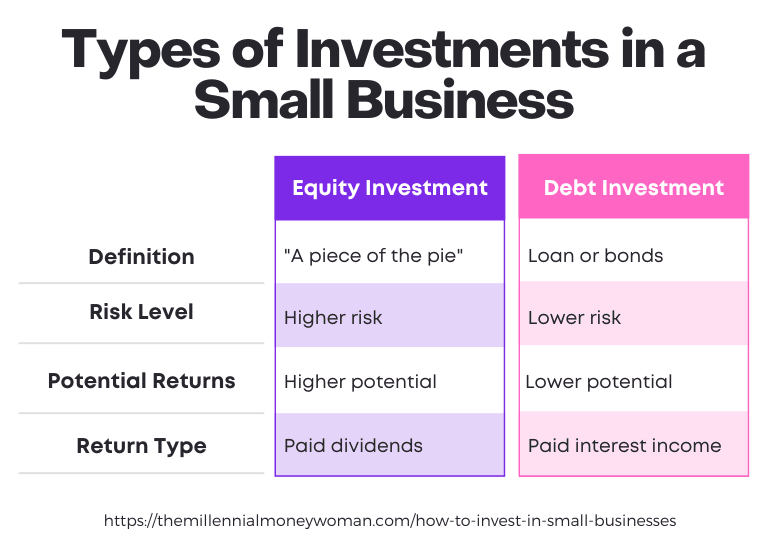

There are 2 main types of small business investment opportunities:

- Equity investment

- Debt investment

There are also additional, lesser-known investments as well:

- Sweat equity investment

- Equity-debt hybrid investment

Here’s a breakdown of each type of investment.

1. Equity Investment

One of the most well-known investment opportunities for businesses is equity investing.

Equity investing is the riskiest investment in business opportunities.

In turn, this ownership gives you the right to a percentage of the profits.

The percentage of profits is typically equivalent to the percentage of the share you hold in the company.

Here’s the best part:

As the business grows, the value of your shares will also gain value over time, which could help you build wealth.

2. Sweat Equity Investment

If you’re thinking that the only way to invest money in business is through equity investing – think again.

Investing in small companies doesn’t just have to depend on investing physical cash.

In fact, to invest in a local business you can also use what is known as sweat equity.

Essentially, sweat equity is the unpaid work and time that you’re giving to a small business in exchange for a potential future profit.

3. Debt Investment

If you’re wondering how to invest in a small business that doesn’t involve an equity investment, here’s your answer: Debt investing.

The loan will typically be repaid in installments over a specific time period.

If you’re investing into a small business via debt financing, here’s the single biggest advantage to debt financing over equity financing:

In other words, if the company can, it will repay its debtors first and its equity investors last.

4. Equity-Debt Hybrid Investment

If you want to be an investor in a small business without committing to just equity or just debt financing, I have a solution for you: The equity-debt hybrid.

The equity-debt solution may work to give you:

- Nonvoting rights

- Can convert to common stock

- Higher dividend yields than bonds (debt instruments)

And in the event of bankruptcy, the small business will repay its preferred stockholders before its equity investors.

The Bottom Line:

Investing in a business successfully comes down to your level of comfort with the pros and cons of each type of financing.

How to Invest in Small Businesses

A small business investment opportunity can help many business owners make their dreams a reality.

At the same time, investing in small companies can help you diversify your portfolio and build wealth.

Here are 9 steps to invest in small business opportunities successfully:

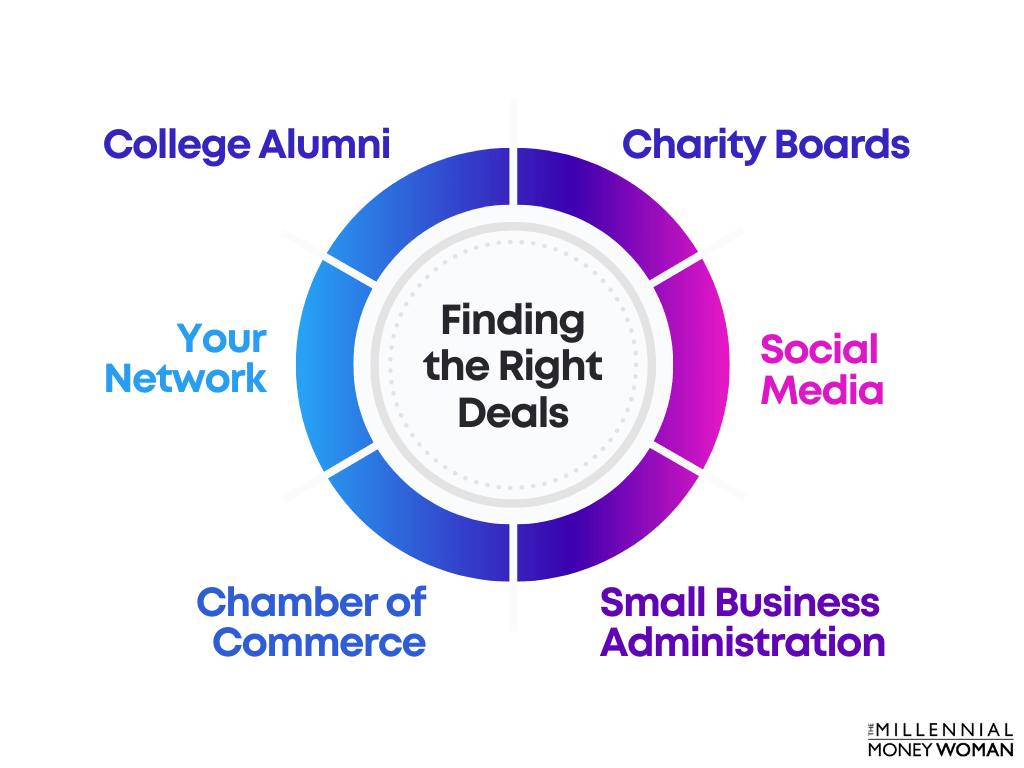

1. Find the Right Deals

If you want to invest money in a business, your first step should be to find the right small business investment opportunity.

Here’s how to find the right entrepreneurs and deals for you:

- Find entrepreneurs in your own network

- Find entrepreneurs and deals on social media

- Connect with your university alumni and/or professors

- Go to your local Small Business Administration (SBA) office

- Join your local Chamber of Commerce to connect with entrepreneurs

Keep in mind that investing in small companies is no easy feat because not all small businesses are seeking investors.

Here’s why:

- Some small businesses may not be ready to give up ownership interest in exchange for equity

- Some small businesses may already be fully leveraged and cannot make additional loan payments

Investing in a business means you need to take the time and effort to go through each deal with a fine tooth comb to find the best offer out there.

2. Do Your Research

Before you invest money in a business – whether it’s a small business or a large business – you need to do your research.

This is when you need to carefully review:

- Potential risks

- Business plans

- Growth potential

- Business strategy

- Outstanding loans

- Financial projections

- Market opportunities

Here are some additional questions you may want to ask the company leadership first:

- Is the business scalable?

- How big is the potential market?

- What returns are you expecting?

- Will you have any additional investors?

- How do you plan to use my investment?

- How hard is it to acquire new customers?

- How often can I expect to receive updates?

- How healthy is the cash flow in the business?

- How long have you been running your business?

- How did you calculate your company’s valuation?

- What are the company’s future financial projections?

- Will your product/service generate recurring revenue?

- Are you running your business alone or will you have partners?

- How much of your own money did you invest into the business?

Understanding how to invest in local businesses successfully means you’ll have to be as thorough as possible when you’re researching the small business’ pros and cons.

3. Understand How the Business is Funded

Investing in a small business requires knowledge as to how the business is funded.

Some ways to fund a business include:

- Debt investing

- Equity investing

- Angel investors

- Second mortgages

- Venture capitalists

- Business credit cards

- Home equity lines of credit

- Small Business Administration Loans (SBA Loans)

If you’re thinking about investing in small business opportunities, you really need to understand your funding options.

Finally, investing in local businesses also means you’ll have to evaluate how the business is currently funded and the company’s status when it comes to:

- Default status

- Current debt level

- Assets versus liabilities

- Liquid versus illiquid assets

Successfully investing in small business opportunities means you’ve done your research and understand the business’s current financial position.

4. Ask for a Business Plan

Any small business investment opportunity will require you to thoroughly review a business plan.

Here are some of the items that go into a business plan:

- Balance sheets

- Market analysis

- Revenue streams

- Cash flow statements

- Operational procedures

- Legal business structure

- Marketing and sales plan

- Resumes of leadership team

- Capital expenditure budgets

- Financial plan and projections

- Licenses, permits and patents

- Customer acquisition channels

- Products and services description

- Organization and management team

Investing in a small business means you need to be 100% clear about how that business will make you money – and that information is always spelled out in the business plan.

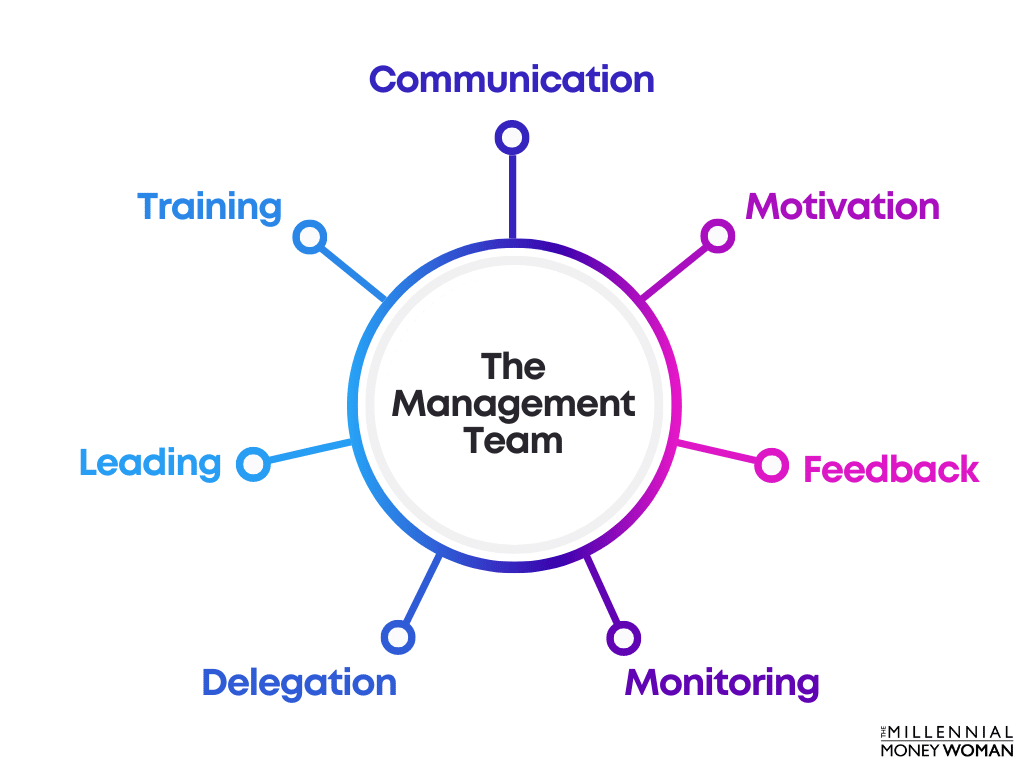

5. Get to Know the Management Team

When investing in a small business you should focus the majority of your time on the management team.

The management team is responsible for:

- Leading an organization

- Communicating a shared vision

- Ensuring proper organizational governance

- Executing the strategies within the business plan

- Monitoring and reacting to external factors appropriately

- Conducting risk assessments and risk mitigation activities

Here are some questions you’ll want to ask the management team:

- What is your background?

- What relevant experience do you have?

- What is your key motivation to succeed?

- Are you involving experienced advisors to help guide you?

- What makes your team able to execute the business plan?

- How much of your own money did you invest in the company?

- Describe the dynamic between you and the leadership team?

- What is your plan to scale your leadership team in the next 12 months?

- Which key additions do you foresee in the management team to fill the gaps?

If you want to invest in a local business, talking to the management team is the best way to get a feeling for the character of the ownership.

In other words, are they:

- Kind

- Ethical

- Honest

- Relatable

- Experienced

- Willing to listen

- Enjoyable to be around

- Utilizing experienced advisors

Since you’re planning to be a future investor, you need to make sure you would want to be in business with the current management team.

6. Negotiate Terms

Negotiating is part of the business game.

If you’re planning to become an equity investor, you’ll want to negotiate:

- How much you’ll finance

- An ownership percentage

- Your percentage of profits

On the other hand, a debt investment means you’ll want to negotiate:

- The loan amount

- The company’s repayment time frame

- The interest rate you’ll earn on your loan

Often, it’s a good idea to have a lawyer draw up these documents.

7. Understand How You’ll Get the Money Out

An investment in business opportunities means you’ll need to be crystal clear about how you’ll be repaid.

If you invest in local businesses, here are some questions you should ask:

- Will I be an employee?

- Will I be paid consulting fees?

- Will I receive quarterly dividends?

- How will I get money out of the business?

For example:

- Will you receive a K1 partnership return?

- Do you need to elect an S Corporation status?

This is a conversation you should best have with your accountant or CPA.

8. Close Deal

Investing in a business all comes down to real-life experience and reading the fine print.

After you’ve reached an agreement with the business owners, the next step is to actually close the deal.

This is when you:

- Sign the paperwork

- Pay the capital (or make a loan)

Here are a few types of records you’ll want to keep copies of if the business entity you’re investing in is a corporation:

- Bylaws

- Minutes

- Shareholder agreement

- Articles of incorporation

On the other hand, here are a few types of records you’ll want to keep copies of if the business entity you’re investing in is a partnership or LLC:

- Agreements establishing the entity

- Filings with the Secretary of State

- Filings with the IRS

And regardless of business structure, always keep the original agreement and notes on loans or receipts of equity purchases.

9. Communication is Key

If you think that you don’t have to stay involved after the deal is done – think again.

It’s always a good idea to stay involved with the small business and communicate regularly.

Things can change from one minute to the next, so to invest in a local business successfully, you’ll need to keep an ear to the ground and be ready to spring into action, if necessary.

Risks for Small Business Investors

Investing in small businesses is arguably one of the best investment vehicles to build wealth.

But first, you’ll need to fully understand the financial risks.

1. You Can Lose Your Investment

Investing in a business can be intimidating, especially since you can lose 100% of your investment.

In fact, almost 33% of small businesses fail within just 2 years of opening.

Data Source: BLS

That’s why you should only invest as much as you are willing to lose.

2. Business Brand Risks

Carefully researching a small business’s risks is key to becoming a successful investor.

Unlike large corporations, small businesses typically don’t have a list of people that have to approve decisions before they’re executed.

And when every decision rests with just 1 (or a few) business owner(s), then you could easily run into the following risks:

- Fraud

- Brand

- Security

- Reputation

That’s why it’s so important to conduct your research before you start investing in any company.

3. Laws & Regulation Risk

Understanding how to invest in a business successfully also comes down to laws and regulations that might pose a risk to your business or even your business’s industry.

Some laws and regulations could impact:

- Exports

- Imports

- Permits and licenses

- Tariffs and other tax laws

- National security regulations

- Money laundering regulations

As a potential small business investor, it’s important to weigh the pros and cons of the current – and potential – laws and regulations.

4. Your Investment is Illiquid

If you want to invest in a business, you’ll need to understand that your investment is illiquid.

In fact, after investing in small businesses, your investment could be tied up for years (5+ years) or you’ll be repaid in smaller increments over an agreed-upon time frame.

That’s why it’s SO important to have enough cash in an emergency savings account.

You need to make sure you can fund your own lifestyle while waiting on your small business investment to earn you the returns you’re looking for.

5. Key Person Risk

Investing in local businesses successfully also comes down to how well you analyze key person risk.

If that employee dies or leaves, for example, then there could be a high chance that the business may either lose revenue or completely shut down.

So how can you protect your business against key person risk?

Get life insurance through companies like Everyday Life on that key person.

Should something happen to that key person (like an unexpected death), at least you’ll have some coverage through a tax-free death benefit.

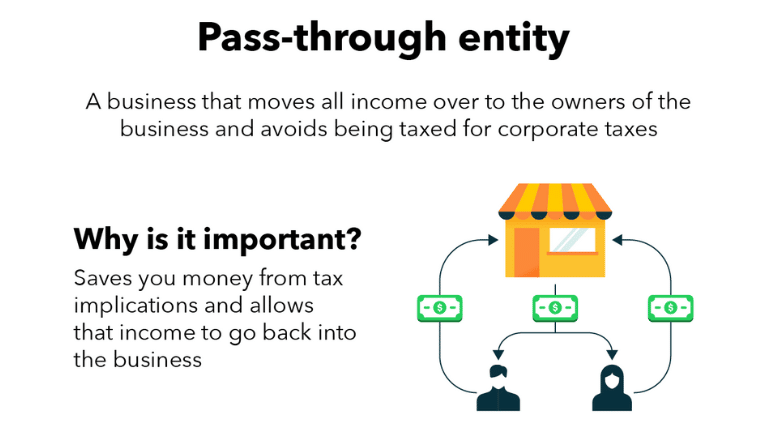

6. Tax Consequences

Investing in a business successfully also means you’ll have to become familiar with the potential tax consequences.

Here are some tax questions you should ask yourself (or better, your accountant):

- Will I be taxed on undistributed profits?

- How would my profits be taxed? As ordinary income or capital gains?

- If my investment loses money, can it be structured to give me a tax benefit?

The first step to help answer these questions is knowing the type of business structure you’re investing in.

If the business you’re invested in, is a pass-through entity, then you’ll be taxed on your portion of the taxable income.

Source: QuickBooks

In a pass-through entity, you’d have to pay taxes on your percentage of the profits (and the percentage is relative to your investment).

Examples of pass-through entities include:

- Partnerships

- S-Corporations

- Sole proprietorships

- Limited Liability Companies

Typically, all business profits and expenses will be reported on your personal tax return.

The Bottom Line:

Make sure you have the available cash to pay any tax consequences that will be passed on to you by the end of the year.

FAQs

Can anyone invest in a small business?

Yes, anyone can invest in a small business. Investing in small businesses is a great way to support the local economy and help people make their dreams a reality, all while also building a passive income stream for yourself.

How can I legally invest in a small business?

You can legally invest in a small business by giving a loan or by buying company shares. Debt and equity investing can help you earn dividends, return on principal investment, and quarterly interest payments.

How much should you invest in a small business?

Since small businesses are considered alternative investment assets, experts typically recommend you invest between 10% to 20% of your portfolio in non-traditional investments. You may also want to consider reinvesting your small business dividends back into the company itself for even greater growth potential.

Can you make money by investing in small businesses?

One of the highest growth investments you can make is investing in small business startups. However, small businesses also have the most risk, since they typically don’t have a proven track record and will likely also have higher up-front expenses, which may cause them to flounder early, without the proper funding.

What should I know before investing in a small business?

Before investing in small businesses, you need to know that your investment is never guaranteed. Only invest as much as you are comfortable losing. Another key to becoming a successful small business investor is to take the time to get to know the management and leadership team because the business’s success – or failure – will lie in their hands.

Who invests in small businesses?

There are three common types of small business investors, which include peer-to-peer investors, equity investors (which often include investors representing larger companies), and angel investors (wealthy individuals who want to help small businesses succeed).

Closing Thoughts

In the end, you’ll find plenty of small business investment opportunities.

The key to successfully investing in local businesses is:

- Doing your research

- Evaluating the pros and cons

If you’re successful, you’ll be making money while you sleep and be better off than if your cash was sitting in a checking account.

As they say, nothing ventured, nothing gained.