Hey friend,

What do you get when you follow money rules?

The answer is increased wealth.

In fact:

Self-made millionaires are 4x more likely to follow money rules than non-millionaires.

And not only that…

But following money rules can:

- Help you save money

- Help you make more money

- Help you get out of debt faster

- Help you lower your stress levels

And that’s exactly what you’re going to discover in this post.

So if you’re ready, here are 7 must-know money rules:

1. 50/30/20 Rule

The 50/30/20 rule helps you take control of your money.

Start by categorizing your spending into 3 sections:

- Needs (food, rent, utilities, etc.)

- Wants (vacations, cars, eating out, etc.)

- Goals (savings, investments, extra debt payments, etc.)

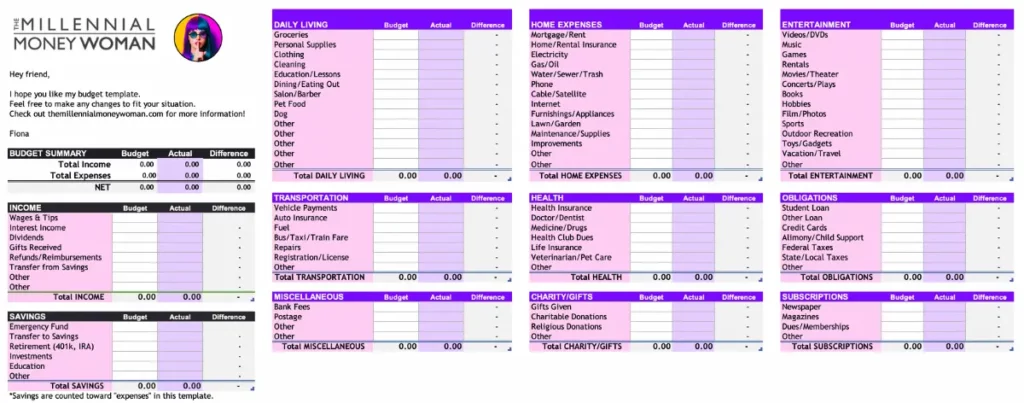

Next, start tracking your expenses using a free budget spreadsheet (like the one below) 👇

FREE RESOURCE

Budget Spreadsheet

This budget spreadsheet will help you track where your money is coming from, and where it is going.

Once you have a better idea of your expenses…

See if they align with the 50/30/20 Rule:

- 50% of your income goes to NEEDS

- 30% of your income goes to WANTS

- 20% of your income goes to GOALS

And if your spending doesn’t align [yet] with the 50/30/20 rule?

Start making small adjustments to your budget.

2. 3-6x Emergency Fund Rule

Always be prepared for unexpected expenses.

Surprise expenses could include:

- A car repair

- A house repair

- A medical emergency

Avoid using high-interest credit cards to pay for surprise expenses.

Instead, save 3 to 6 months’ worth of basic living expenses in an emergency fund.

Pro tip: Multiply your wealth by storing your emergency fund in a high-yield savings account.

A high-yield savings account can earn you over 5% APY (variable rate).

A 5% rate on $10,000 of cash would earn you $500.

For doing absolutely NOTHING.

Recommended resource:

If you want to find the highest-yielding savings accounts, check out Raisin.

Raisin is available in 30+ countries.

It also offers FDIC insurance, no fees, and a $1 minimum deposit.

3. Rule of 72

Find out how long it will take your investment to DOUBLE.

Divide the number 72 by the expected growth rate of your investment.

This expected growth rate is expressed as a percent.

Here’s an example:

Let’s say you invest $10,000 in a rare art painting.

And that painting averages returns of around 17.8% per year.

So according to the Rule of 72, you would double your money in 4 years.

72 ÷ 17.8 = 4.044 years!

The Rule of 72 can also tell you how long it will take for your money to HALVE due to inflation.

Here’s an example:

Let’s say you have $10,000 in cash…

And inflation is stuck at 9.1%…

It would take your money 7.9 years to HALVE itself.

72 ÷ 9.1 = 7.9 years!

4. The 4% Rule

The 4% Rule says you can take out 4% of your savings each year during retirement without running out of money.

It helps you plan how much money you can spend without using it up too fast.

For example:

Let’s say you saved $1,000,000.

Here’s how to use the 4% Rule:

- Total money = $1,000,000

- $1,000,000 x 0.04 = $40,000

- $40,000 ÷ 12 months = $3,333 (pre-tax)

That means you can spend up to $3,333 per month in retirement.

Now, this rule is not perfect.

There are a few considerations to keep in mind, like inflation.

So it should only be used as a guide.

5. 3x Rent Rule

The 3x rent rule says rent should not exceed three times a person’s gross monthly income.

Here’s an example:

Let’s say the rent for an apartment is $800 per month.

The 3x rent rule suggests you should earn at least $2,400 per month ($800 x 3) to afford it comfortably.

The idea behind this rule is that housing shouldn’t consume more than a third of a person’s income.

Why?

So you have money left over for expenses, savings, and investments.

Remember: This rule is not set in stone and should only be used as a guideline.

6. 5x to 6x Rule

The 5x to 6x rule suggests buying term life insurance worth 5x to 6x your gross annual salary.

Here’s an example:

Let’s say you have an annual gross salary of $60,000.

According to the 5x to 6x rule, you should look for a term life insurance policy with a death benefit in the range of $300,000 to $360,000.

($60,000 x 5 = $300,000 and $60,000 x 6 = $360,000).

Remember to consider your debts, number of kids, etc. to better customize your life insurance needs to your situation.

Consider buying term life insurance to protect yourself and your family.

Recommended resource:

Getting term life insurance is easy with Everyday Life. Get a free quote here.

7. 20/10 Rule

The 20/10 Rule helps you decide WHEN it makes sense to take on debt.

Here’s how it works:

- Your total debt should NOT be more than 20% of your annual income

- Your total monthly debt payments should NOT be more than 10% of your monthly income

Here’s a quick example:

- Let’s say you earn $100,000 per year (so $8,333 per month)

- According to the 20/10 rule, your total debt should NOT be more than $20,000 (20% of $100,000)

- And your total monthly debt payments should not be more than $833 (10% of your monthly income at $8,333)

Here are some items that are NOT included in the 20/10 Rule:

- Mortgage payments

- Monthly rent payments

- Student loan debt payments

The 20/10 Rule works best BEFORE you take on debt.

It helps you borrow and repay money responsibly.

The Bottom Line

Following money rules is an easy way to keep your finances on track.

Not only that, but they also give you clarity.

And help you visualize your path to wealth.

Start today.

And be consistent with your efforts.

Your bank account will thank me later.

That’s all for now!

Your friend,

Fiona

PS: When you’re ready, here’s how I can help you…

• Check out my available programs

• Book a one-on-one money coaching call with me (limited spots available)