In the post, I’m going to show you how to create a budget (step-by-step).

In this guide, you’ll learn:

- What a budget is

- Why you need a budget

- How to create a budget

So if you’re ready, let’s dive right in!

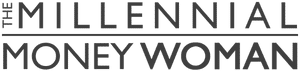

Bonus: Get your free budget spreadsheet below.

FREE RESOURCE

Budget Spreadsheet

This budget spreadsheet will help you track where your money is coming from, and where it is going. Simply type in your own numbers and you will have a complete overview of your financial picture.

What is a Budget?

A budget tracks every cent earned and every cent spent over a set period of time.

The “B-word” is often considered to be an ugly, disgusting word – but in reality, it’s not!

A budget is just another tool in your financial toolkit to help you figure out what you need to do to accomplish your future financial goals.

The key to creating a budget – that actually works – is to be honest with yourself.

You literally have to track every cent that is spent over a certain period of time.

That means if you purchase a piece of chewing gum for $0.15 – you need to track that 15 cent expenditure.

It may sound silly, but you need to be as detailed as possible – only when you create your budget.

Why Do You Need a Budget?

Are you staying up at night because you are worried about money?

Do you want to retire at some point in your life but just don’t know how to start?

If you answered yes to any of these questions – the answer is simple: You need a budget.

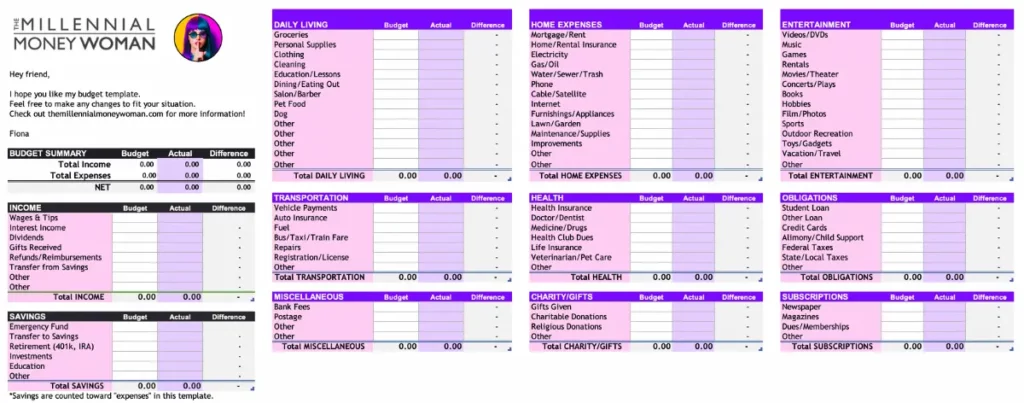

How to Create a Budget

Creating a budget is not as bad as it sounds.

There are several ways you can create your budget:

- Use your traditional pen and paper

- Use an excel spreadsheet (my favorite)

- Use budgeting apps like YNAB (more on that, later)

And here’s my favorite part: I do my budget over a glass of wine and some soothing background music.

That ambiance makes the actual budgeting part much less scary and daunting – because budgeting really isn’t scary!

Budgeting is there to help you benefit and reach your financial goals.

Step #1: Collect Your Financial Information

Before you start analyzing, calculating, creating, or implementing – the first step is to gather all financial documents that apply to your financial situation.

The financial documents that I would look for are below.

Documents needed to monitor income:

- W-2 forms (if applicable)

- Latest tax return

- 1099’s (if applicable)

- Pay stubs

- Investment accounts (Used to monitor the gains / losses)

Documents needed to monitor expenses:

- Credit card (or store card) statements

- Mortgage (or rent) statements

- Auto loan statements

- Student loan statements (if any)

- Utility bills

- Bank statements

- Other receipts from the past 3 months

The more financial information you can find before starting the actual budget analysis, the better.

A budget requires a detailed overview of your income and spending patterns and the more insight you have, the better you can tailor your budget to help you accomplish your financial goals.

Step #2: Figure Out Where Your Money is Coming From

The second step is pretty fun: We’re figuring out how much money you earn and where that earned income is coming from!

(Get ready to pour some wine!)

There are a few ways you could be earning income, some of which I’ve listed below:

- Tips

- Salary

- Commission

- Investment income

- Self-employed / freelance

As you can see, there are many different ways to earn income – and of course, the income frequency can also vary by the type of income earned.

The Difference Between Variable and Fixed Income

Next, you’ll want to figure out whether you live off of a fixed income or a variable income – or both.

Even if you are out sick, or you take a 4-day vacation, your income will still be the same.

A variable income typically is a bit riskier than a fixed income because you simply don’t know if you’ll see a check in your bank account during any given month.

However, the upside (or your earning potential) of a variable income stream is much, much higher than with a salary.

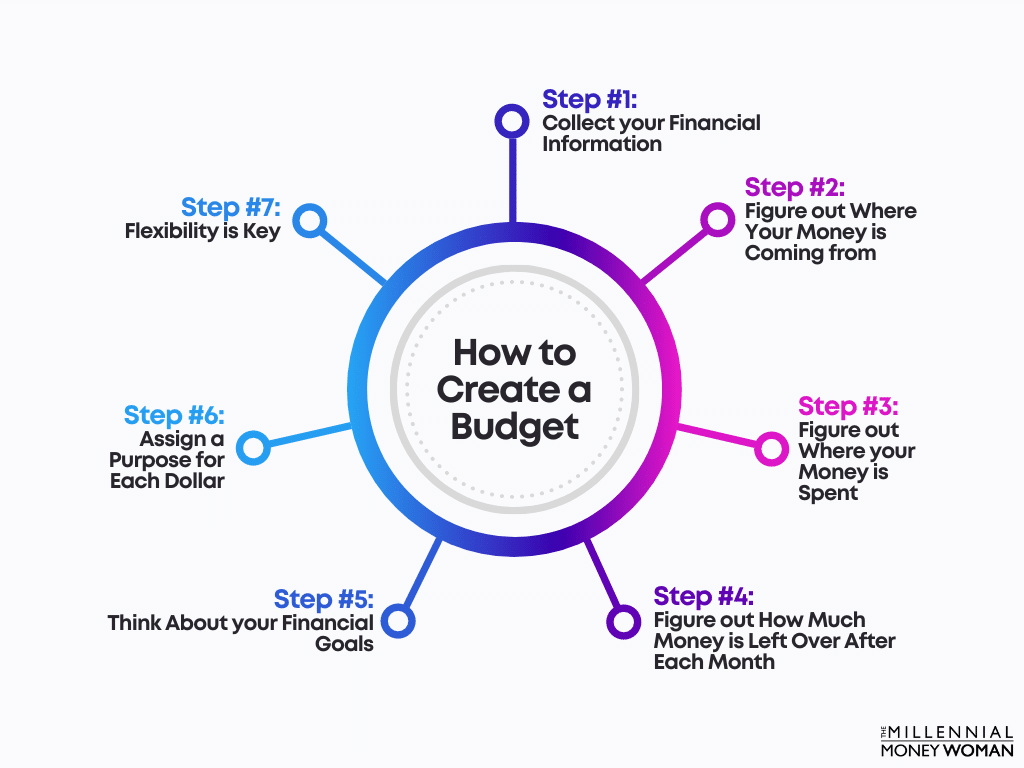

How to Calculate Total Monthly Pay on a Variable Income

Let’s say you make your living off of a variable income – so your paycheck fluctuates every month.

- Take an average of last year’s annual income

- Use your lowest monthly income for your monthly income reference

I would suggest 1 of 2 steps:

- Assuming you worked in a variable income job the previous year, look at last year’s income tax returns

- Divide that gross number by 12 – and that’s your average monthly salary going forward

You could also use your lowest income month – and take that lowest monthly income number as a baseline for your budget

Bottom Line: Make sure you have a good understanding of how much money you earn each month – even if it’s just an average.

Step #3: Figure Out Where Your Money is Spent

The next step is figuring out how (or on what) you are spending your money.

This is the step where you are the detective of your own story!

Believe it or not – even though we are in control of how much we spend and on what items we spend our money on – typically we don’t remember (or we actively choose not to remember).

That’s why we’ll resort back to the financial documents that we gathered in Step 1 – and now we start the analysis part of the budgeting process.

Now we actually start peeling back the layers of the onion, taking that detective magnifying glass and looking for the clues that answer the 2 questions:

- How much did we spend?

- What did we spend our money on?

Some of the most helpful documents that will pinpoint some of the clues for your spending trail are listed below (I’ve also listed where you’ll find your spending information):

- Credit card (or store card) statements – Review the full monthly credit card / store card statement

- Mortgage (or rent) statements – Make sure you include the following in your expense break-down: Principal, Interest, Taxes, Insurance (sometimes mortgage statements only list principal and interest owed, but you need to include all 4 categories on your budget)

- Auto loan statements – Typically listed on page 1 or 2 of the statement

- Utility bills – Should be page 1 of the statement

- Bank statements – Expenses (or withdrawals) are generally listed on page 2 or 3 of bank statements

- Other receipts from the past 3 months – Take a look at the following 2 factors on physical receipts: The type of purchase and the amount of the purchase

Of course, if you have an oddball account, then your spending information will be listed somewhere else.

Is it a painful process?

Absolutely (especially when you are in denial over spending $500 per month on restaurant food).

Is it worth the pain?

Absolutely.

Now, let’s say you exhausted your detective skills.

There simply is NO trace (for whatever reason) of your past 3 months’ worth of spending history.

Rest assured – I have a Plan B.

Create an Expense Diary & Track all Monthly Expenses

In the case you really can’t provide an accurate picture of your spending pattern over the past 3 months, it’s time to start tracking your monthly spending for the next 3 months.

Every. Single. Cent.

Ouch.

Tracking every cent sounds super painful – but honestly, I think tracking your spending actually helps you in the long run for the following reasons:

- Helps you build an up-to-date budget

- Makes you aware of how much you’re spending

- Helps you better understand your spending patterns

- Helps you identify potential serious spending problems

- Might incentivize you to reduce spending (because you’re so shocked at how much you’re spending)

- Provides you with an exact (and honest) overview of your monthly spending patterns

It’s tedious, but your bank accounts will thank me later.

Or you could download an expense tracking phone application (such as Mint or YNAB).

The next step is determining what type of spending you are doing.

Determine Whether the Expenses are Necessary or Discretionary

Now that you’ve created a spending diary (or used bills and statements from the last 3 months), it’s time to categorize your expenses.

In most cases, fixed expenses (such as rent or a car loan payment) is a necessary expense.

You need to keep paying those bills in order to function properly.

However – fun fact – the majority of variable expenses are actually NOT necessary (minus vet bills or doctor bills, for instance).

Variable expenses are *typically* discretionary, which means that you didn’t need to spend money on those items. But you still did.

Examples include vacations and birthday gifts.

Trust me – birthday (and wedding) gifts can add up over the year.

Be careful.

Assuming you are struggling to find some money in your budget, chances are you can slash your monthly expenses quite drastically simply by looking at your variable expenses (because they are often discretionary).

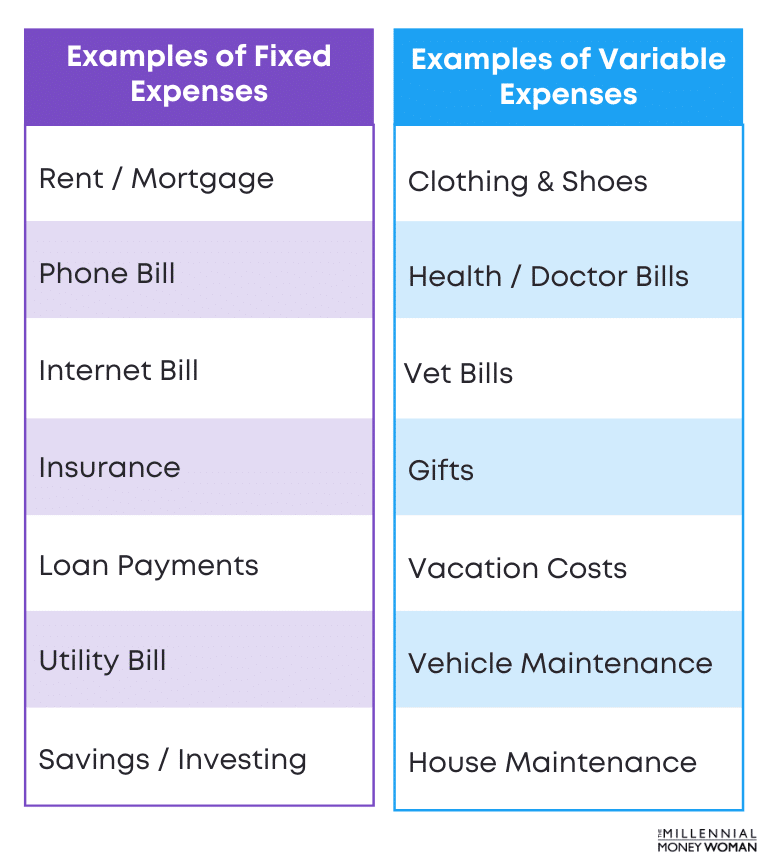

Determine Whether the Expenses are Fixed or Variable

One of the important parts to figuring out your spending habits is determining whether your expenses are 1 of 2 (or both) things:

- Fixed

- Variable

In my opinion, these are the best types of expenses because you know exactly how much you’ll owe and when you have to pay for it.

Variable expenses can be a budget-killer because if you don’t properly budget for variable expenses (such as an unexpected vet bill), your annual budget will likely be thrown off track.

This is where an emergency savings fund will help you stay on your budgeting track.

As a quick reminder, your emergency savings fund should typically consist of anywhere between 3 to 6 months’ worth of your expenses in a high yielding savings account.

Below is an illustration providing some examples of fixed expenses versus variable expenses:

As you can see from this example, fixed costs are predictable (and they’re typically the boring costs like rent or life insurance).

Variable costs, on the other hand, are the unpredictable expenses (also much more fun expenses, like vacation or gift purchases).

Step #4: Figure Out How Much Money is Left Over After Each Month

Now that we’ve determined how much money you spend each month and how much money you make each month – it’s time for the nail biter:

How much money (if any) is left over each month?

There are 3 types of outcomes:

- You spent less than you earned

- You spent exactly what you earned

- You spent more than what you earned

We will want to avoid the 3rd option by any means.

We will also want to avoid the 2nd option if possible.

The ultimate goal with a budget is this: To have money (and preferably a lot of it) left over at the end of the month.

What if you don’t have any money left over at the end of the month?

Determine if you can slash the variable costs.

Do you remember Step #3 and how we determined whether your expenses were fixed or variable?

This is the part where we want to dig further into the variable costs.

If you remember, variable costs (fluctuating costs) typically are considered to be discretionary – not necessary – expenses.

The step in this case will be to determine if you can slash variable expenses.

Variable expenses could include spending money on:

- Gifts

- Vet bills

- Clothing

- Vacation

- Groceries

Of course, vet bills and groceries will be necessary.

However, clothing, vacations, and gifts are arguably not necessary expenses and these expenses could be slashed to help your budget.

What if you don’t have any variable costs to slash?

If you can’t slash more of your variable costs, determine if you can slash any of the fixed costs.

This is typically where it gets a little more complicated.

If you truly cannot slash any variable costs, it’s time to look at your fixed costs (predictable costs).

Typically speaking, fixed costs are necessary costs and most fixed costs include:

- Rent / Mortgage payments

- Auto loan payments

- Student loan payments

However, fixed costs could also include discretionary expenses:

- Magazine subscriptions

- Gym memberships

- Membership dues

These fixed costs are not necessary – so this is where I would look to slash any fixed costs to create a better and more flexible budget.

What if you can’t slash more fixed and variable costs?

In this case, you will need to add more income to your budget.

You could accomplish that in several ways:

- Find a roommate

- Find a better paying job

- Start working a side hustle

These are some examples that I have resorted to in the past to help boost my monthly income.

Step #5: Think About Your Financial Goals

Since a budget is a tool in your financial toolkit to help you reach your financial goals with ease – it’s now time to consider what you actually want to accomplish with your money in the future.

Below are some common finance goals:

- Retire early

- Car purchase

- Start a business

- House down payment (typically recommended 20%)

All of these goals have 1 thing in common: They require money – and typically lots of it.

And that’s where you have to start using your budget as a tool to guide you in the right direction to reach your financial goals.

Determine how much Money you want to Save / Invest for Retirement

If your goal is to retire early – or retire at all, for that matter – it’s important to consider several factors first:

- What age do you plan to retire?

- Where will you live during retirement?

- How much money do you want upon retirement?

- How much money will you need annually during retirement?

- Do you plan to do part-time work or consulting while “retired”?

Once you have come up with some answers to these questions, you should have a better idea of how much you need to start saving (and investing) each month to take one step closer to your retirement goal.

What if you haven’t started your investing journey?

I would suggest by opening an account with M1 Finance. I really like this investing app because it’s user friendly, and the basic version is free.

The earlier you start with investing and saving, the faster you’ll reach your retirement goal.

Time is on your side.

Don’t be discouraged if you are in your 40’s or older.

Start investing and saving for retirement today – you’ll have to contribute more but you’ll likely also have the income to do so.

Determine the Cost of Your Lifestyle

Figuring out how much you plan to spend at any point in your life cycle is a very important factor to the budgeting process.

Every person has a different lifestyle in mind:

- Some want to live in beautiful mansions

- Others want to move in with their children

- While others want to leave the country and start new somewhere else

It just depends on your personality and how you envision living your life at any stage.

Once you have a rough estimate of how much your lifestyle will cost you – it’s time to create a budget that will help guide you toward living that type of lifestyle.

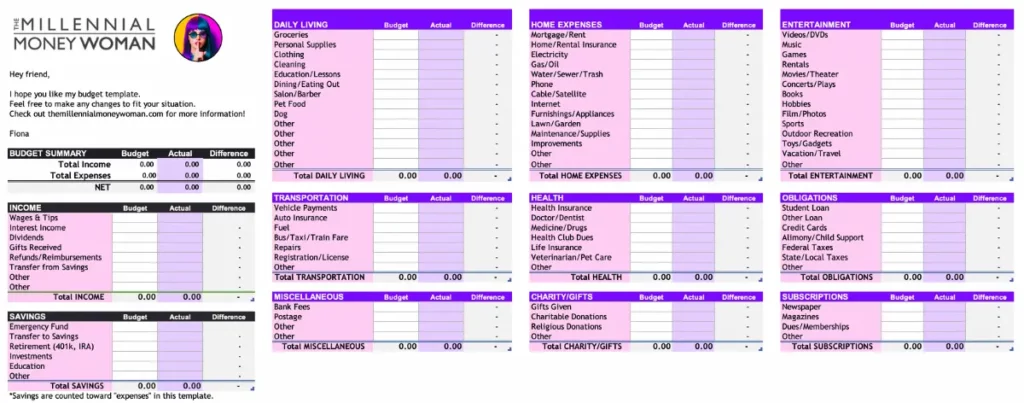

Step #6: Assign a Purpose for Each Dollar

This step, in my opinion, is really cool – because now you get to figure out how each dollar is going to be spent – and in which category it will be spent.

Below is a list of categories that I would use in my budget to allocate how much money to spend in each category:

- Food

- Utilities

- Housing

- Insurance

- Medical & Healthcare

- Saving, investing & debt payments

- Transportation / Vehicle Maintenance

Bonus: Get my free budgeting templates below.

FREE RESOURCE

Budget Spreadsheet

This budget spreadsheet will help you track where your money is coming from, and where it is going. Simply type in your own numbers and you will have a complete overview of your financial picture.

The reason why I think it’s so important to know exactly where each dollar is going – is because now you can’t make any more excuses!

Let’s say you have allocated $100 to the “eating out category” and you have $20 left.

It’s a Friday night and your BFF calls you up to go out to the movies and then out to a bar.

That’s easily $50 to $80 for the night.

Can you afford that?

Nope. Not according to your budget.

This is where you have to be the bigger person (and withstand peer pressure) and say “no” so that you keep following your budget – and ultimately keep following your financial goals.

If you say “yes” and overspend by $30 to $60 every time someone asks you to do something – that’s going to add up easily (overspending by $720 per year, $7,200 every 10 years) and will make a severe dent in your financial goals (and budget).

You have to be the bigger person, not succumb to peer pressure, and stick to that budget.

Step #7: Flexibility is Key

Ok, so I just went on a tangent to NOT overspend in any budget category.

But you know what?

Sometimes life just happens – and that’s OK.

That’s why my last and final step here is to make sure you know that flexibility is an absolute KEY when it comes to budgeting.

Sometimes life will force you to overspend in a certain category (and that’s just the way things are – they are never predictable).

Some of those “life happens” expenses could include:

- Home repairs

- Vehicle repairs

- Unexpected vet bills

- Unexpected health or medical bills

You get my point.

Typically, the unexpected bills will be categorized under the variable expense (necessary expense) category.

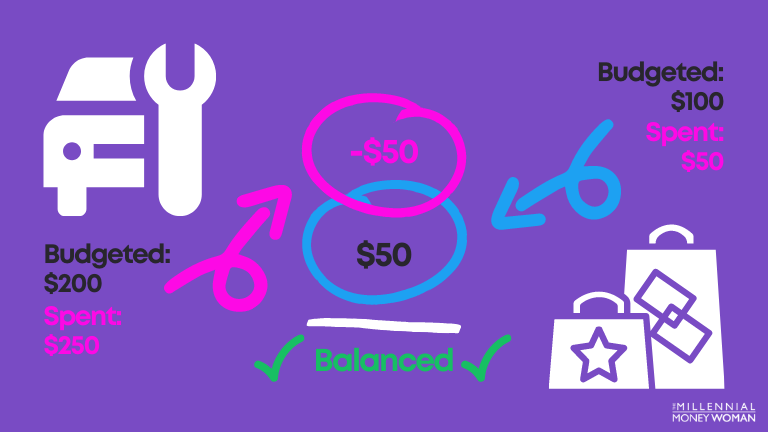

So what happens if you overspend in 1 category of your budget?

If you overspend in 1 category, adjust your budget accordingly.

That’s all there is to it: You simply adjust another category to match your current budget spending.

Here’s an example:

As you can see from the image above – you’ll have to adjust your budget spending categories at some point.

In this case, if you have to go into the auto repair shop for unexpected car maintenance (such as replacing a flat tire), you’ll have to adjust your spending plans in another category – such as going grocery shopping or going out to eat for that month.

It’s that simple.

Closing Thoughts

Although budgeting sounds boring and scary at the same time… it’s actually not!

Budgeting is a tool that will help you achieve your financial goals so much faster than if you were blindly trying to stay on top of your finances.

It opens your eyes to the many possibilities of saving money wherever possible so that you can accomplish your financial goals (be it retire early, invest more, pay off student debt, etc.)

Happy Budgeting – your bank accounts will thank me later!

Now it’s your turn:

Do you already have a budget?

Or are you just getting started?

Let me know in the comments below!