Unlock the Secrets to Modern Wealth

Join 30,000+ others and get access to exclusive tips, strategies, and case studies that I don’t share anywhere else 👇

FIONA HAS BEEN FEATURED ON

WHAT OTHERS ARE SAYING

"Fiona’s content is both useful and understandable, which is a rare combination."

Brian FeroldiAuthor, Investor

"I can confidently say that Fiona is one of the most knowledgeable and trustworthy people I know when it comes to finance."

KennyFounder of Accent Investing

"Fiona has an abundance of financial knowledge. Her content is specific and actionable, providing her audience with huge value."

Cori ArnoldFounder of Win With Your Money

"Fiona has the experience that backs up her content. I'm consistently gaining new knowledge from her content!"

Rajat SoniCFA

"Fiona is an excellent resource for learning how to create wealth and build a better life for you and your family."

Andrew LokenauthFounder of Fluent in Finance

Previous

Next

60,000+ Monthly Readers

Top 500 Entrepreneur

275,000+ Followers

FREE RESOURCE

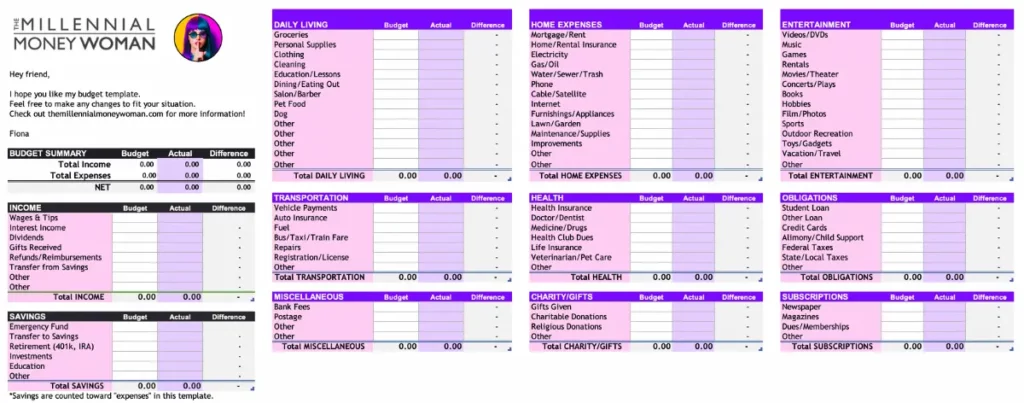

Budget Spreadsheet

This budget spreadsheet will help you track where your money is coming from, and where it is going.